In trading on June 7, the pound gained against the US dollar. In yesterday's trading, however, the situation changed. It is common knowledge that with inflation spiking due to supply chain disruption, rising energy prices and some other negative nuances as a consequence of the COVID 19 pandemic, many of the world's leading central banks have moved to tighten monetary policy and started the process of raising interest rates. The Bank of England, which has already increased its key interest rate several times by 25 basis points, is not an exception.

However, this factor is not really supporting the British pound sterling, which has been rather modest so far in comparison with the US dollar. I believe that market participants are not convinced by the 25bp increase in the key interest rate. They are probably waiting for more significant and tougher decisions by the English central bank. A number of large commercial banks think that the English regulator is not meeting the expectations of market participants. We will find out more about this on June 16 at the BoE interest rate meeting. I don't think Boris Johnson, who has been under intense criticism, has a meaningful and landmark impact on the pound sterling exchange rate. Of course, investors are more interested in the further degree of monetary policy tightening by the Bank of England.

The most important event not only for today but probably for the whole trading week will be the European Central Bank's interest rate decision and the subsequent press conference by the President of the European Central Bank Christine Lagarde. It should not come as a surprise as sterling often follows the single currency after such an important and meaningful event for the market. As for the US data, the only thing worth mentioning is the initial jobless claims, which will coincide with the start of Christine Lagarde's press conference. Of course, technical factors will also have a significant impact on the GBP/USD dynamics.

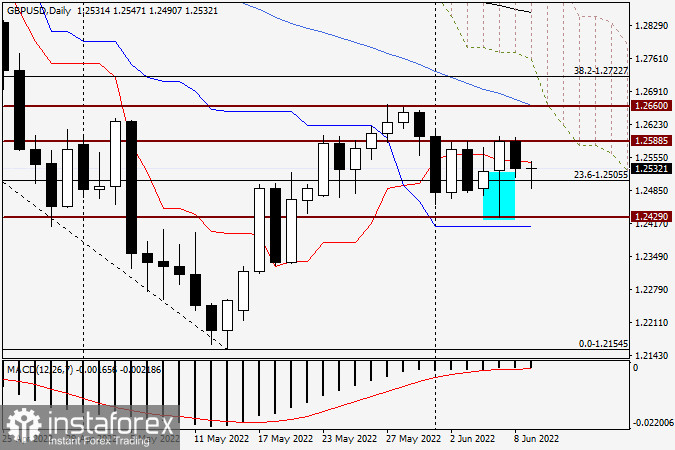

Daily

After the decline to 1.2429 the day before yesterday, GBP/USD managed to show some growth, which resulted in a candle with a rather long lower shadow and a rather impressive bullish body on the daily chart. However, there are both positives and negatives for the bulls. As for the positive moments, it is the closing of yesterday's session above the red Tenkan line of the Ishimoku indicator. The negative trend is the inability of the bulls on the pound to pass the yesterday's indicated and rather strong resistance of the sellers at 1.2588. It is quite typical that yesterday's trading on GBP/USD closed at 1.2587, which means that it was just a little short to end the June 7 session above this resistance level.

The GBP/USD pair changed its price direction yesterday. Once again, the decline started after an attempt to overcome 1.2588. Given that yesterday's highs were shown at 1.2596, it is safe to assume that near 1.2600 is a very important and at the moment key resistance for the sellers. I think that if the pound bulls manage to go up to 1.2600 and to consolidate above this level, the further growth, the target of which is the area of 1.2680-1.2720, might follow quite swiftly. Today, the pair was slightly down, but it is still holding above the psychological mark of 1.2500. At the moment, I consider the current decline as a pullback and an opportunity to open long positions in the GBP at very reasonable prices. Thus, aggressively and riskily one can try to open long positions from the current market prices. Less risky is to buy sterling after it rises above 1.2545 on a pullback to this mark. Opening short positions will only become relevant after a breakout of support at 1.2429, where the June 7 trading lows were shown.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română