On the eve of today's meeting of the European Central Bank (ECB) on interest rates and the subsequent press conference of ECB President Christine Lagarde, the EUR/USD currency pair continues to trade in a relatively narrow range. Market participants are waiting for today's news and have been in no hurry to force events for several days, that is, to activate the course of trading. We can say that this trend has been observed since the opening of trading of the current five-day period. It is quite possible that following the statements of the head of the ECB, the single European currency will receive support, since the increase in inflation leaves the European Central Bank no choice but to tighten its rhetoric, and then proceed to active action, namely, to start the process of raising rates. I think it's no secret that the number of "hawks" in the ranks of the ECB is constantly growing, especially this is felt by the comments of the representatives of the regulator, which have been heard recently.

There is no time for "dovish" sentiments here, since the jump in inflation, which became a consequence of the COVID-19 pandemic, forces the world's leading central banks to take the path of tightening monetary policy. As we know, following the Federal Reserve System, several other central banks have already begun the process of raising rates. In this sense, the ECB is still trailing at the end of the list and until recently preferred to take a wait-and-see position. But there is a limit to everything, and it has become obvious for a long time that a wait-and-see policy will not fix the situation. The rise in inflation, which was previously considered a temporary phenomenon, was an erroneous opinion, and this was first stated by the trendsetter in monetary world policy - the Fed. Well, today we'll find out everything, it won't be long to wait. In the meantime, I propose to proceed with the consideration of price charts.

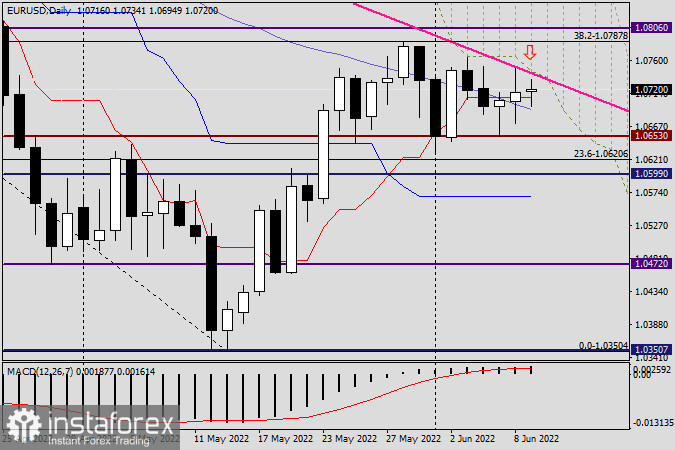

Daily

Looking at the daily timeframe, we have to mention the red line of the Tenkan Ichimoku indicator again, and, as we see, for a reason. After the day before yesterday's initial decline to 1.0653, the euro/dollar pair found strong support here and rapidly turned up. However, it was the Tenkan line that prevented a more significant growth, as well as the 50-simple moving average, which should also not be written off in any case. The indicated indicators are the impassable barrier for euro bulls, preventing the rise of the quote to higher prices. However, above Tenkan and 50-MA there is also a pink resistance line, built at points 1.1495-1.1185, as well as the lower boundary of the Ichimoku cloud. At yesterday's trading, euro bulls managed to raise the quote slightly above the Tenkan and end the session on June 8 above this line.

Nevertheless, yesterday's candle had almost equidistant shadows, which indicates the struggle of the opposing sides, as well as the expectation of today's events related to the ECB. I assume that these very events can become the very driver for passing up all the listed obstacles. Naturally, this will happen only if the ECB tightens its rhetoric and brings more clarity to the timing of rate hikes. Otherwise, the EUR/USD pair may fall to the support area of 1.0655, or even fall below. For today, the possibility of positioning in both directions remains. It is better to open purchases near the support of 1.0655 and use a strong technical price zone of 1.0720-1.0750 for sales. At the same time, in both cases, it is better to wait for the corresponding candle signals to appear at smaller time intervals, and only then enter the market. It is also not superfluous to understand and take into account. That today's euro/dollar price dynamics will largely depend on the degree of the ECB's "hawkish" rhetoric.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română