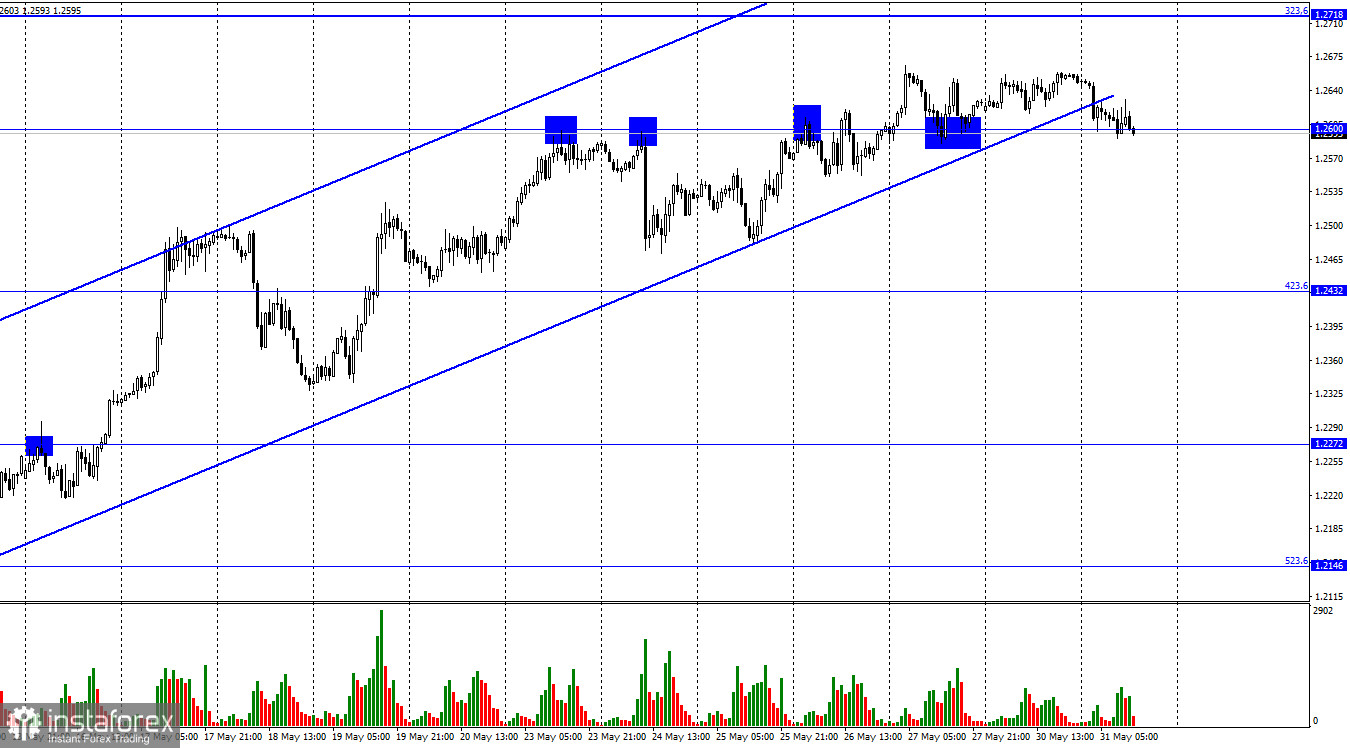

Hi, dear traders! According to the H1 chart, GBP/USD closed above the ascending trend channel. However, the pair reversed downwards afterwards. GBP/USD could possibly settle below 1.2600 in the next couple of hours. The pair broke above this level several days ago. If GBP/USD settles below 1.2600, it could then fall towards the retracement level of 423.6% (1.2432). GBP and EUR are ready to slump, as their recent performance suggests. There were no events on the economic calendar yesterday and early on Tuesday in both the US and the UK, and the US consumer confidence data is unlikely to give support to the pound sterling. The British currency is clearly about to enter a slight correction after rising for 12 days straight.

Recent events do not favor the euro and the pound sterling, and any downward retracement could turn into a new bearish trend. The upturn of EUR and GBP over the past three weeks was likely only a correction, as can be seen on larger timeframes. Both currencies need strong support from positive events in the EU and the UK, which are unlikely to happen. In Ukraine, heavy fighting continues in the Donbas, while the ECB cannot determine when to begin its first interest rate hike. In the meantime, the EU regulator continues its APP quantitative easing program, which has slightly pushed inflation up. The Federal Reserve could hike interest rates by 0,50% at its next two meetings. Bearish traders could take advantage of these increases and regain the initiative in the market.

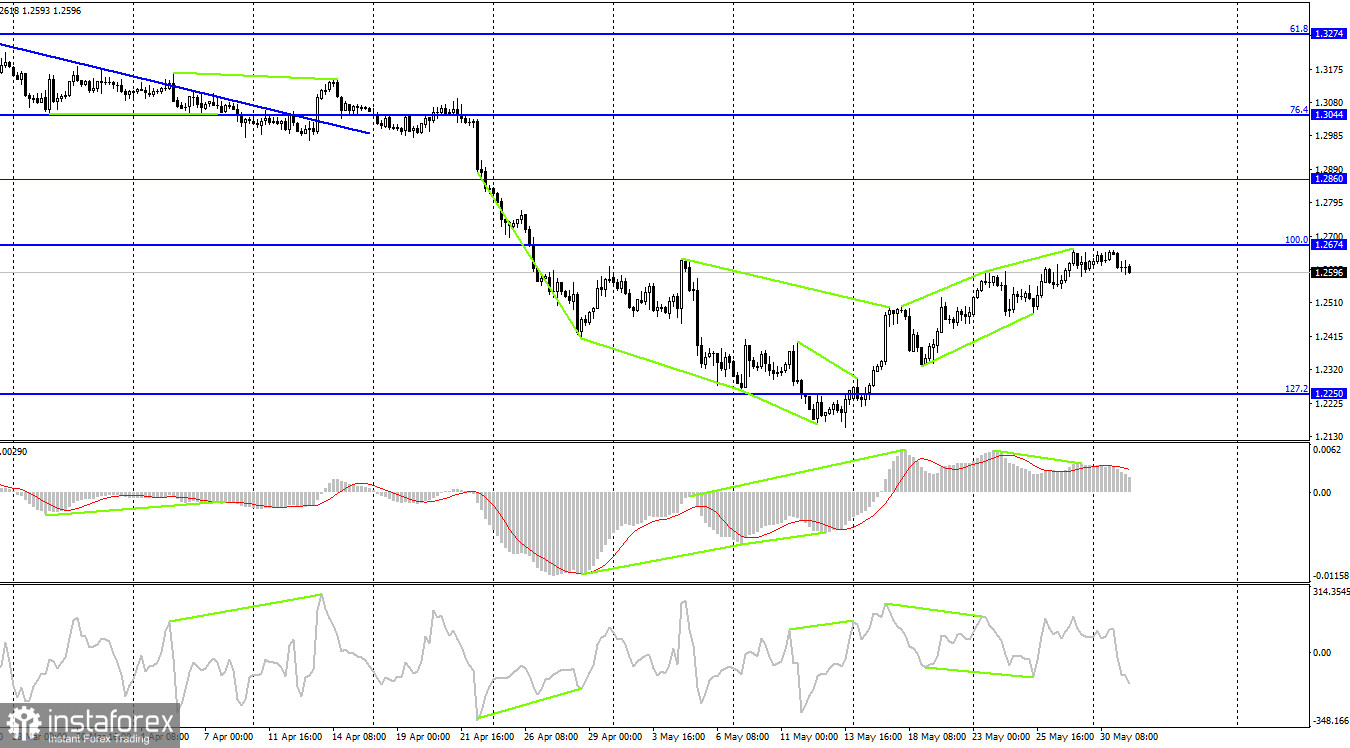

According to the H4 chart, GBP/USD reversed downwards near the retracement level of 100.0% (1.2674) after forming a bearish MACD divergence. However, the pair did not bounce off 1,2674 upwards, indicating that it could fall towards the retracement level of 127.2% (1.2250). If the pair settles above the Fibo level of 100.0%, it could then rise towards 1.2860.

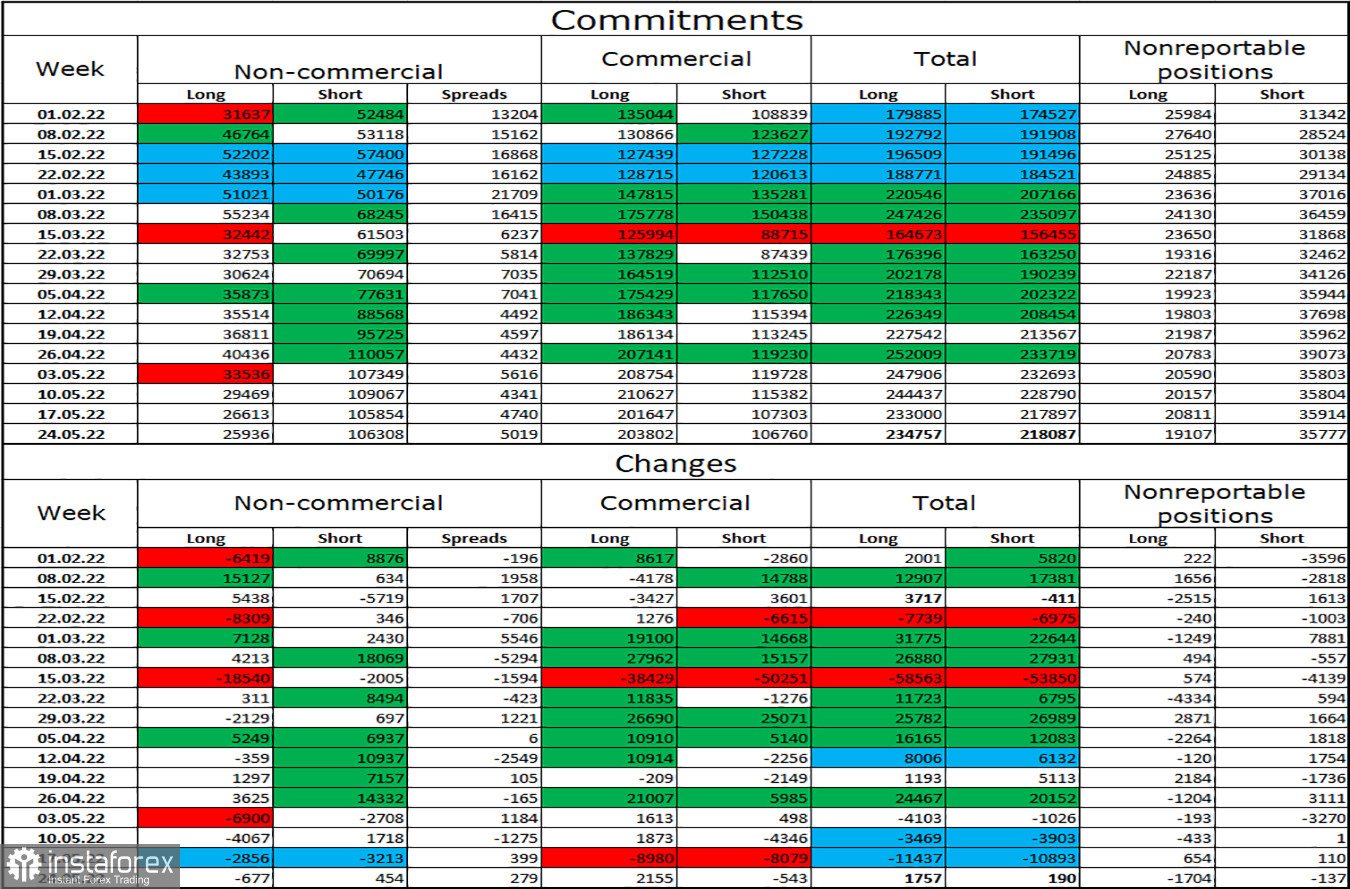

Commitments of Traders (COT) report:

Last week, traders closed 677 Long positions and opened 454 Short positions. Market players have become even more bearish on GBP/USD, while long positions outnumber short ones by 4 to 1. GBP/USD could decline in the next couple of weeks, as traders reduce their exposure to GBP. A large gap between net-long and net-short traders could indicate a trend reversal, making trend channels at H1 and H4 charts especially important. At this point, market players have become more bearish on the pound sterling.

US and UK economic calendar:

US - CB consumer confidence index (14-00 UTC)

The single data release in the US is unlikely to influence traders significantly.

Outlook for GBP/USD:

Earlier, traders were recommended to open short positions if the pair closes below the trend channel on the H1 chart. If the pair settles below 1.2600, it will allow traders to keep short positions targeting 1.2432 open. GBP/USD is likely to fall in the next couple of days - opening long positions is not recommended at this point.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română