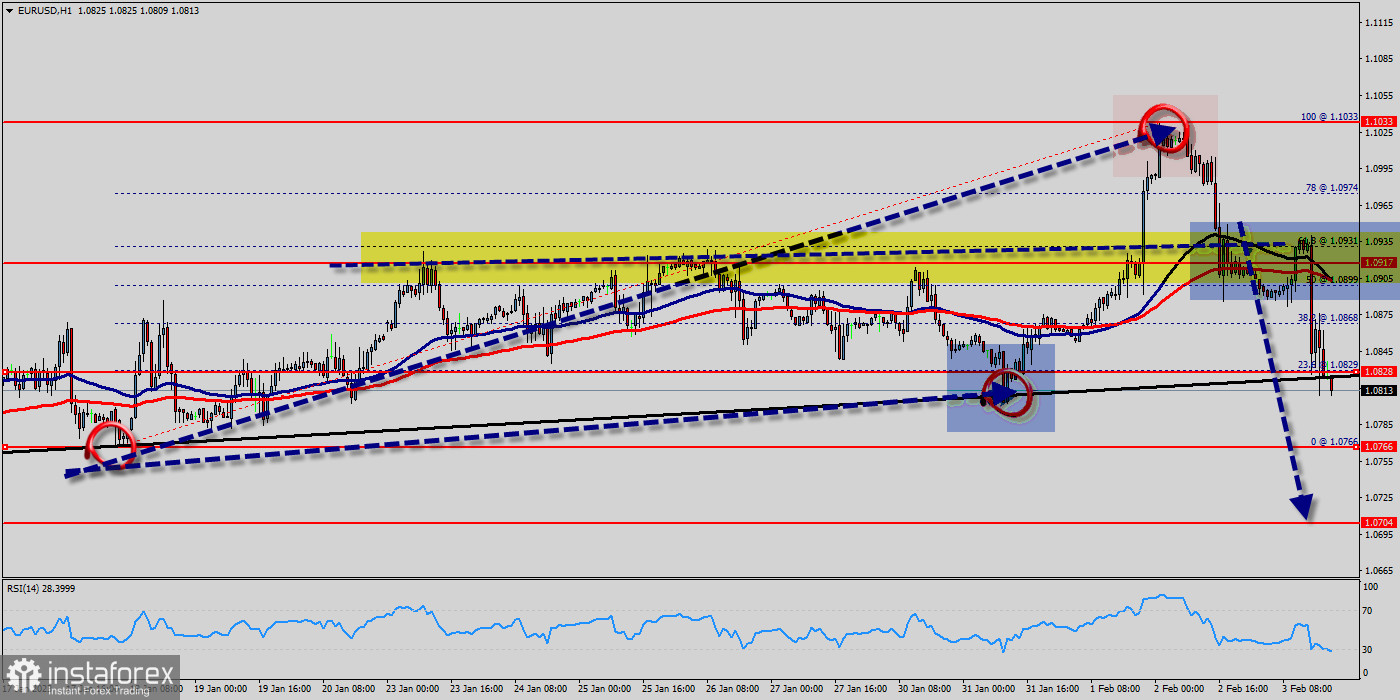

The EUR/USD pair has dropped sharply from the level of 1.0917 towards 1.0813. Now, the price is set at 1.0868 to act as a daily pivot point.

It should be noted that volatility is very high for that the EUR/USD pair is still moving between 1.0868 and 1.0766 in coming hours.

Furthermore, the price has been set below the strong resistance at the levels of 1.0899 and 1.0868, which coincides with the 50% and 37.2% Fibonacci retracement level respectively.

Additionally, the price is in a bearish channel now. Amid the previous events, the pair is still in a downtrend. From this point, the EUR/USD pair is continuing in a bearish trend from the new resistance of 1.0917.

Thereupon, the price spot of 1.0917 remains a significant resistance zone. Therefore, a possibility that the EUR/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective; In order to indicate a bearish opportunity below 1.0828, sell below 1.0828 with the first targets at 1.0766 (the double bottom is seen at 1.0766).

However, the stop loss should be located above the level of 1.0917.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română