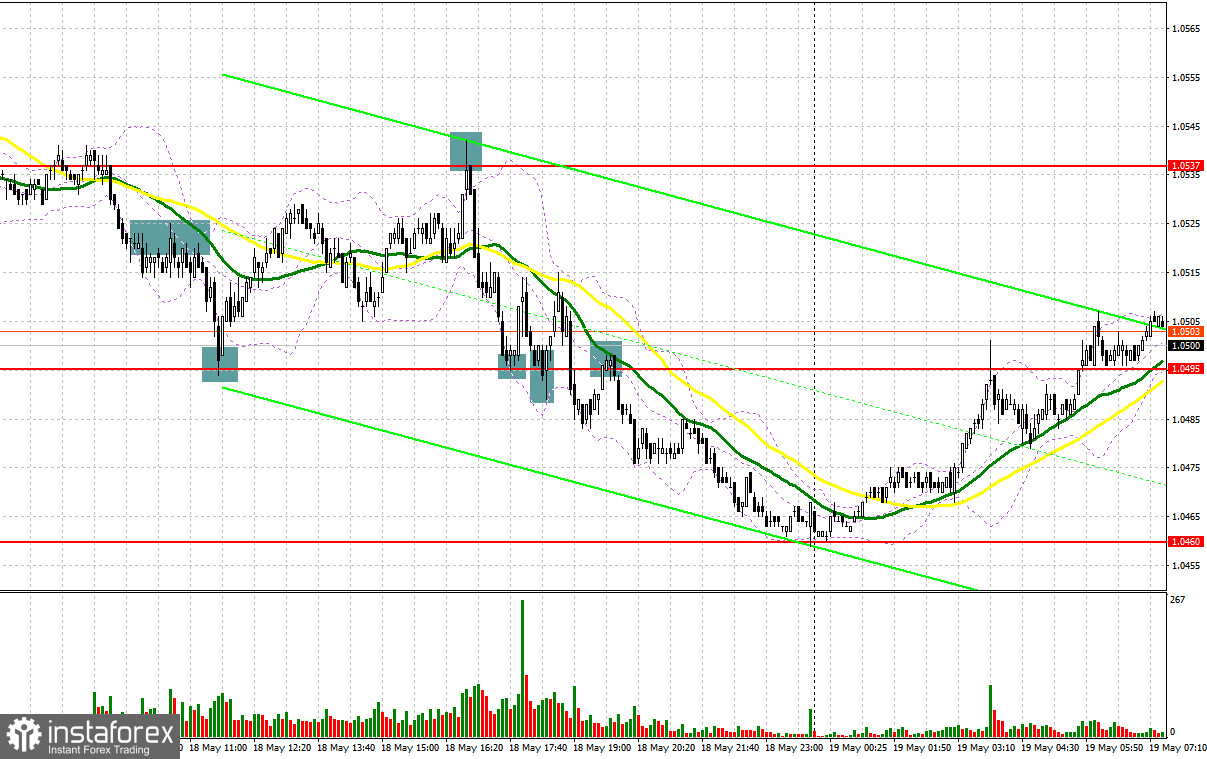

Many profitable signals were made yesterday. Let's turn to the M5 chart to get the picture. Inflation in the eurozone slowed down in April. In this light, demand for the euro decreased, and the pair plummeted. A breakout and a retest of 1.0522 from bottom to top created an excellent sell signal. As a result, the pair went down by 30 pips and encountered support at 1.0493. A false signal produced a buy signal. Eventually, the quote rose to 1.0522, bringing another 30 pips of a profit. During the North American session, daily levels were revised. The price unsuccessfully tried to consolidate above 1.0537, making a strong sell signal. The pair plunged to 1.0495, bringing about 40 pips of a profit afterward. During the North American session, bulls had to protect the 1.0495 level several times, producing buy signals. The price, in turn, grew by 20 pips every time. Consequently, a breakout at 1.0495 occurred. Another sell entry point was formed after a retest of the mark from bottom to top. A profit from the trade totaled about 35 pips. The fall stopped somewhere near the next support level of 1.0460.

When to go long on EUR/USD:

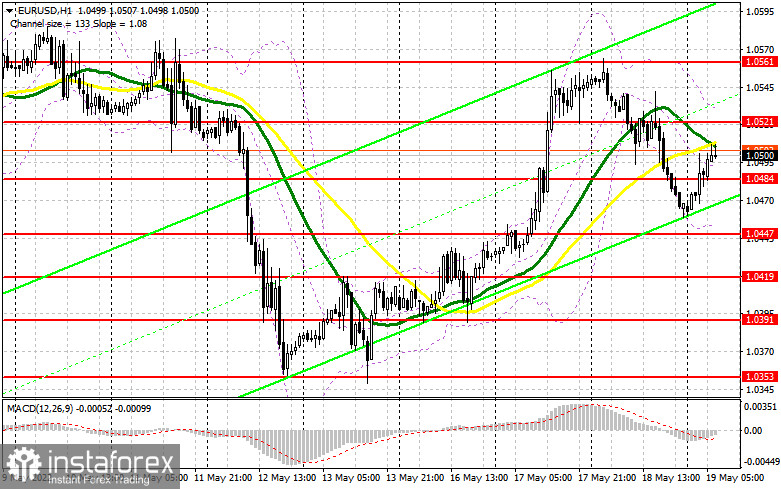

Euro bulls tried to act amid a dramatic decrease in market sentiment in the wake of disappointing GPD data. However, a short break in the middle of the day after a sharp drop in the morning ended. During the North American session, risk assets resumed the bear run. The eurozone macroeconomic calendar is empty today. The ECB's monetary policy meeting accounts will be released during the European session. It is important to pay attention to the report. A lot has changed since the last meeting and the ECB has become more hawkish. In this light, the outcome of the report is unlikely to help bulls offset yesterday's losses. Buyers will try to protect intermediate support at 1.0484. If the pair is bearish after the release, a buy signal will be made after a false breakout only. If so, the price may return to 1.0521. The bearish moving averages are slightly below the mark. A new buy signal will be produced after a breakout and a test of this level from top to bottom, with the target at 1.0561 where profit taking should be considered. A more distant target stands at the 1.0602 high. Due to pessimistic market sentiment, reaching the mark would be challenging. Bearish EUR/USD and no bullish activity at 1.0484 would signal that growth during the Asian session was just a correction after yesterday's fall, and not the continuation of the uptrend that emerged on May 13. Long positions could be opened after a false breakout of the 1.0447 high. It will also be possible to go long on EUR/USD after a bounce off 1.0419, or even lower, off 1.0391, allowing a 30-35 pips correction intraday.

When to go short on EUR/USD:

The presence of bears in the market is obvious. Yesterday's aggressive selling helped recoup losses of the previous day. If the ECB monetary policy meeting accounts are dovish, pressure on the pair will increase. In case of growth, a false breakout at 1.0521 will produce the first sell signal, with the target at the intermediate support level of 1.0484. A breakout and consolidation below the mark as well as a retest from top to bottom will create a new sell signal, with targets at 1.0447 and 1.0419 where profit taking should be considered. A more distant target is seen at 1.0391. If EUR/USD shows growth during the European session and there is no bearish activity at 1.0521, the uptrend will continue. In this light, short positions could be opened after a false breakout at 1.0561. Selling on EUR/USD could also be considered on a bounce off 1.0602 or even higher, off 1.0640, allowing a 30-35 pips downward correction intraday.

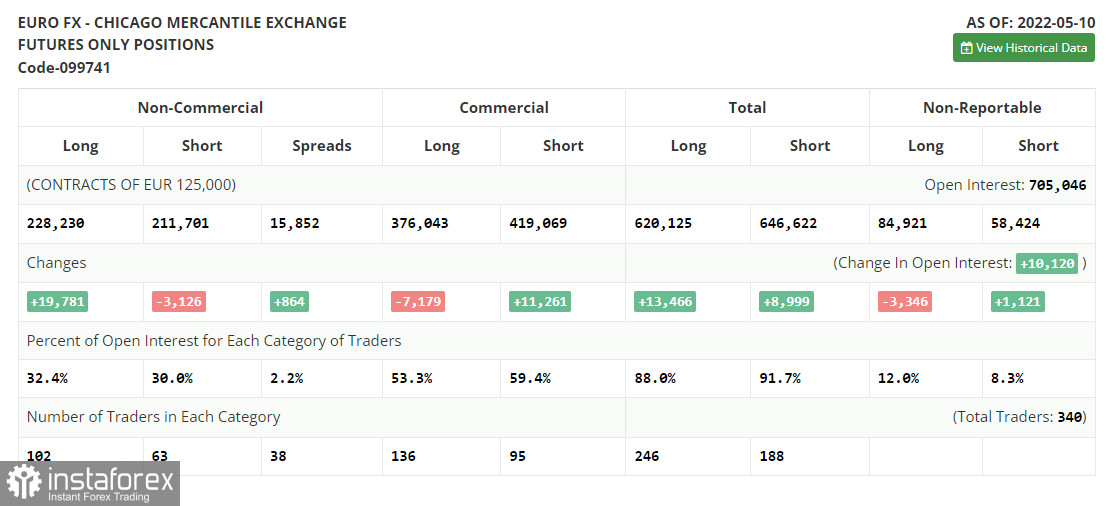

Commitments of Traders:

The Commitments of Traders report for May 10 logged a steep rise in long positions and a decrease in short ones. The fact the euro is now oversold shows an increase in demand among traders and investors. Recent statements by the ECB instill optimism about the beginning of a new bullish cycle. The European regulator is now expected to raise the deposit rate by a quarter-point as early as July this year and then hike it in September and December, bringing it to 0.25% by the end of the year. The key interest rate could be increased to 0.5% in September and December from the current 0.0% rate. In the wake of the aggressive ECB, euro bulls may hit the bottom. However, it might not be the case due to the hawkish Federal Reserve and the escalating geopolitical situation in the world. The US Fed plans to continue hiking rates. At the next meeting, there could be a 0.75% increase, which would be a clear signal to buy the dollar in the medium terms. According to the COT report, long non-commercial positions rose by 19,781 to 228,230 from 208 449. Short non-commercial positions dropped by 3,126 to 211,701 from 214,827. Amid a low exchange rate of the euro, demand for the currency is increasing, which is confirmed by a rise in long positions. In a week, non-commercial net positions increased to 16,529 from the negative value of -6,378. The weekly closing price practically did not change – 1.0546 versus 1.0545.

Indicator signals:

Moving averages

Trading is carried out in the range between the 30-day and 50-day moving averages, indicating a battle between bulls and bears.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The lower band at 1.0450 stands as support. Resistance is seen at 1.0525, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română