Analysis of trades and tips on trading EUR

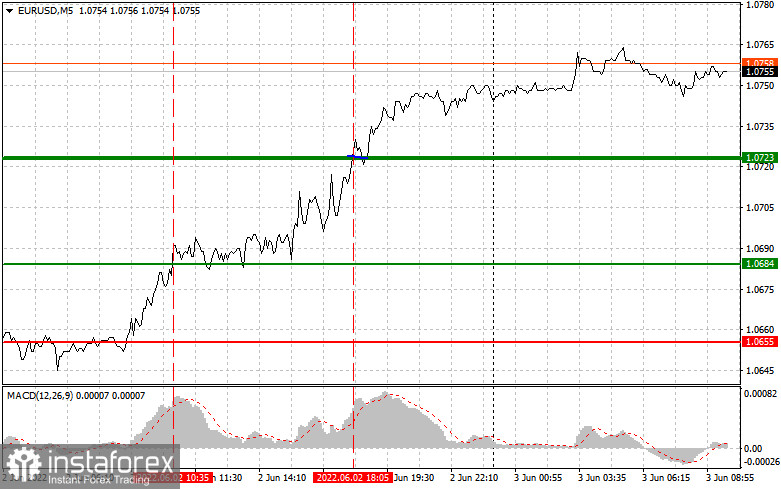

The euro kept rising all day yesterday. So, it was not possible to get a good entry point according to my trading strategies. The euro approached 1.0684 at a time when the MACD indicator moved quite far from the zero level. Thus, I was expecting the implementation of scenario No.2 for short positions. However, this scenario did not take place. The test of 1.0723 in the afternoon, where I advised to sell the euro immediately, brought losses as there was no downward movement from this level.

Yesterday, the euro rose amid the speech of Joachim Wuermeling of the Bundesbank and the release of the Eurozone Producer Price Index. A slowdown in the index in May improved market sentiment. The US labor market reports, on the contrary, dragged the US dollar down. ADP data turned out to be disappointing. In the first half of the day, traders are anticipating a batch of economic reports. Italia and Germany will unveil their Services PMI Indexes. The Composite Output Index for Germany and the euro area are also on tap. These macro stats will hardly impact significantly the trajectory of the euro. The Euro Area's retail sales data for April is unlikely to be of great interest. Today, traders will mainly focus on the US Nonfarm Payrolls report. Analysts believe that the indicator may be weaker-than-expected, which may increase pressure on the US dollar. The Fed's aggressive interest rate hikes clearly do not boost the US labor market. The report on the unemployment rate, which is projected to decline to 3.5%, will scarcely help the greenback advance. There could be a surge in volatility after the publication of the ISM Manufacturing PMI Index. Positive figures will surely fuel demand for the US dollar. However, the reading should exceed economists' forecasts.

Buy signal

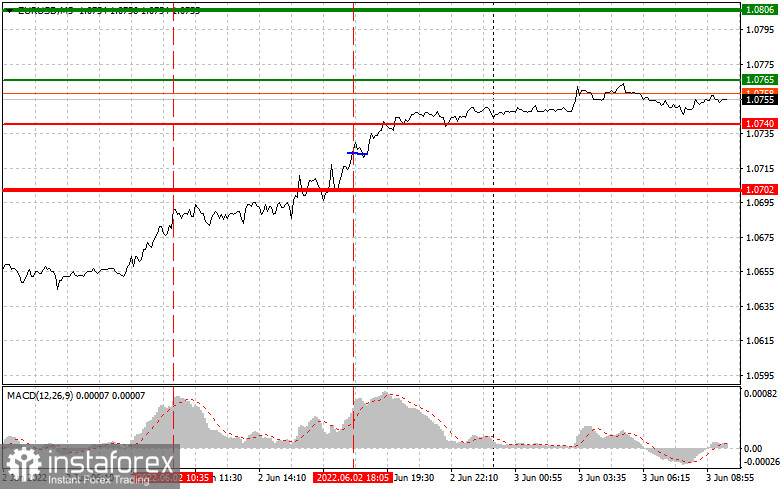

Scenario No. 1: it is recommended to open long positions today if the price reaches 1.0765 (the green line on the chart) with an upward target of 1.0806. It is better to close long positions at 1.0806 and open short ones, keeping in mind a downward correction of 30-35 pips from the given level. The euro may edge higher in the first half of the day if the eurozone macro stats are upbeat. However, its growth will be limited. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price approaches 1.0740. At this moment, the MACD indicator should be in the oversold area, which may limit the downward movement of the pair. It may also trigger an upward reversal. The pair is expected to lift up to the opposite levels of 1.0765 and 1.0806.

Sell signal

Scenario No.1: it is recommended to sell the euro if the price hits the level of 1.0740 (the red line on the chart). The target will be the 1.0702 level. It is better to close short positions at this level and open long ones, keeping in mind an upward correction of f 20-25 pips from the given level. The pressure on the euro will escalate only if the US Nonfarm Payrolls report turns out to be positive. During the European session, the pair may reach new monthly highs. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price drops to 1.0765. At this moment the MACD indicator should be in the overbought area, which will limit the upward movement of the pair. It may also trigger a downward reversal. The price is expected to take nosedive to the opposite levels of 1.0740 and 1.0702.

What's on the chart:

The thin green line shows the entry price where you can buy the trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profits manually as the price isunlikely to rise above this level.

The thin red line shows the entry price where you can sell the trading instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profits manually as the price isunlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to the overbought and oversold zones.

Important. Novice traders should make very careful decisions when entering the market. It is better to stay away from the market ahead of the release of crucial fundamental reports. It helps speculators avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română