EUR/USD

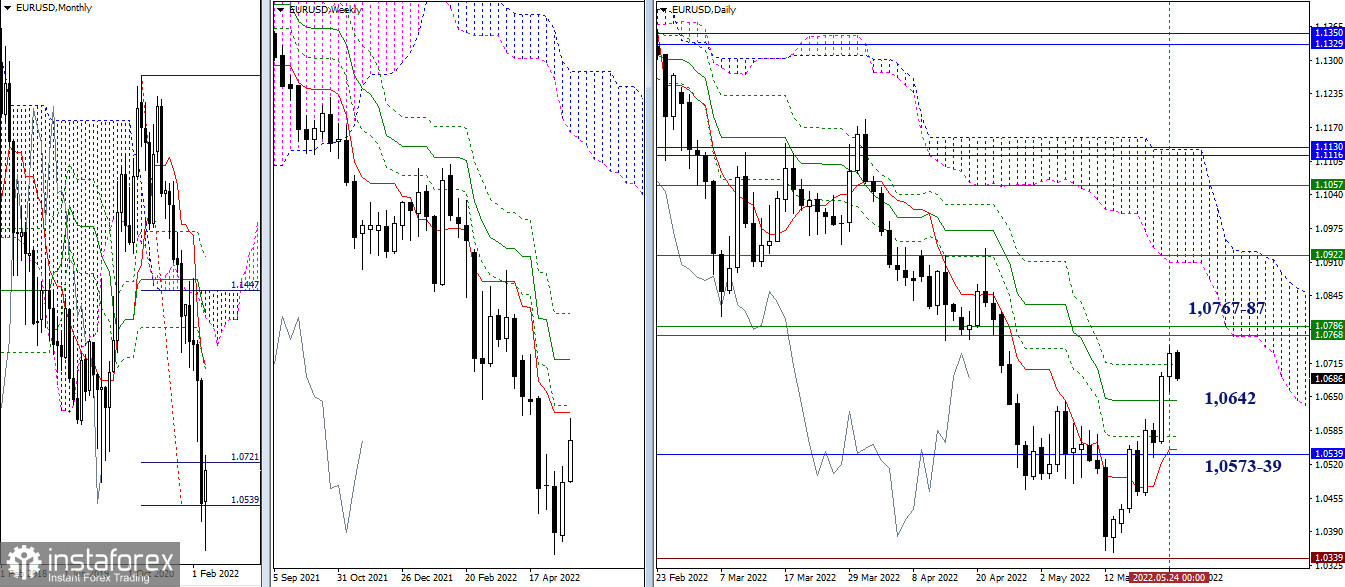

Higher timeframes

Bulls slowed down yesterday but managed to mark a new high and came close to the weekly resistance zone 1.0767 – 1.0787 (short-term trend + Fibo Kijun). The strength and influence of these levels are now able to make some adjustments to the development of the movement. A breakdown and a reliable consolidation above will open new prospects for the bulls, and their attention will immediately rush to the daily cloud and the weekly medium-term trend (1.0922). Supports are now represented by previously passed levels 1.0642 (daily medium-term trend) and 1.0573-39 (daily + monthly levels).

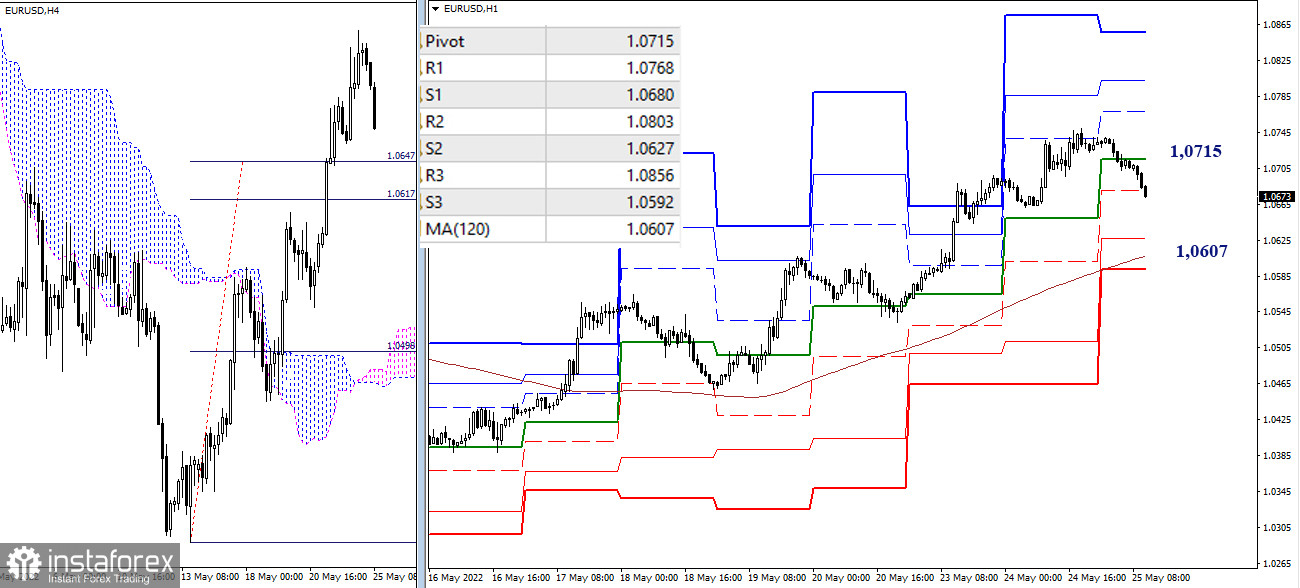

H4 - H1

At the moment, a downward correction is developing on the lower timeframes. Bears have already seized the central pivot point (1.0715), which, in case the opponent restores positions, will now work as immediate resistance. The main reference point for the continuation of the decline today is the weekly long-term trend (1.0607).

***

GBP/USD

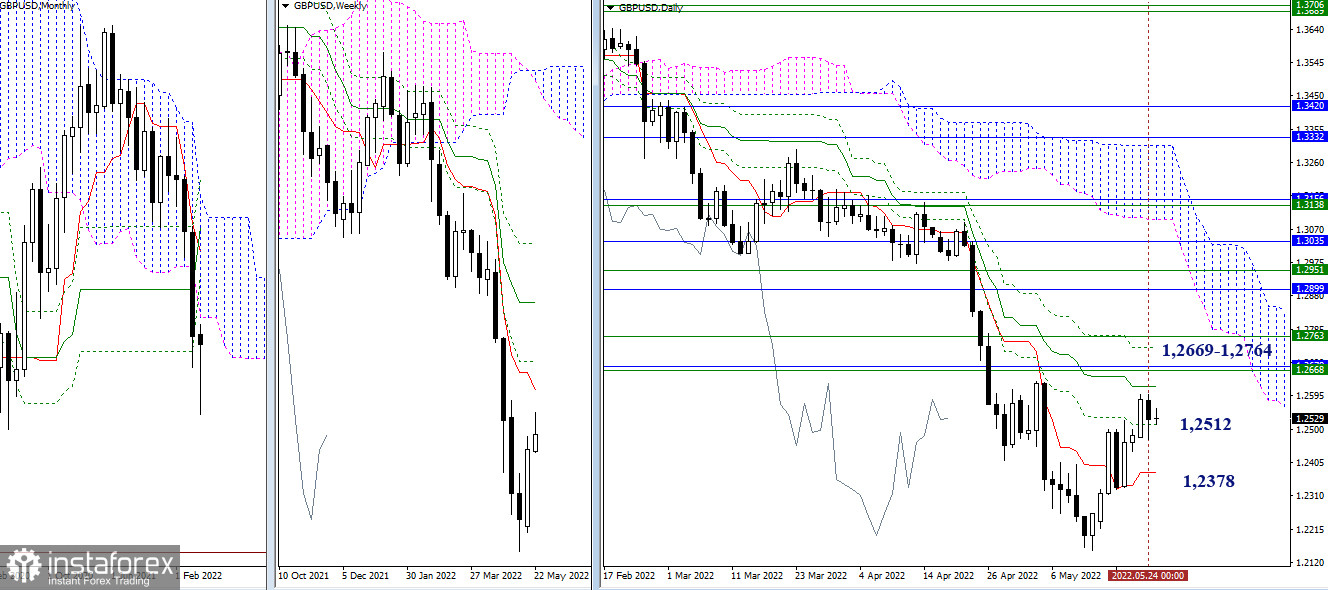

Higher timeframes

The pound was unable to continue the rise yesterday and limited itself to working in the daily Fibo Kijun zone (1.2512). The nearest upward targets are still the final levels of the daily death cross (1.2622 – 1.2733), weekly levels (1.2669 – 1.2764), and the lower boundary of the monthly cloud (1.2678). When the mood changes, the support of the daily short-term trend (1.2378) may be important.

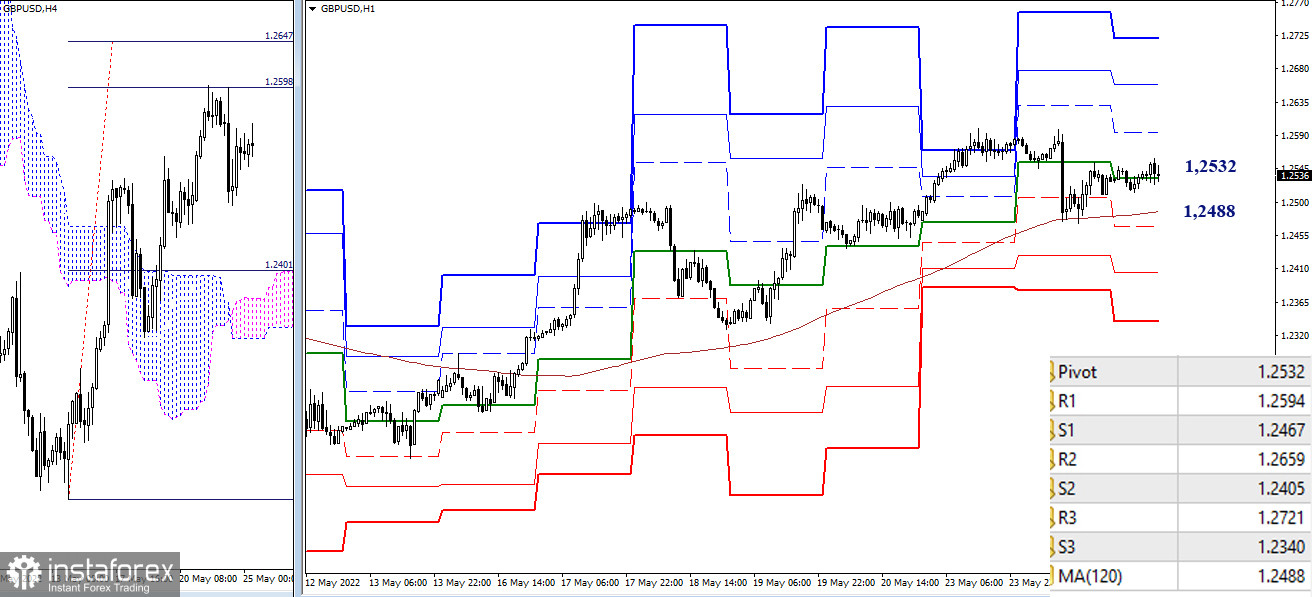

H4 - H1

The main advantage on the lower timeframes continues to remain on the side of bulls. At the same time, there has been a struggle for key levels that defend bullish interests for a long time now. Today key levels are located at 1.2532 (central pivot point of the day) and 1.2488 (weekly long-term trend). In the event of a change in mood and activity, other reference points within the day may come in handy for bulls, these are the resistance of the classic pivot points (1.2594 – 1.2659 – 1.2721) and the target for the breakdown of the H4 cloud (1.2598 – 1.2647). For bears, the support of the classic pivot points (1.2467 – 1.2405 – 1.2340) may be of interest.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română