The EUR/USD pair ended its rebound and now it could extend its short term downside movement. It's trading at 1.0724 at the time of writing and it seems very heavy. DXY's upside continuation after temporary retreats should lift the greenback.

As you already know, the fundamentals moved the market today. The US CPI and Core CPI came in line with expectations, reporting higher inflation in January compared to December. In addition, the CPI y/y came in at 6.4% versus 6.2% expected.

Tomorrow, the Euro-zone Industrial Production and Trade Balance could bring some action. Still, the US retail sales data and the Empire State Manufacturing Index represent high-impact events and could drive the price.

EUR/USD Exit Its Range Soon?

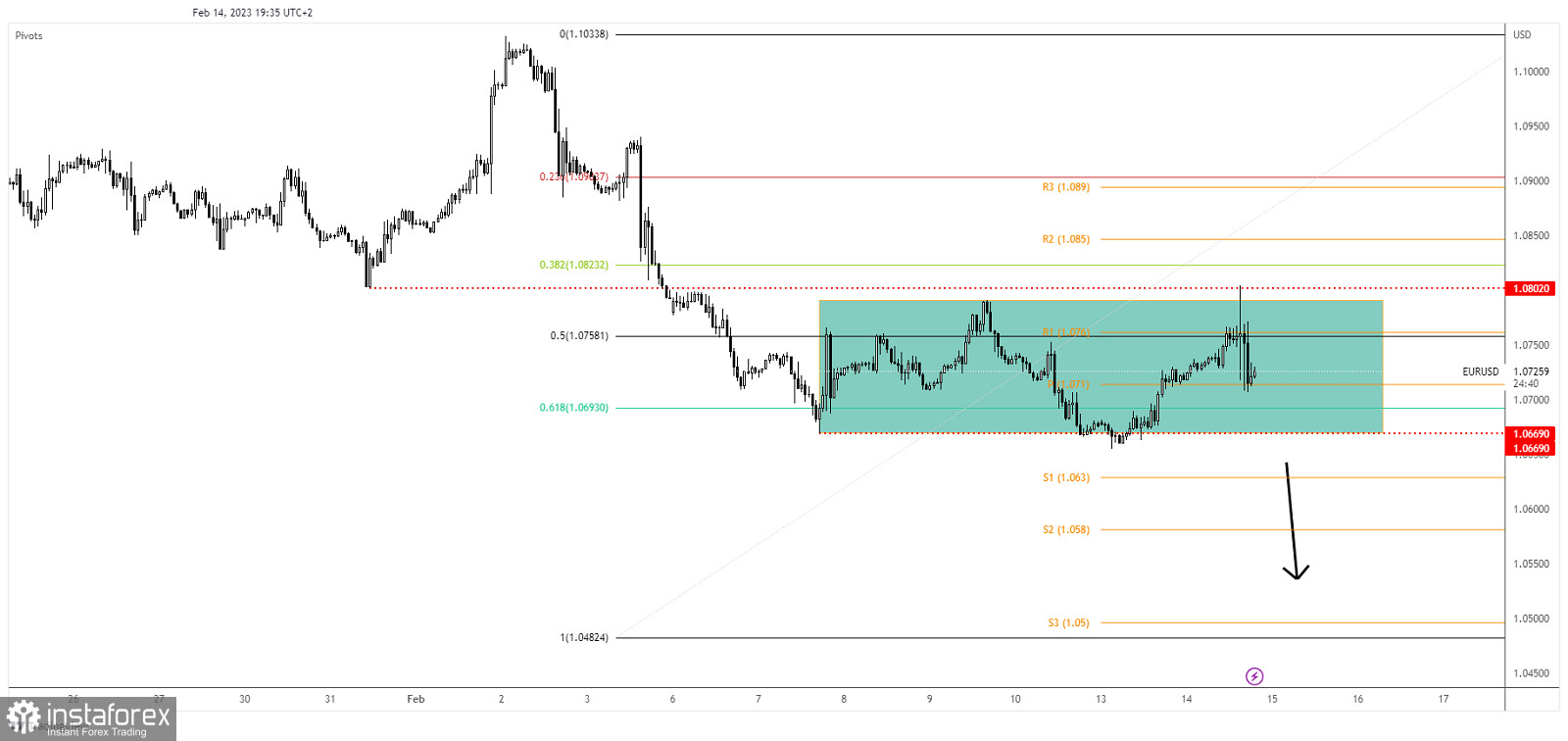

Technically, the rate moves somehow sideways in the short term. It's trapped between 1.0790 former high and the 1.0669 levels. It has registered a false breakout with great separation through the 1.0790 and 1.0802 static resistance levels signaling exhausted buyers.

In the short term, the currency pair could extend its sideways movement. Escaping from this pattern could bring us new trading opportunities.

EUR/USD Outlook!

Its false breakout with great separation may announce a downside breakout. A bearish closure below 1.0669 may announce more declines. A valid breakdown represents a selling opportunity.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română