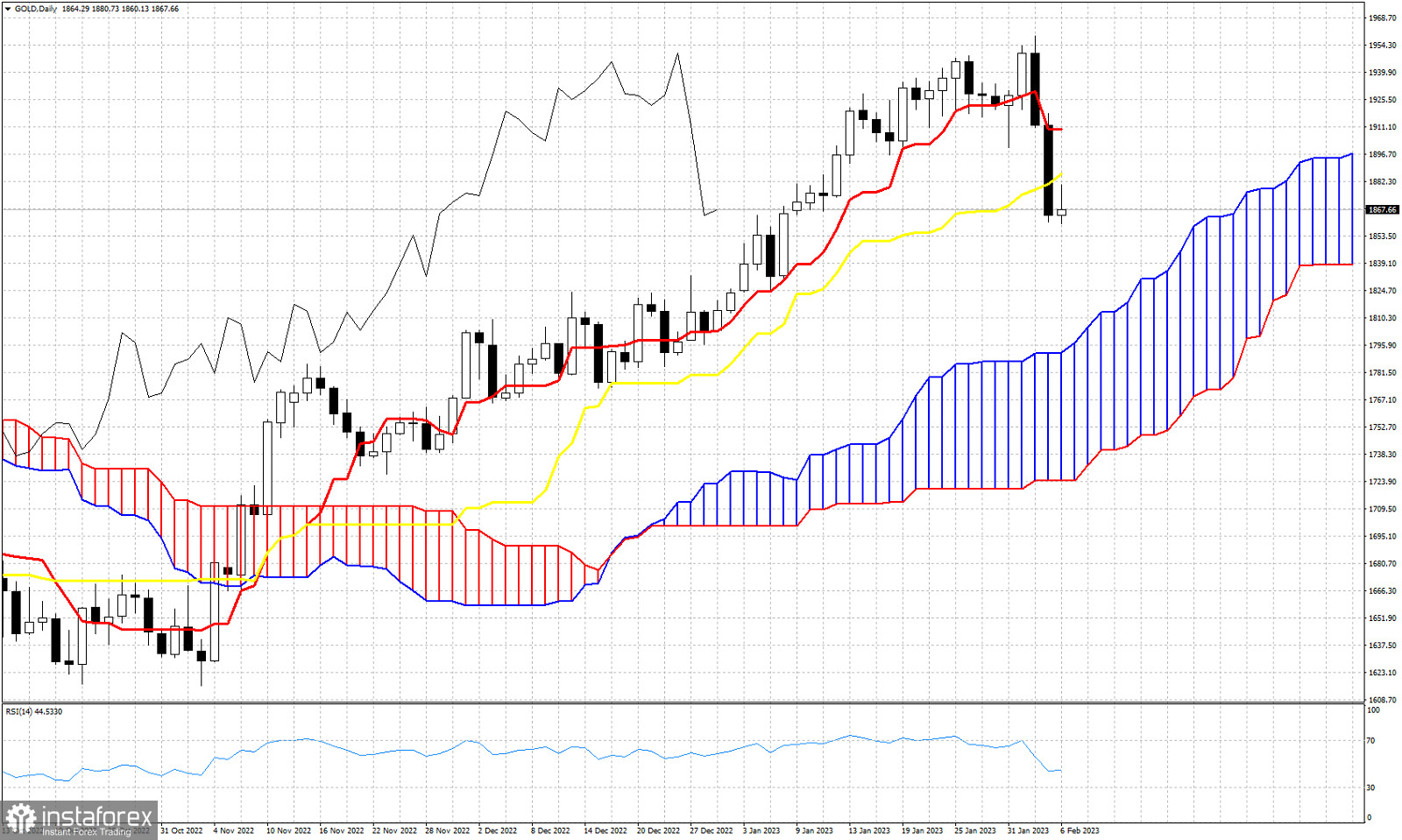

Gold price is bouncing after last week's sell off and decline from $1,960 to $1,860. According to the Ichimoku cloud indicator in the 4hour chart we got a trend change last week to bearish. On a daily basis the Ichimoku cloud indicator remains on a bullish side but with many indications of weakness. Last Thursday Gold price closed below the tenkan-sen (red line indicator). This was the first sign of weakness. On Friday price broke and closed below the kijun-sen (yellow line indicator) providing us with another sign of weakness. Today price is bouncing but Gold remains vulnerable to another move lower towards the Kumo (cloud). Support by the cloud is at $1,800-$1,810. The Chikou span (black line indicator) is still above the candlestick pattern. Support according to the Chikou span is at $1,825-35. Technically Gold price is vulnerable to more downside also. The bearish RSI divergence signals have warned bulls, price broke out of the bullish channel. Current Gold price action suggests more downside should be expected.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română