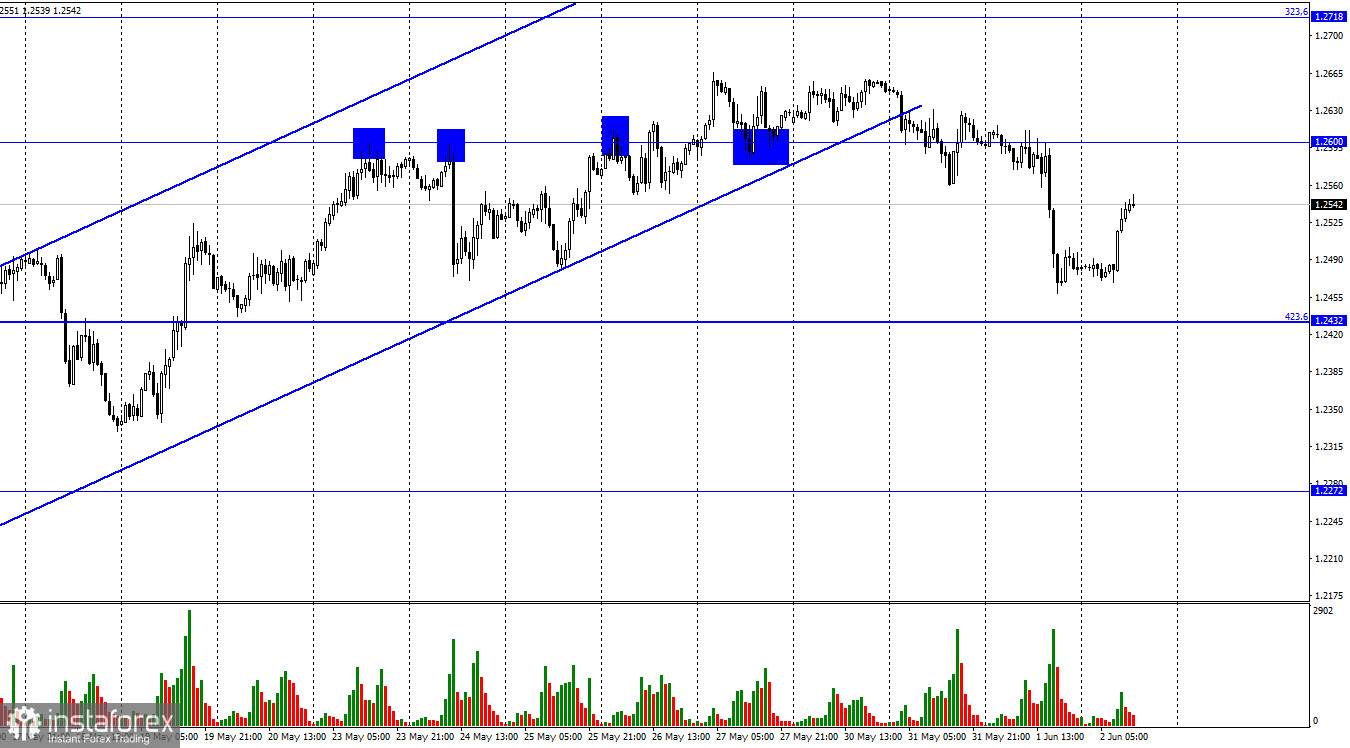

According to the hourly chart, the GBP/USD pair yesterday performed a drop almost to the corrective level of 423.6% (1.2432), not reaching it by only a couple of dozen points. However, this morning, the pair performed a reversal already in favor of the British, thus showing absolutely the same movements as the EUR/USD pair. However, the earlier closing of quotes under an upward trend corridor indicates a change in the mood of traders to bearish, so I am more counting on the continuation of the fall of the British. There has been and will be very little important news and reports this week. So far, the most important events of the week have been the report on inflation in the EU, which has nothing to do with the pound, and reports on business activity in the manufacturing sectors of the US and the UK. I would also like to note that in reality, traders did not pay any attention either to the growing inflation in the European Union or to the business activity index in Britain. Thus, traders are now only interested in American data. And there are even fewer of them this week.

Today, the ADP report will be released in just an hour, which will show how much the number of workers in the non-agricultural sector has changed. This report has about the same meaning as the Nonfarm Payrolls report, but traders pay much less attention to it. This week, the Fed's Beige Book economic report was released in the United States, which noted a slight deterioration in the economic situation in the 12 Federal Reserve districts. The report noted that economic growth continues, but slows down in comparison with the previous period. Retail sales are declining, consumers are facing strong price increases, inflation continues to remain high, interest rates are rising, credit rates are rising, supply chain issues and the Ukraine-Russia conflict have not been resolved, and all this greatly affects the plans of American businesses and households. In some areas of the economy, there is also a shortage of workers, which forces companies to raise wages and fight for the necessary employees or automate the process. This also spurs inflation to growth.

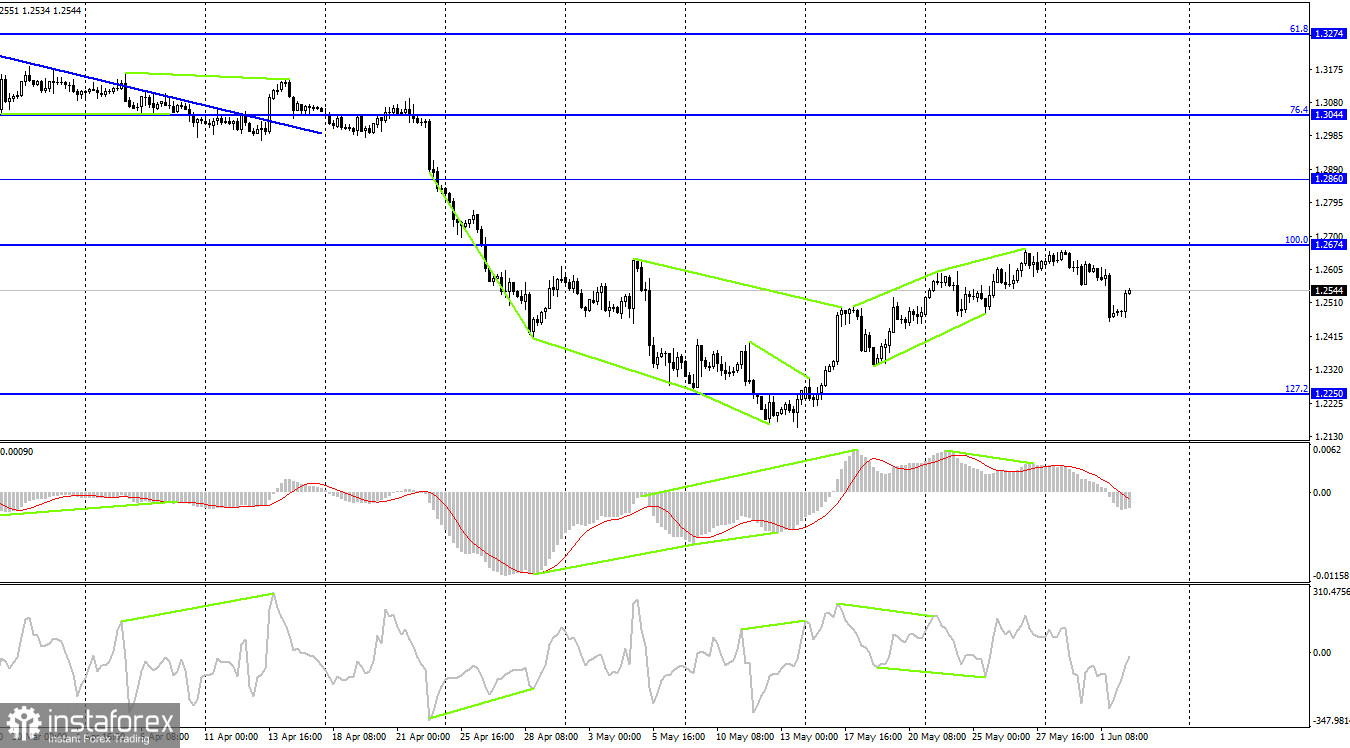

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the MACD indicator. The reversal occurred near the corrective level of 100.0% (1.2674), but there was no rebound. Thus, the fall in quotes began in the direction of the corrective level of 127.2% (1.2250). Fixing above the Fibo level of 100.0% will work in favor of the British and will increase the likelihood of the pair resuming growth in the direction of the 1.2860 level.

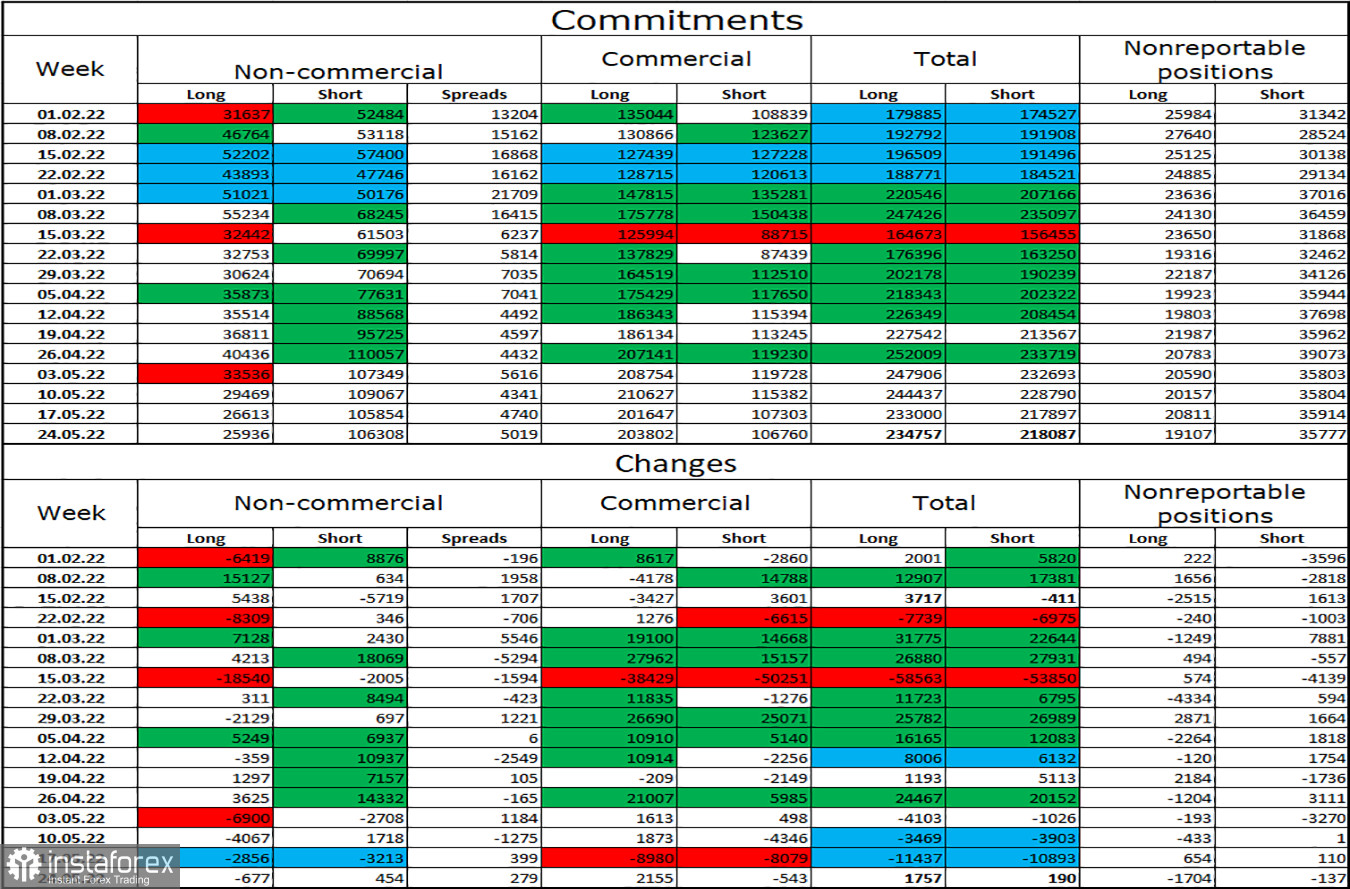

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed too much over the past week. The number of long contracts in the hands of speculators decreased by 677 units, and the number of short contracts increased by 454. Thus, the general mood of the major players remained the same - "bearish", and the number of long contracts exceeded the number of short contracts by four times, as before. The big players continue to get rid of the pound and their mood has hardly changed over the past week. Thus, I expect that the pound may resume its decline over the next few weeks. Now the corridors on the hourly and 4-hour charts will be of great importance since such a strong discrepancy between the numbers of long and short contracts can also indicate a trend reversal. But there is no point in denying that speculators sell more than they buy.

News calendar for the US and the UK:

US - change in the number of people employed in the non-agricultural sector from ADP (12:15 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On Thursday in the UK, the calendar of economic events does not contain a single entry. But two reports from the United States, which are scheduled for the afternoon, may affect the mood of traders with average strength. The ADP report is more important.

GBP/USD forecast and recommendations to traders:

I recommended selling the pound if the closing is performed under the corridor on the hourly chart. Anchoring below the 1.2600 level allows you to hold sales with a target of 1.2432. I recommend buying the British if the 4-hour chart closes above the level of 1.2674 with a target of 1.2860.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română