According to preliminary estimates, inflation in the eurozone grew to 7.5% from 7.4%. Meanwhile, the final reading showed slightly different results. Figures remained unchanged, which could be interpreted as a positive factor on the one hand. Nevertheless, inflation is still at an extremely high level, and the ECB does nothing to tame it. Investors fear long-term severe consequences for the European economy.

Eurozone Inflation Rate:

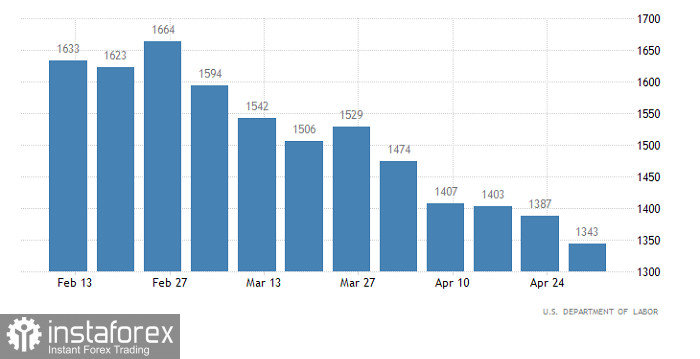

The greenback began to strengthen after the release. Today, the currency is likely to show growth. Weekly jobless claims in the US will have no effect on the dollar. All in all, initial claims are projected to rise by 4,000 and continuing ones are estimated to drop by 3,000. In other words, the situation in the US labor market will not change.

United States Continuing Jobless Claims:

EUR/USD slowed its corrective move near 1.0550, and the volume of short positions grew. The quote then pulled back below 1.0500.

The RSI crossed line 50 from top to bottom on the 4-hour chart at the moment of a pullback, which indicates a possible end of the corrective move.

The crossover of the Alligator's green and red MAs on the 4-hour chart signals the end of the corrective move. On the daily chart, there is still a downtrend, according to the Alligator, as its MAs are moving down.

In the daily time frame, there is a corrective move from the 2016 swing low within the mid-term downtrend.

Outlook:

Against the current backdrop, consolidation below 1.0500 will signal the end of the corrective move. Alternatively, there could be fluctuations in the range between 1.0500 and 1.0600.

In terms of complex indicator analysis, there is a sell signal for short-term and intraday trading due to a pullback. In the medium terms, there is still a sell signal because of the general trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română