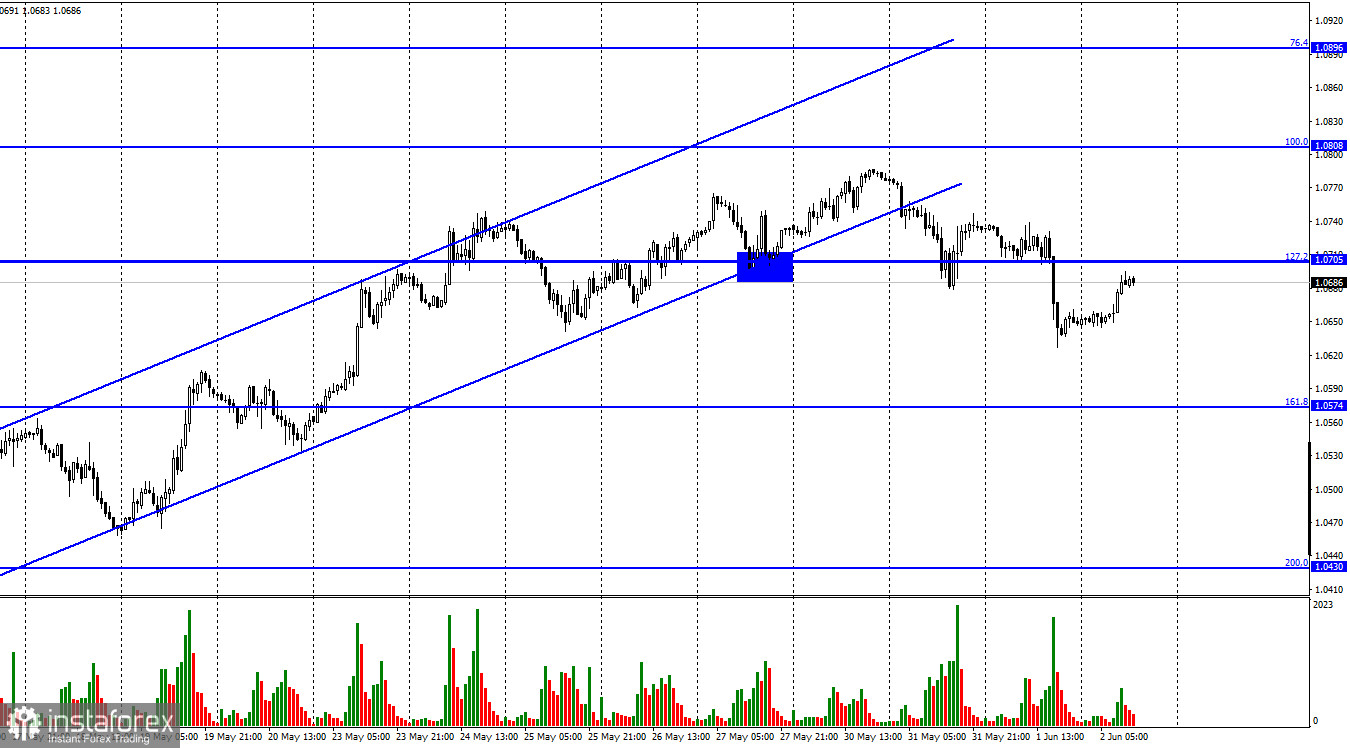

On Wednesday, the EUR/USD pair performed a reversal in favor of the US dollar and a new consolidation under the corrective level of 127.2% (1.0705). However, on Thursday morning, a reversal was already made in favor of the European currency, and the process of returning to the level of 1.0705 began. The rebound of quotes from this level will work in favor of resuming the fall in the direction of the Fibo level of 161.8% (1.0574). Fixing the pair's rate above the level of 1.0705 will increase the probability of new growth of the European in the direction of the corrective level of 100.0% (1.0808). In the last few days, traders have been desperately looking for at least something to cling to when opening trade deals. Yesterday, for example, traders paid excessive attention to the ISM business activity index in the US manufacturing sector. This index is certainly important, but not so much that traders rush to buy the American currency. In May, the ISM index was 56.1 points. The previous value was 55.4, and the forecast was 54.8.

Thus, both the forecast and the April value were exceeded, but still, the dollar rose too much for this kind of data. Traders could already make a reverse move today and start to win back yesterday's not quite logical dollar growth. But with all this, the activity of traders remains quite high. As a rule, if there are no important statistics or very few, and traders are not quite sure what to do with the pair, activity drops. At the same time, the pair consistently passes 80-100 points every day. Therefore, I believe that the most important now is the graphical component, namely, the consolidation under the upward trend corridor. The mood of traders could change again to bearish. There is practically no information background today, but traders can cling to the ADP report in the same way as they clung to the ISM report yesterday.

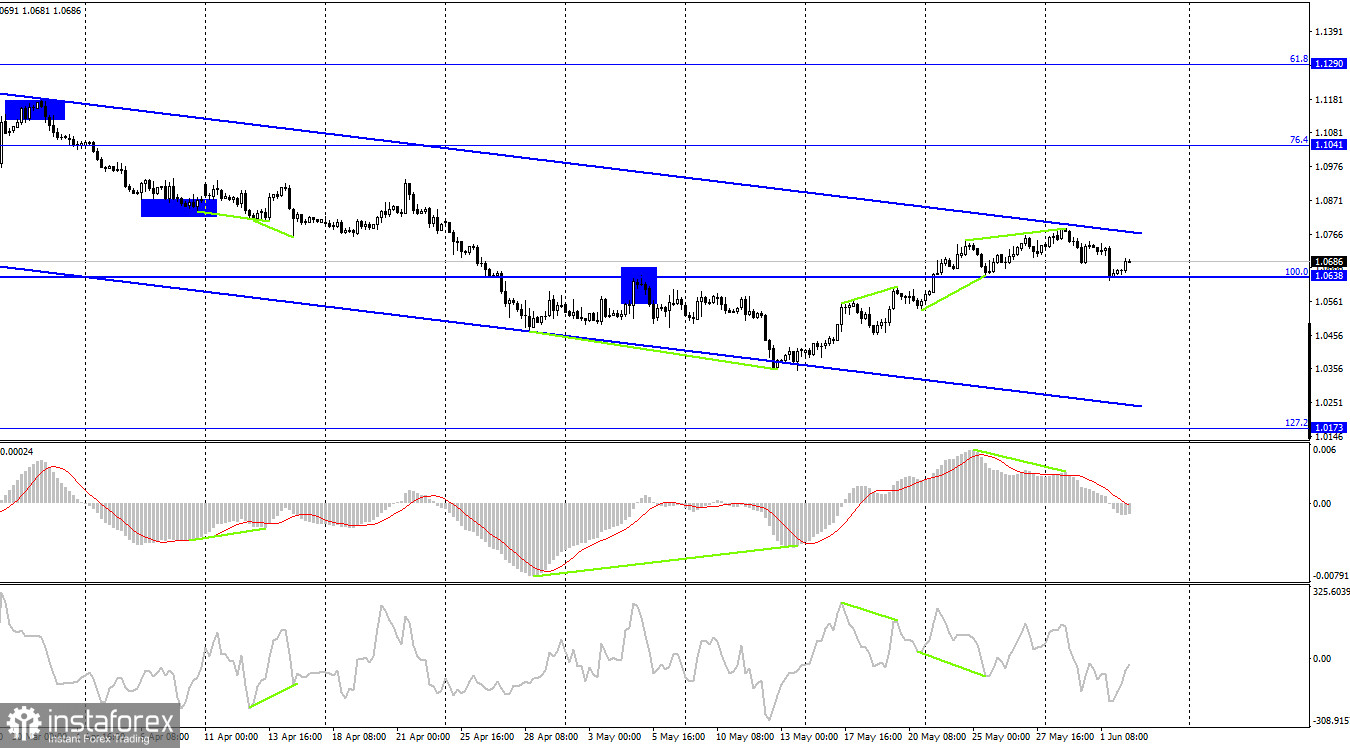

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the MACD indicator. The reversal occurred near the upper line of the descending corridor, which still characterizes the mood of traders as "bearish". And on the hourly chart, the quotes closed under the ascending corridor. Thus, the probability of a new fall in the euro currency has grown significantly. The fall may continue in the coming days in the direction of the corrective level of 127.2% (1.0173), but the bears should first consolidate under 1.0638. Fixing above the corridor on the 4-hour chart will greatly improve the prospects of the euro.

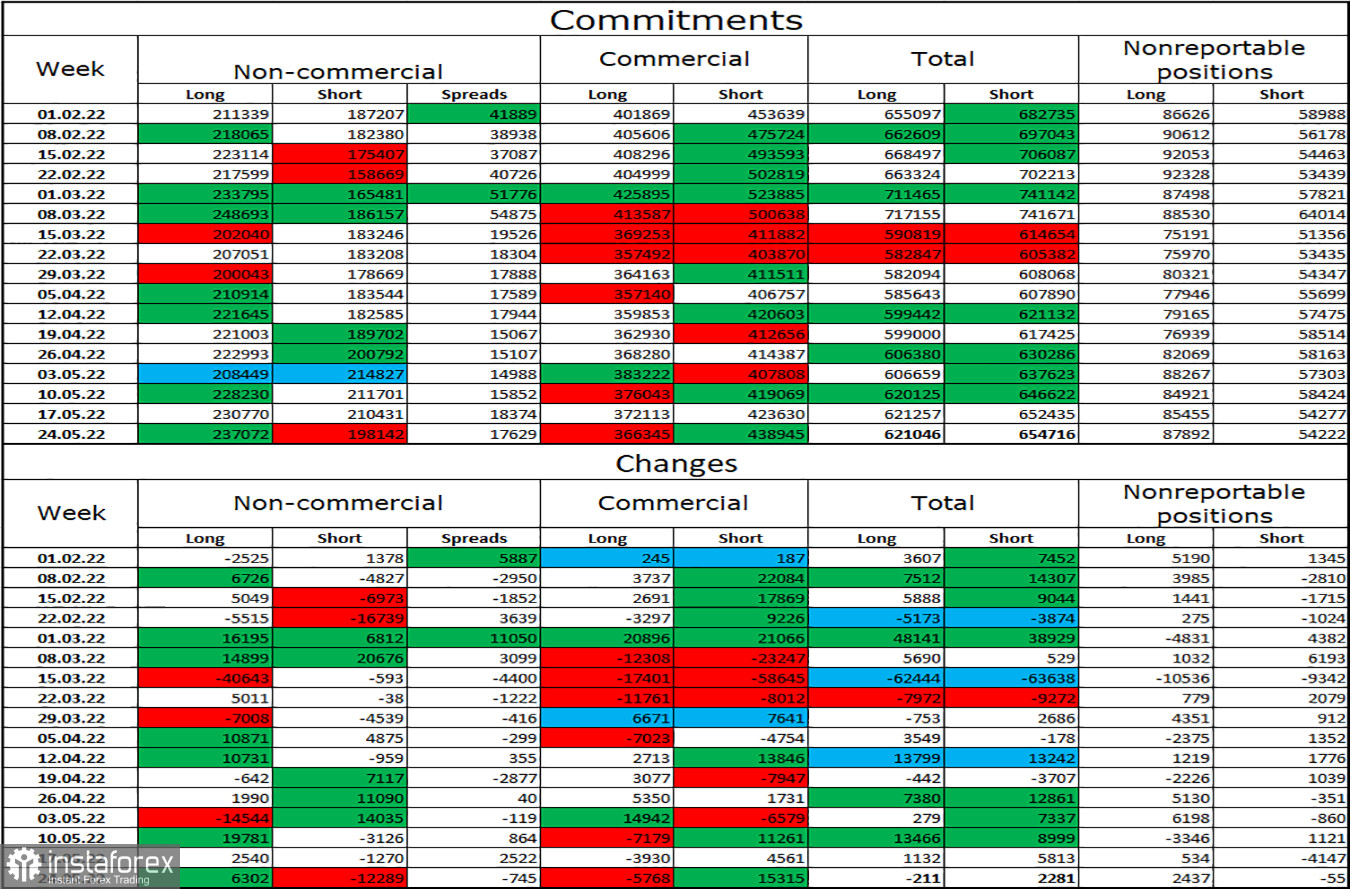

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 6,302 long contracts and closed 12,289 short contracts. This means that the bullish mood of the major players has intensified again. The total number of long contracts concentrated on their hands is now 237 thousand, and short contracts - 198 thousand. As you can see, the difference between these figures is not very big, and you can't even say that the European currency has been falling nonstop in recent months. In recent months, the euro has mostly maintained a "bullish" mood in the category of "Non-commercial" traders, but this did not help the EU currency. However, now we still see how on all charts the mood of traders begins to change to "bullish". Thus, the prospects for the euro currency are improving every day. If bear traders do not start to retreat sharply from their intentions in the next week or two, the euro may seize the initiative from the dollar for a long time.

News calendar for the USA and the European Union:

US - change in the number of people employed in the non-agricultural sector from ADP (12:15 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On June 2, the calendar of economic events in the European Union does not contain interesting entries. Two reports will be released in America, which can only have a restrained effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair if there is closure under the corridor on the hourly chart, with targets of 1.0705 and 1.0574. Now, these transactions can be held. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română