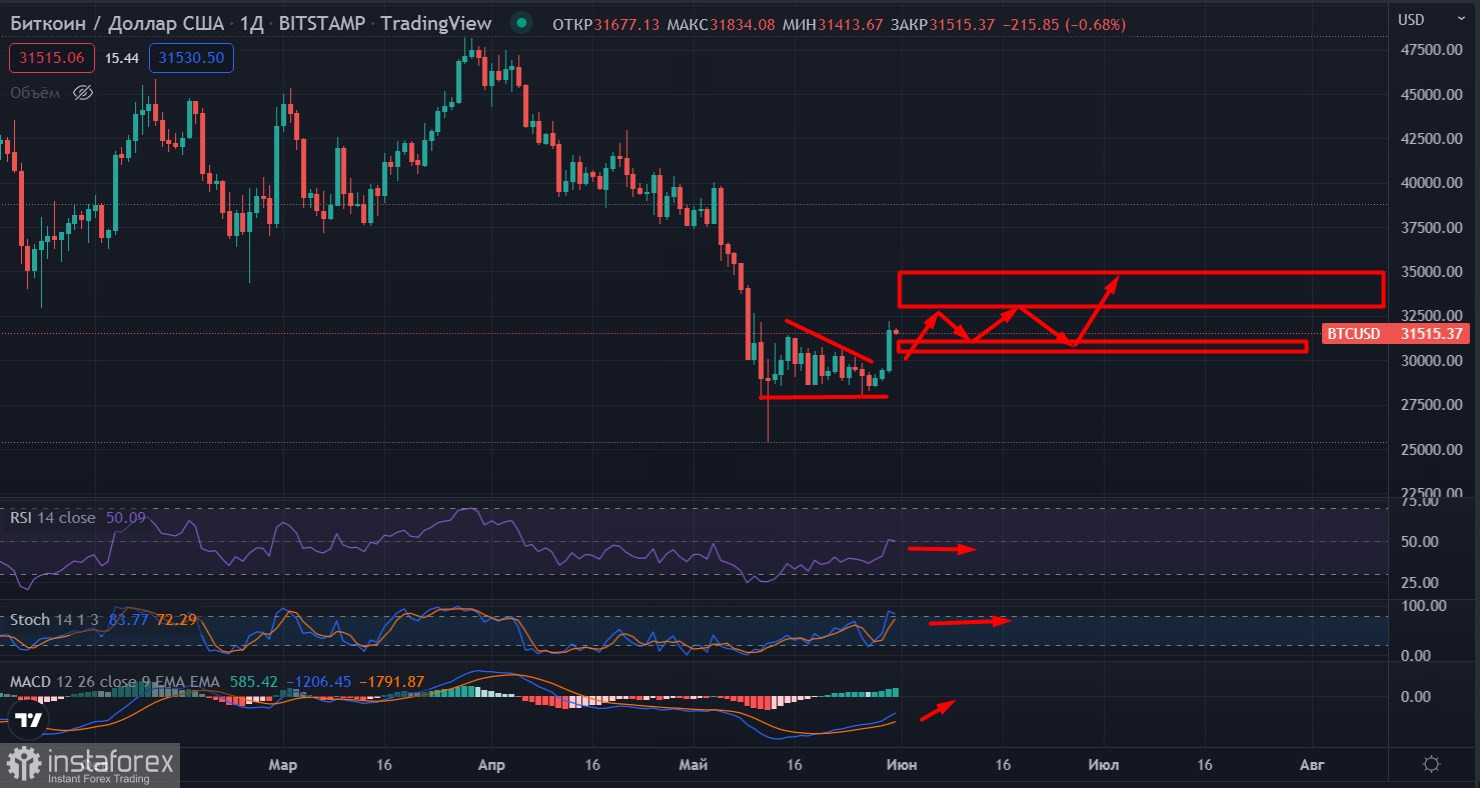

After a boring consolidation week, Bitcoin resumed its upward movement. The asset managed to reach a local high at $32.3k. The cryptocurrency has also formed a bullish engulfing pattern, which is a positive signal indicating a gradual change in the investment paradigm. More and more investors are leaning towards the beginning of the upward movement of Bitcoin. The immediate targets for the upward movement of BTC/USD are the $33k–$35k area.

If you look at the situation from a technical point of view, then the upward momentum to the level of $32k looks natural. The asset recovered after the collapse to $25k and began to systematically consolidate in a narrow area of $29k–$30.5k. Subsequently, large players staged a local test crash of the price and collapsed it to $28k, where there was a large sell order.

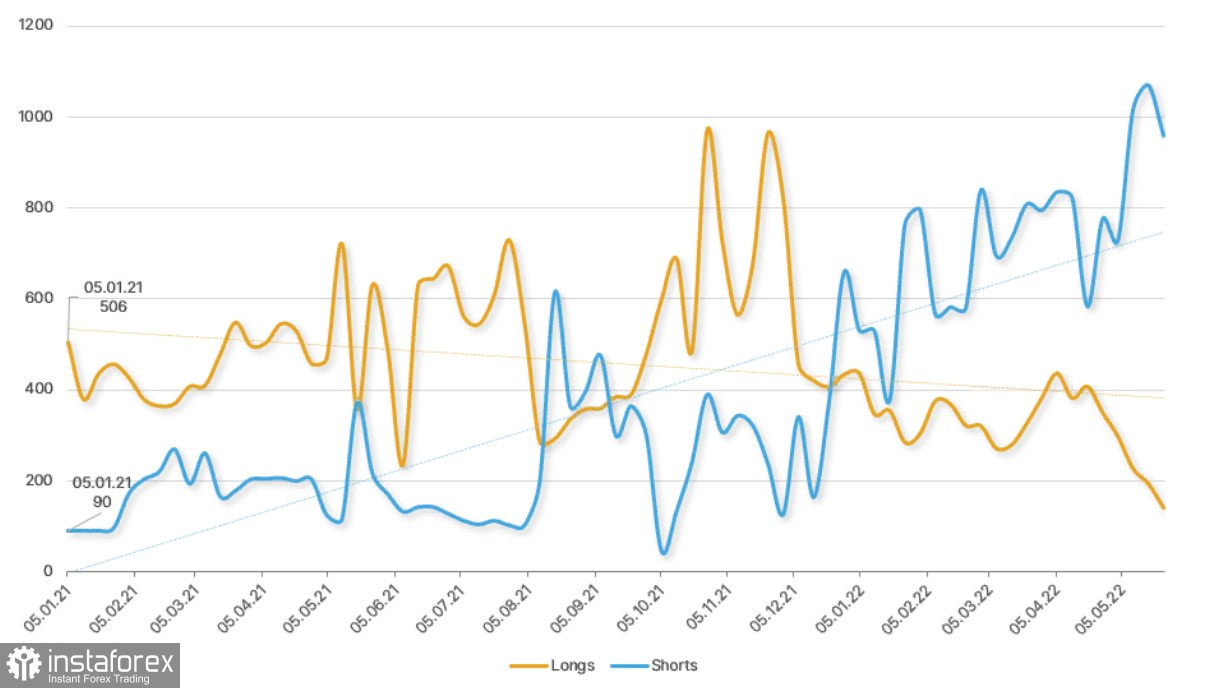

This process can be called knocking out "weak hands," which is an important preparatory step before rising. After consolidating and falling towards $28k, we saw a quick recovery of the situation and an increase in longs, which became clear from technical indicators. Subsequently, the buyers accumulated sufficient volumes for a powerful exit from the range and the formation of a bullish engulfing pattern.

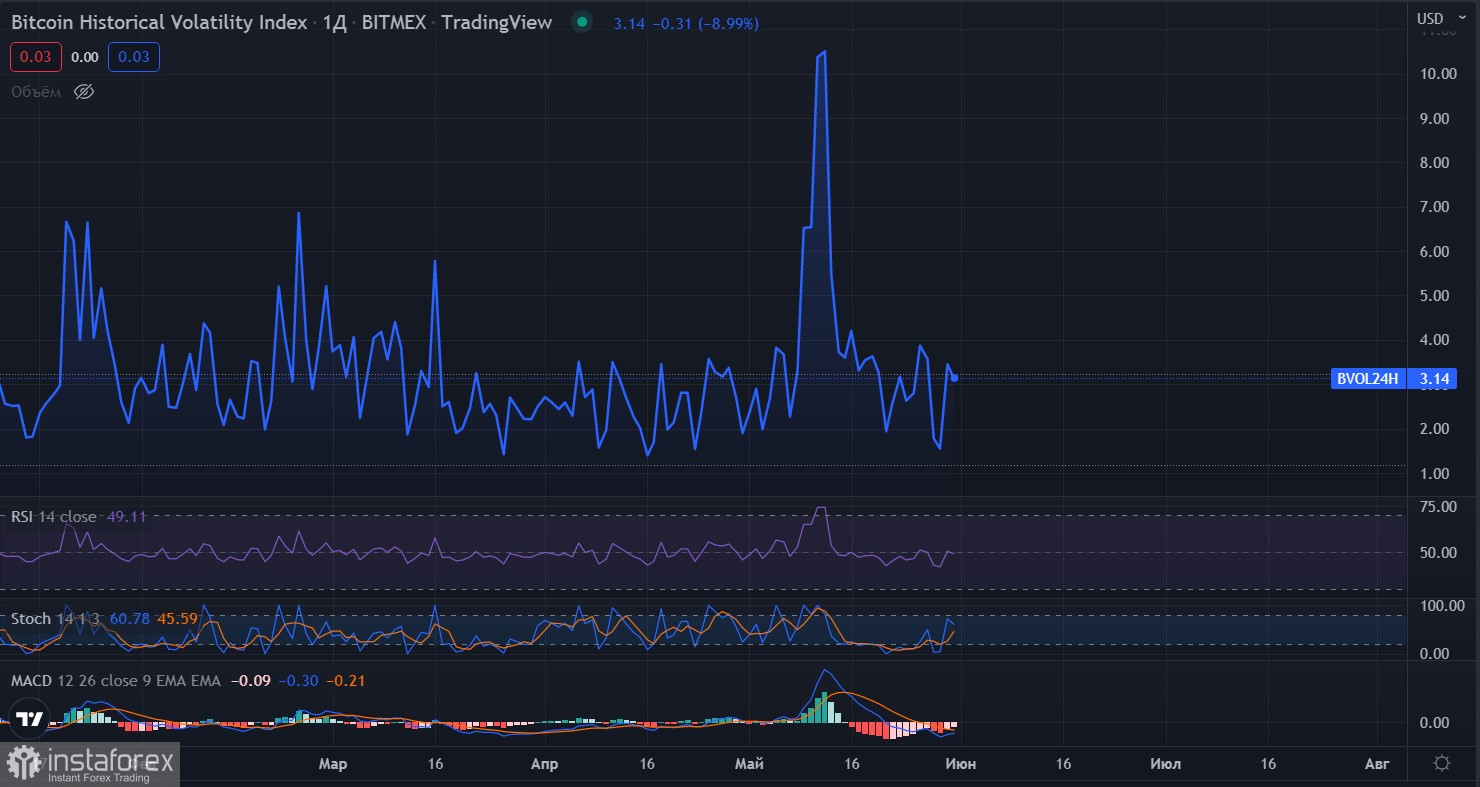

The main reason for the successful implementation of the bullish plan was the $29.7k support zone, which the bears were trying to break through with all their might. However, as a result, the buyers defended the line, which made it possible to form a strong support zone, from which an upward impulse followed. A very important and positive moment in the current impulse upward movement was the low level of volatility.

This suggests that the asset has had a serious consolidation in the $29k–$30k area and this area will become an important support zone in the near future. The low level of volatility during the bullish engulfing formation is also a positive signal for large investors who did not interact with BTC after the collapse of Luna and the massive collapse of the entire market.

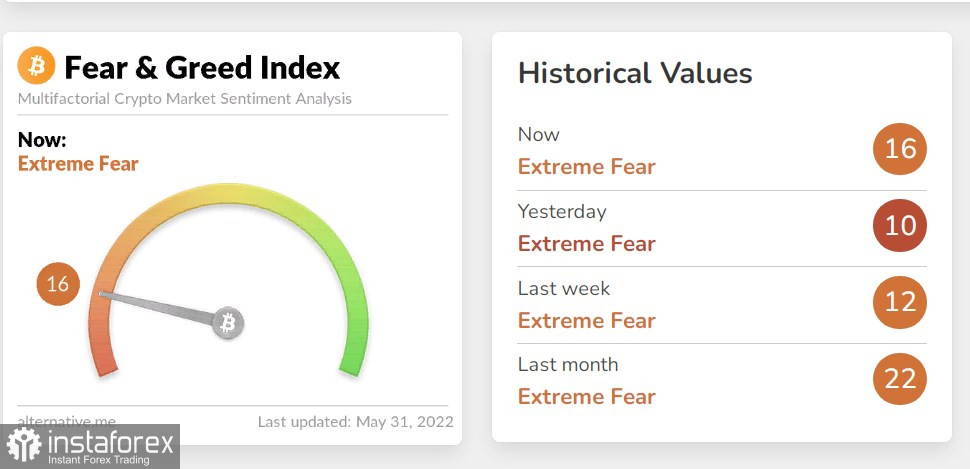

What is the future of the asset and will it be able to form the basis for a long-term bullish trend? Most likely not in the near future. The positive movement of investors is already appearing, but the general is not conducive to a protracted upward movement. The fear and greed index is still at the fear levels, which directly reflects the weak buying activity in an attempt to resume the bullish trend.

In addition, there is a significant influx of coins to cryptocurrency exchanges, as well as an increase in the number of shorts among retail and institutional investors. The combination of these factors indicates that the market has just begun to recover and restore its former buying activity.

From a purely technical point of view, we see that the MACD on the daily timeframe is still below zero, which means that it will not be possible to resume a massive uptrend, since the market lacks volume and confidence. Given the starting quantitative tightening program from the Fed, there are big questions about the appropriateness of a bullish rally, as the situation with access to liquidity will worsen.

Most likely, investors will take a wait-and-see attitude and, having assessed the prospects, will begin an upward movement. As for the current short-term momentum, Bitcoin has broken through the important 0.236 Fibonacci level at $30.7k. If the price manages to fully consolidate above this level by the end of the day, this will eliminate the possibility of a false breakout, and will also open the way for the coin to the $33k–$35k area after a short consolidation. Technical indicators have taken a flat direction, which also indicates a lack of volumes from buyers. With this in mind, the assault on the $33k–$35k range may take place in the second part of the current week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română