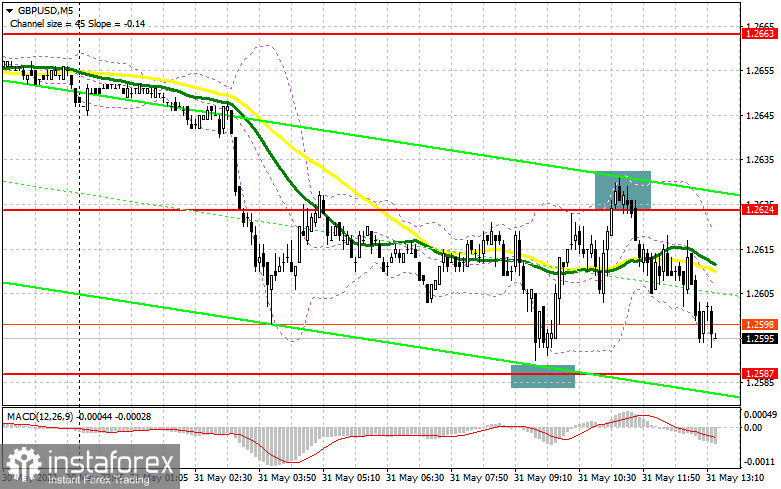

In my morning forecast, I paid attention to the level of 1.2624 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out where and how it was possible and necessary to enter the market. The growth and formation of a false breakdown at the level of 1.2624 against the background of the absence of important fundamental statistics were quite expected. This led to an excellent sell signal and a sharp downward movement of more than 30 points at the time of writing. Until the moment when trading is conducted below this range, we can count on updating the nearest support of 1.2587, which we did not reach during the European session to get a buy signal from there. And what were the entry points for the euro this morning?

To open long positions on GBP/USD, you need:

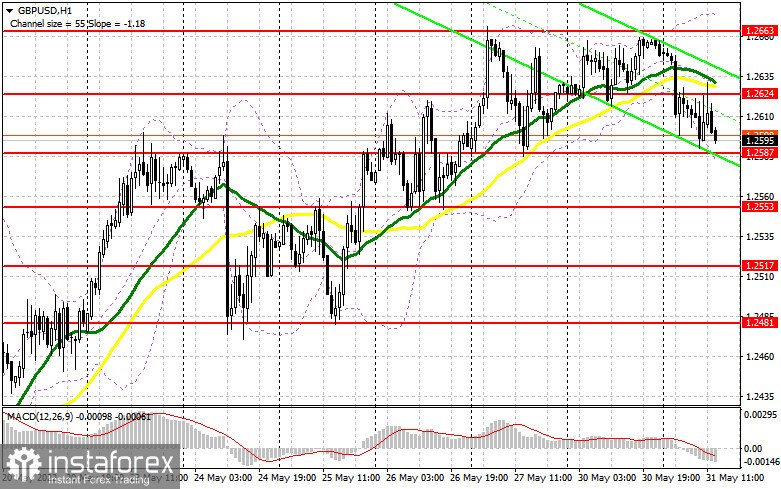

From a technical point of view, nothing has changed for the second half of the day, nor has the strategy itself changed. Although the buyers of the pound have made several unsuccessful attempts to break above 1.2624 and the moving averages, however, it is still quite early to say that they are fleeing the market. By and large, nothing has changed to somehow indicate serious bull problems. Therefore, I advise you to stick to the previous levels and the previous strategy. In the afternoon, several data on the Chicago PMI business activity index and the US consumer confidence index are expected, the release of which may lead to a jerk of the pound down to the 1.2587 area. In this case, the primary task of buyers will be to protect this particular range. Only the formation of a false breakdown there will lead to a signal to open new long positions, counting on the continuation of the bullish trend. The target will be a return to the morning resistance of 1.2624. It is possible to expect a sharper jerk of the pair, but only after fixing above this range with a reverse test from top to bottom. This will open the way to a monthly maximum of 1.2663 with the prospect of updating 1.2709 and 1.2755, where I recommend fixing the profits. A more distant target will be the area of 1.2798. If the pound declines and there are no buyers at 1.2587, and this is a more likely scenario at the end of this month, the pressure on the pair will seriously increase. This will allow GBP/USD to return to 1.2553, but it is best to enter the market from this level after a false breakdown is formed there. It is possible to buy GBP/USD immediately for a rebound only from 1.2517, or even lower - around 1.2481 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears coped with the tasks perfectly and managed to protect 1.2624. While trading will be conducted below this range, I advise you to keep short positions with the expectation of a breakthrough of 1.2587. In the event of a jump of GBP/USD up after the US data, the primary task of sellers will be to protect the same 1.2624. A false breakout at this level will be another ideal condition for opening short positions to consolidate below 1.2587. A breakout and a reverse test from the bottom up of this range form an additional sell signal, allowing GBP/USD to return to the area of 1.2553, and opening a direct road to the minimum of 1.2517, where I recommend fixing the profits. The longer-range target will be the weekly low of 1.2481. A test of this level will greatly harm the developing bullish trend. With the option of GBP/USD growth and lack of activity at 1.2624, another upward spurt may occur and a return to the monthly maximum. In this case, I advise you to postpone short positions until the 1.2664 tests, which should occur together with the formation of a false breakdown there. You can sell GBP/USD immediately for a rebound from the maximum of 1.2709, or even higher - from 1.2755, counting on the pair's rebound down by 30-35 points within a day.

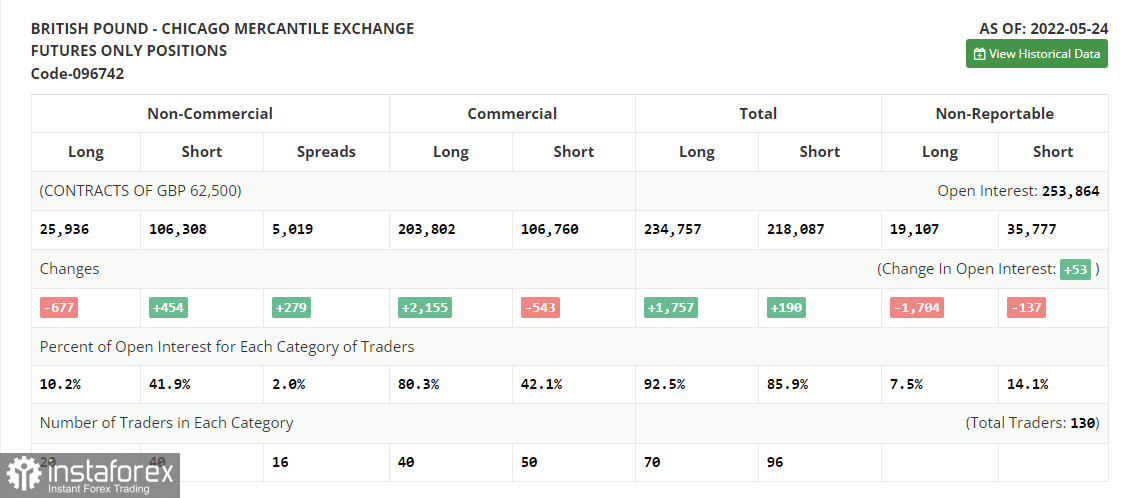

The COT report (Commitment of Traders) for May 24 recorded a reduction in long positions and an increase in short ones. However, this did not significantly affect the balance of power. Despite the growth of the pound since the middle of this month, the market remains completely under the control of sellers. Only the lack of fundamental statistics, to which the pair have been reacting quite negatively lately, and small profit-taking from annual lows allowed GBP/USD to recover a little. There are no other objective reasons for growth. The economy continues to slide into recession, inflation is breaking new records, and the cost of living in the UK is steadily rising. The Bank of England continues to rush between two fires, but even despite all this, the governor of the Bank of England, Andrew Bailey, continues to say that the regulator is not going to give up on raising interest rates yet. Rumors spread that the US central bank plans to "pause" the cycle of interest rate hikes as early as September of this year continues to gain momentum, which puts little pressure on the US dollar and leads to a strengthening of the pound. The COT report for May 24 indicated that long non-commercial positions decreased by -667 to the level of 25,936, while short non-commercial positions increased by 454 to the level of 106,308. This led to an increase in the negative value of the non-commercial net position from the level of -79,241 to the level of -80,372. The weekly closing price rose from 1.2481 to 1.2511.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română