The EUR/USD currency pair continued its upward movement on Monday. The most important thing that was achieved on the first trading day of the week was an update of the previous local maximum near the level of 1.0620. It should also be noted that the growth of the European currency began at night, and no macroeconomic statistics were planned for Monday. Consequently, on an empty day of the week, and even the first, traders found grounds for new purchases of the euro currency. We talked about this over the weekend - the current week should show the mood of traders and answer the question of whether the pair's growth last week was accidental. If there is no macroeconomic information, then traders trade without influence from outside. And the first day of the week showed that they are set up for purchasing. This is not surprising, since in recent weeks we have been regularly talking about the technical need to adjust.

Thus, we may be now seeing a technical correction. But how long it will last is an open question. The current growth of the pair can be ensured by the exit of bears from short positions, or maybe by the opening of long positions by bulls. In the first case, the bears may return to the market. Therefore, it is now quite difficult to say whether the pair will now start a new upward trend. Recall that most factors continue to remain on the side of the US dollar. Over the past two weeks, nothing has changed much in the balance of power between the euro and the dollar. The Fed is still on the path of a strong tightening of monetary policy, and the ECB is still in the clouds and does not say anything specific about raising the rate. The geopolitical background has weakened its influence on the market in recent weeks, but this does not mean that the conflict in Ukraine is over, and tomorrow a new conflict will not begin somewhere else.

Lagarde's speech takes precedence over Powell's.

As we have already said, there will be a small number of important events this week. However, quite a large number of publications are planned for today. However, we are talking only about the indices of business activity in the services and manufacturing sectors of the EU and the USA. And these indices rarely provoke strong movements in the market. And in any case, there were no statistics yesterday, but the pair showed both good volatility and trend movement. But tonight there will be speeches by the heads of the ECB and the Fed, Christine Lagarde and Jerome Powell. Regarding Powell, we are not waiting for any new information, because the Fed's plans have long been known to everyone and they are unlikely to change dramatically. But there are a lot of questions about Lagarde. It is still completely unclear whether the ECB will raise the key rate this summer, or is it all just talk? From this point of view, every speech by Lagarde can potentially provide an answer to this question. It is clear that the head of the ECB doubts the correctness of this decision, so he is in no hurry to announce it publicly. Nevertheless, time is passing and the closer the month of July is, the more difficult it will be for Lagarde to remain silent. Moreover, some heads of central banks of the EU countries have already begun to openly declare the need to raise the rate. Thus, Lagarde's speech is much more important than Powell's. Well, the euro currency, of course, will be waiting for words about raising the rate. If it doesn't wait, a pullback may follow, but in general, traders now seem to be aiming for the growth of the euro/dollar pair. If so, then the speeches of Lagarde and Powell will not lead them off this path. So far, both linear regression channels are directed downwards, but this is normal, since if we are now observing the formation of an upward trend, then it has just begun.

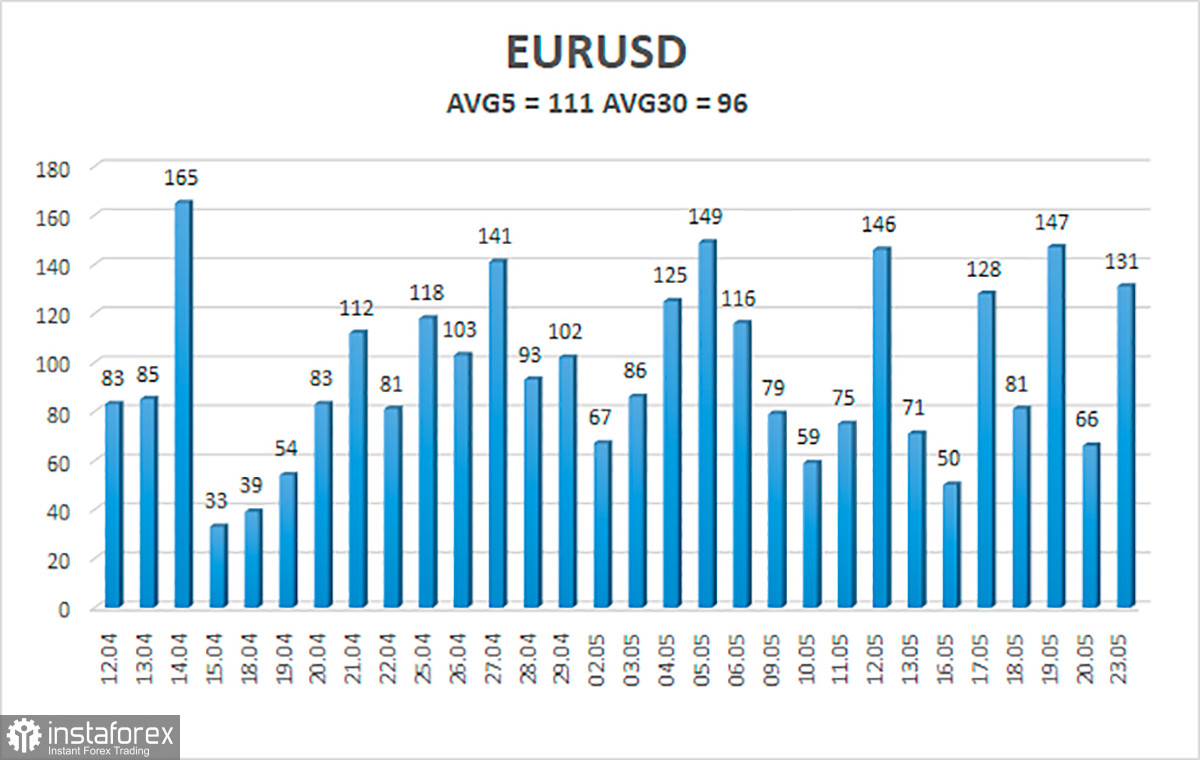

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 24 is 111 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0567 and 1.0789. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and is trying to maintain the formation of a new upward trend. Thus, now it is necessary to stay in long positions with targets of 1.0742 and 1.0789 until the Heiken Ashi indicator turns down. Short positions should be opened with a target of 1.0376 if the price is fixed below the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română