Brent and WTI still trade in the wide sideways range. The price can't go down amid increasing demand uncertainty due to high recession risks as well as geopolitical developments in Ukraine. The market is clearly willing to buy oil contracts on a decline, which may be a good trading strategy.

Technical picture:

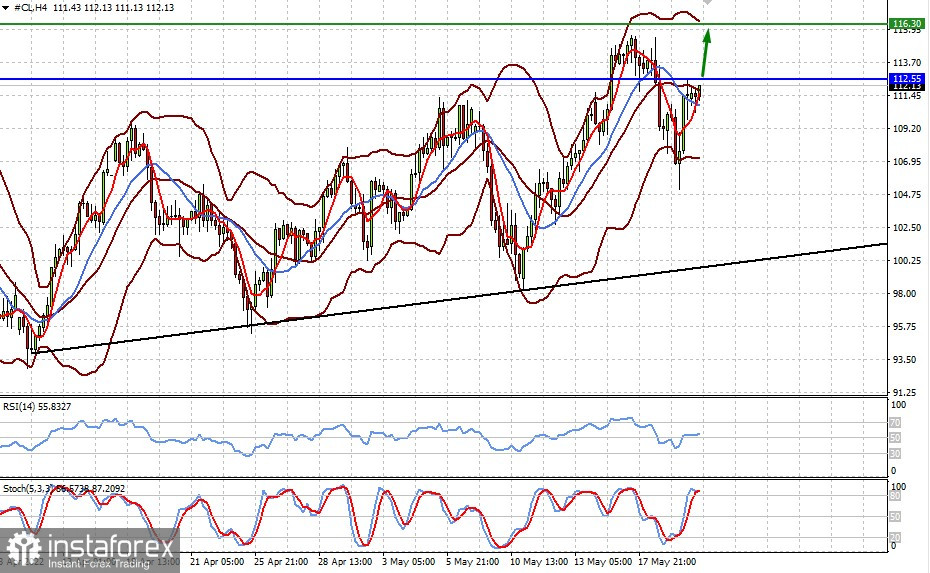

The price is above the middle Bollinger band, the SMA 5, and the SMA 14. A crossover of the moving averages signals to buy the instrument. The Relative Strenght Index is above 50, indicating the likelihood of a bullish move. The Stochastic is in the overbought zone and is uninformative.

Daily forecast:

A breakout and consolidation above 112.55 may lead to a rise to 116.30.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română