At the same time, traders note that the market has recently been trading within fairly narrow boundaries. So, this month the S&P 500 did not rise above 4200 points and did not fall below 4000 points, according to MarketWatch.

Saxo Bank's head of equity strategy Peter Garnry suggested that the market is moving into a tighter range in anticipation of new information from which it will be possible to decide whether to continue the uptrend or turn down.

The number of Americans who applied for unemployment benefits for the first time increased by 13,000 last week to 196,000, according to a report from the US Department of Labor. Analysts polled by Bloomberg predicted an average increase in the number of applications to 190,000.

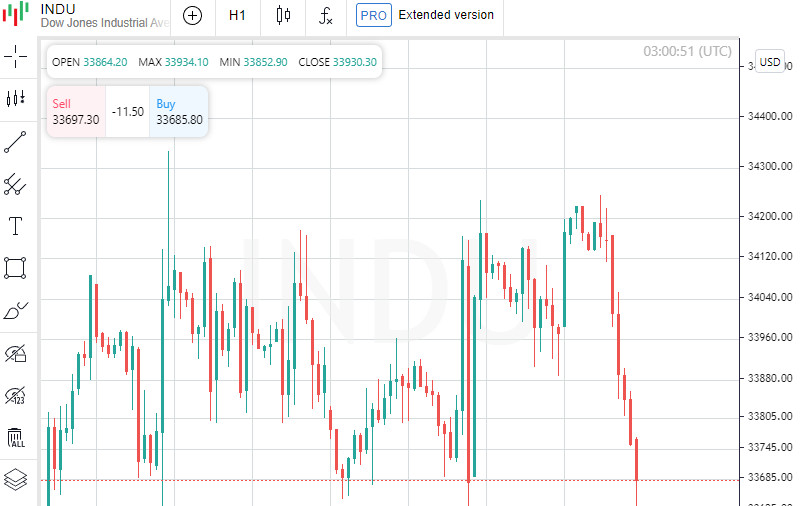

Dow Jones Industrial Average by 18:00 GMT + 3 increased by 0.65% and amounted to 34169.97 points.

Leading gainers among the index components include Walt Disney, as well as Salesforce Inc., which rose 2.9%, Microsoft Corp. - by 1.8% and Intel Corp. - by 1.3%.

The value of the Standard & Poor's 500 by this time increased by 0.6% - up to 4144.06 points.

The Nasdaq Composite index has risen 0.9% since the market opened and reached 12021.51 points.

Walt Disney Co. share price increased by 4.5% in early trading. The world's largest entertainment and media company increased its net profit and revenue in the first quarter (October-December), largely due to strong performance in the amusement parks segment. The head of the company, Bob Iger, announced a reorganization of the business, which includes cutting costs by $5.5 billion a year and laying off about 7,000 people. He also promised to resume at the end of this year the payment of dividends suspended during the coronavirus pandemic.

PepsiCo Inc. increased revenue in October-December by 10.9%, increased dividends by 10%. Shares of one of the world's largest producers of soft drinks are growing by 1.7%.

Hilton Worldwide Holdings rose 2.5%. The hotel chain more than doubled its fourth-quarter net income, with its adjusted figure and revenue beating analysts' expectations.

Cost of Kellogg Co. rises by 1.2%. The breakfast cereal and snack maker posted a net loss in the fourth quarter, but it was driven by write-downs related to the company's spin-off plan. At the same time, profit excluding one-time factors exceeded the forecasts of experts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română