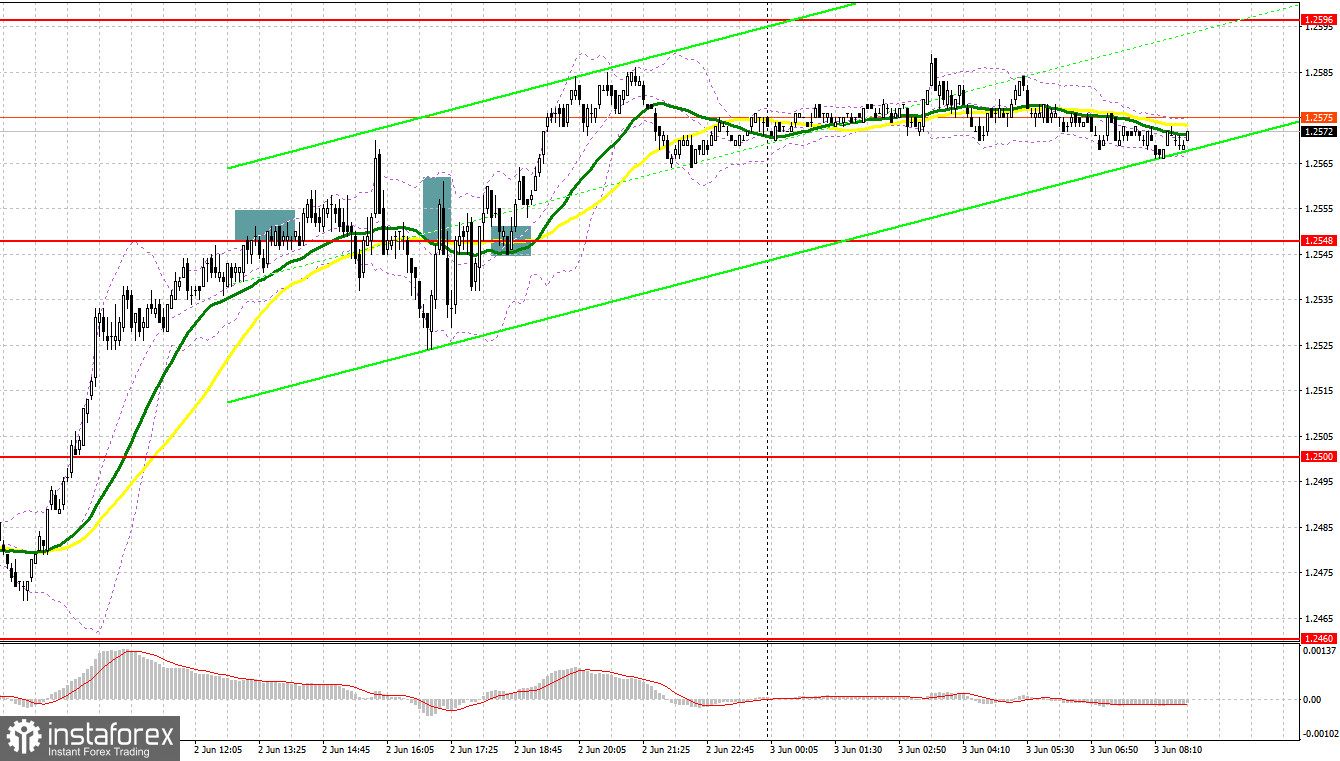

Yesterday, several market entry signals were formed. Let's take a look at the 5-minute chart and see what happened. I paid attention to the level of 1.2500 in my morning forecast and advised you to make decisions on entering the market from it. Bulls quickly rose above 1.2500 at the beginning of the US session and all that remained was to wait for a reverse test from the bottom up of this range. Unfortunately, I did not see the implementation of this scenario. For this reason, I was forced to miss the entire upward movement of the pound. A false breakout in the resistance area of 1.2548 in the afternoon gave a signal to sell the pound, but there was no major downward movement. After falling by 25 points, demand returned. The second false breakout at 1.2548 led to another sell signal, but even then I did not see a major drop. As a result, the bulls regained control of this level. Testing 1.2548 from top to bottom in the middle of the US session forced us to close short positions and buy the pound. As a result, the upward movement amounted to about 35 points.

When to go long on GBP/USD:

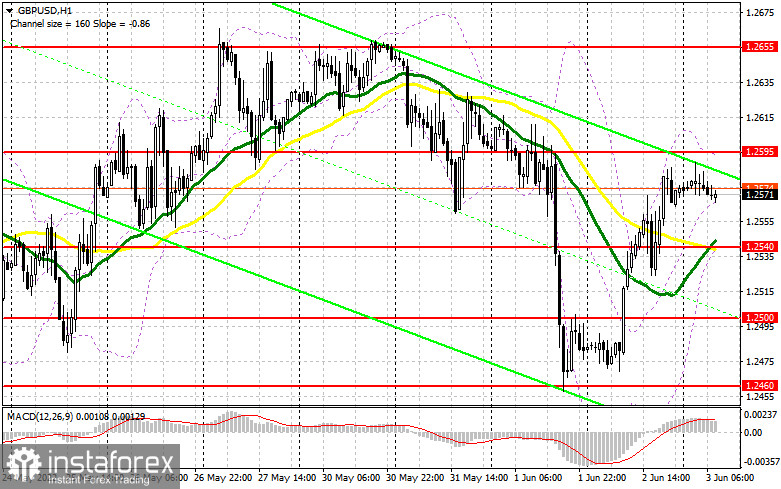

It is quite expected that today the pound will continue to grow, and bulls will try to secure above 1.2595. Considering that the UK will not release any data today, we can only hope for the general weakness of the US dollar after the release of statistics on the US labor market. If there is no active upward movement in the near future, forming a false breakout at 1.2540, where the moving averages pass, will lead to the first signal to open new long positions, counting on the resumption of the bullish trend. An equally important task for the bulls will be to consolidate above the major resistance at 1.2595, which must be returned - if the bulls, of course, plan to maintain the bull market. We can expect a sharper jump of the pair, but only after consolidating above this range with a reverse test from top to bottom, which will open the way to a high of 1.2655. Surpassing this range will return the GBP/USD to the resistance area of 1.2709 and 1.2755, where I recommend taking profits.

If the pound falls and bulls are not active at 1.2540, the pressure on the pair will only increase. This will make it possible to reach 1.2500, which will call into question a further bullish trend for the pair. For this reason, I advise you not to rush into long positions. It is best to enter the market after a false breakout at this level. I advise you to buy GBP/USD immediately on a rebound from 1.2460, or even lower - around 1.2411 with the goal of correcting 30-35 points within the day.

When to go short on GBP/USD:

The bears have one last chance to regain control of the market. To do this, it is necessary to protect the resistance at 1.2595, the test of which will definitely take place in the near future. Forming a false breakout there will provide a signal to open short positions in anticipation of a downward correction of the pair to the area of 1.2540, where the moving averages are. An equally important task is to settle below 1.2540. A breakthrough and reverse test from the bottom up of this range will create a sell signal, allowing GBP/USD to return to the 1.2500 area, from which the most active growth of the pair was observed yesterday. A breakthrough of this range will open a direct path to a low of 1.2460, where I recommend taking profits. The long term target will be at 1.2411 low, which will completely cancel out the bull market.

In case GBP/USD grows and traders are not active at 1.2595, a surge upwards may occur amid bears' stop orders being dismantled. In this case, I advise you to postpone short positions until the May high of 1.2655. I advise you to sell the pound there only in case of a false breakout. Short positions immediately for a rebound can be made from 1.2709, or even higher - from 1.2755, based on the pair's rebound down by 30-35 points within the day.

COT report:

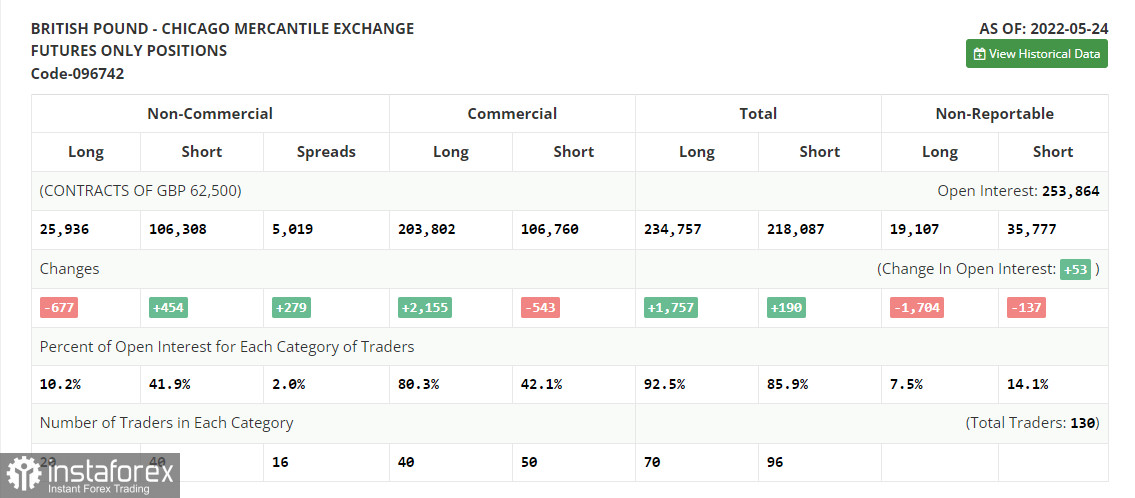

The Commitment of Traders (COT) report for May 24 showed that long positions decreased while short positions increased. However, this did not significantly affect the balance of power. Despite the pound's growth since the middle of this month, the market remains completely under the bears' control.

Apparently, only the absence of fundamental statistics, to which the pair has been reacting rather negatively lately, and a slight profit-taking from annual lows have enabled the GBP/USD to recover slightly. There are no other objective reasons for growth. The economy continues to slide into recession, inflation hits new records, and the cost of living in the UK is steadily rising. The Bank of England continues to rush between two fires, but despite all this, BoE Governor Andrew Bailey continues to say that the central bank is not going to refuse to raise interest rates yet. The widespread rumors that the US central bank plans to "pause" the cycle of raising interest rates in September this year continue to gain momentum, which puts some pressure on the US dollar and leads to the strengthening of the pound.

The COT report indicated that long non-commercial positions decreased by -667 to 25,936, while short non-commercial positions rose by 454 to 106,308. This led to an increase in the negative value of the non-commercial net position from -79,241 to -80,372. The weekly close rose from 1.2481 to 1.2511.

Indicator signals

Moving averages

Trading is just above the 30 and 50-day moving averages, which indicates the bulls' attempt to take control of the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator around 1.2540 will act as support. In case of growth, the area of 1.2595 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română