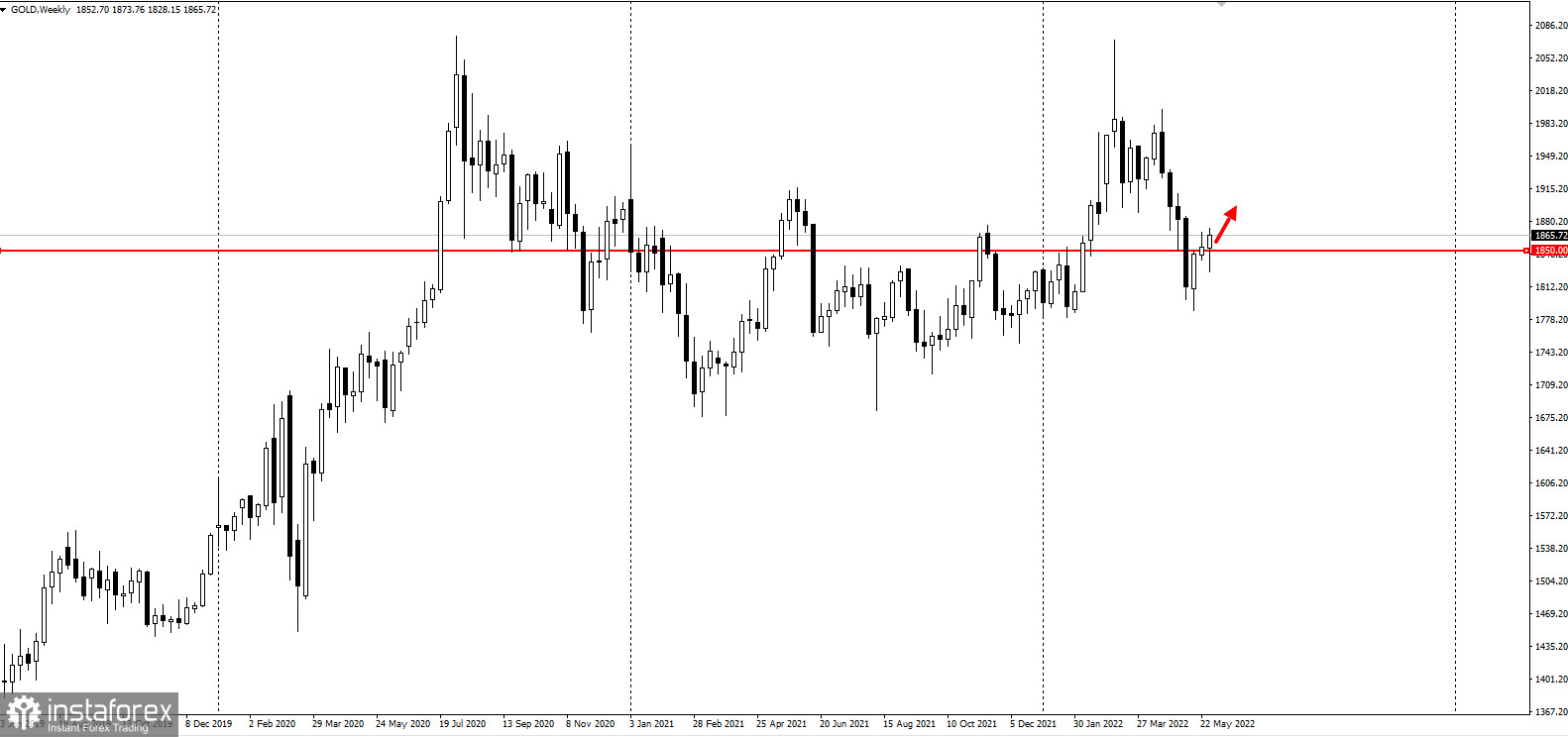

The gold market is holding above the critical psychological level of $1,850 and picking up after weaker-than-expected private sector job growth, according to the latest ADP payrolls report.

The gold market is holding above the critical psychological level of $1,850 and picking up after weaker-than-expected private sector job growth, according to the latest ADP payrolls report.

Private-sector firms added 128,000 payrolls last month, ADP said in its monthly employment report. That fell short of the median forecast for 300,000 new jobs.

Employment in April was also revised downwards. The report notes that this is the slowest pace of job growth in 12 months.Although the data was softer than expected, some economists point out that this will help to reduce inflation, thereby possibly enabling the Federal Reserve to conduct a less aggressive monetary policy than traders expect.

As expected, the US central bank will raise interest rates by 50 basis points at its next three meetings.

Capital Economic analysts said that while investors should not panic over one bad report, they would have to keep a close eye on the labour market.

It is impossible to add 500,000 jobs a month with this level of unemployment. Meanwhile, a slowdown in employment growth of more than 100,000 would be a big concern. Nevertheless, as long as employment figures remain stable and jobless claims barely exceed 200,000, there is no cause for concern.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română