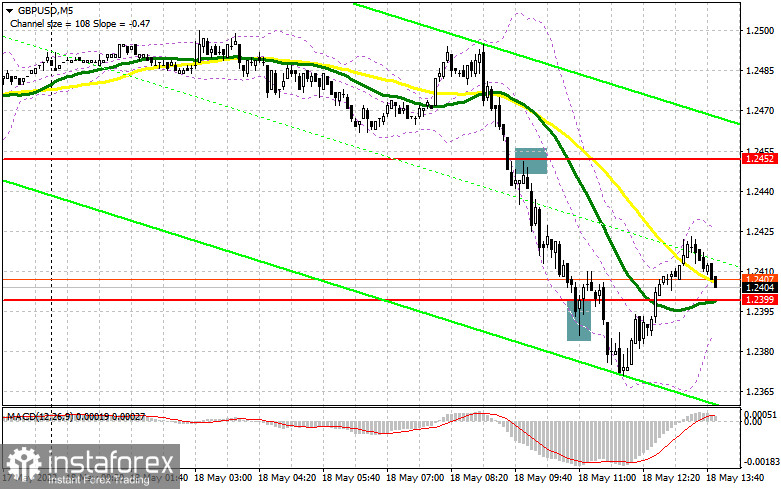

In my morning forecast, I pointed out a rather high probability of today's fall of the British pound in the first half of the day, which happened. Let's look at the 5-minute chart and figure out where and how it was possible and necessary to enter the market. Less active inflation growth in the UK confused all the cards of buyers of the pound, which forced them to close long positions. The breakout and the reverse test from the bottom up of the 1.2452 range became a direct signal to build up short positions with the prospect of falling to the 1.2399 area, which happened. This allowed us to take about 50 points of profit from the market. But the false breakout at 1.2399 turned out to be not as profitable a signal as we would like. At the very beginning, the pair began to move up from this level, but then the bears failed at 1.2399, which led to the demolition of stop orders and fixing losses. In the afternoon, the technical picture changed. And what were the entry points for the euro this morning?

To open long positions on GBP/USD, you need:

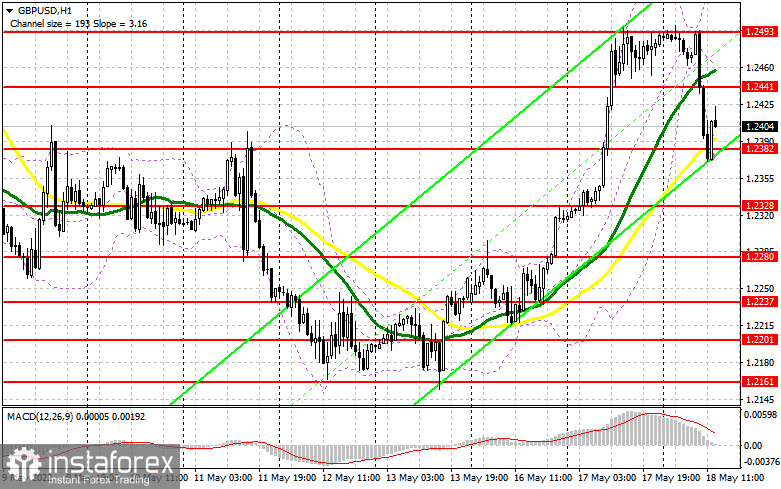

Even despite the fall of the pound, buyers still have a fairly good chance of continuing growth, since so far everything is happening within the framework of a downward correction after the beginning of the growth of GBP/USD at the end of last week. US data may increase pressure on the pound, but it is necessary that reports on the volume of construction permits issued and the number of new foundations laid in the US exceed all forecasts of economists. If the pressure on the pound returns after the data, I advise you to focus on the nearest support of 1.2382, which has already worked itself out in the first half of the day. Therefore, only the formation of a false breakdown there will lead to a new signal to open long positions in the expectation of growth to the resistance of 1.2441 - a new level that I had to revise after the morning movement of the pound. It is possible to expect a sharper jerk of the pair, but only during weak statistics on the United States and aggressive statements by FOMC member Patrick T. Harker, which is unlikely to be such - there is no reason for this. Fixing above 1.2441 with a reverse test from top to bottom, similar to those that I just disassembled, but in the opposite direction - all this will lead to a buy signal followed by a move to the area of today's highs of 1.2493. I recommend fixing profits there. The more distant target will be the 1.2574 area. In the case of a decline in the pound and the absence of buyers at 1.2382, and most likely it will be, given that bulls may start taking profits after another attack by sellers at this level, I advise you not to rush into purchases. It is best to enter the market after a false breakdown at 1.2328. You can buy GBP/USD immediately on a rebound from the minimum of 1.2280, or even lower - around 1.2237 and only to correct 30-35 points within a day.

To open short positions on GBP/USD, you need:

The powerful response of sellers to yesterday's growth, which was completely blocked during the European session, was not something surprising, although the further prospects for the direction of the pound are rather vague. In the current realities, only the protection of 1.2441, the new resistance, will help the bears to get a sell signal, which will lead to an increase in the downward correction and the pair's return to the area of 1.2382. Strong US data and a false breakdown at this level will be an excellent setup for opening short positions with the expectation of a breakthrough and consolidation below 1.2382. A breakout and a reverse test from the bottom up of this range from an additional sell signal that can collapse the pound to 1.2328, where I recommend fixing the profits. A more distant target will be the 1.2280 area, the test of which will cast doubt on the further growth of the pair in the near future. But so far, there is no hope for the implementation of this scenario. With the option of GBP/USD growth and lack of activity at 1.2441, another upward jerk may occur against the background of the demolition of stop orders. In this case, I advise you to postpone short positions until today's maximum of 1.2493. I also advise selling there only in case of a false breakdown. It is possible to open short positions on GBP/USD immediately for a rebound from 1.2574, counting on the pair's rebound down by 30-35 points within a day.

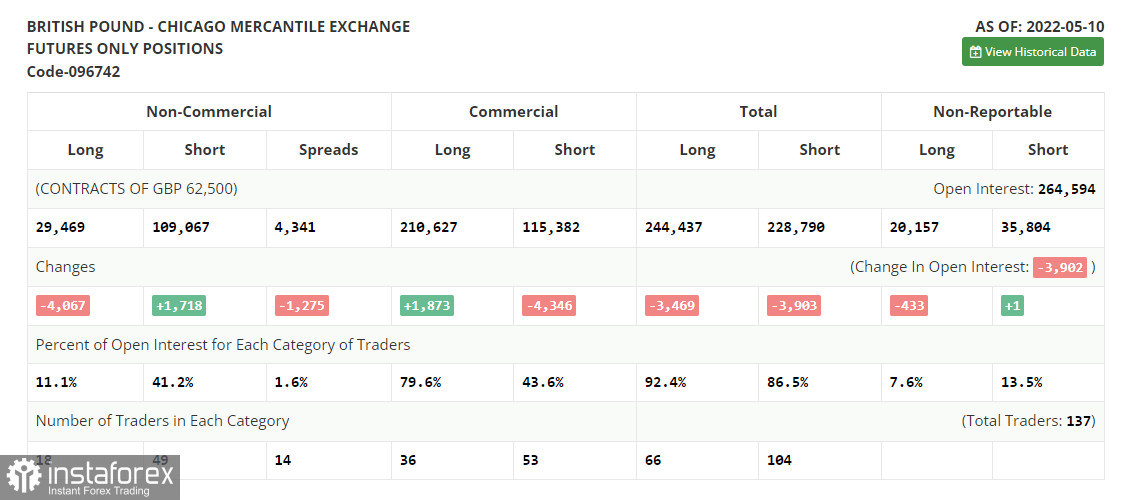

The COT report (Commitment of Traders) for May 10 recorded a reduction in long positions and another increase in short positions, which led to a further increase in the negative delta. The presence of several problems in the UK economy and a rather difficult situation with inflation is forcing investors to get rid of the British pound, which is very seriously losing its attractiveness against the background of demand for safe-haven assets and more profitable instruments. The monetary policy of the Federal Reserve System, aimed at tightening the cost of borrowing, will continue to support the US dollar, pushing the British pound lower and lower. The Bank of England's actions to raise interest rates have not yet brought the proper result, and talk that due to serious economic difficulties, the regulator may even suspend the normalization of monetary policy, scares investors even more. As I have repeatedly noted, future inflation risks are now quite difficult to assess also due to the difficult geopolitical situation, but the consumer price index will continue to grow in the coming months. The situation in the UK labor market, where employers are forced to fight for every employee by offering higher and higher wages, is also pushing inflation higher and higher. The COT report for May 10 indicated that long non-commercial positions decreased by -4,067, to the level of 29,469, while short non-commercial positions increased by 1,718, to the level of 109,067. This led to an increase in the negative value of the non-commercial net position from the level of -73,813 to the level of -79,598. The weekly closing price decreased from 1.2490 to 1.2313.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română