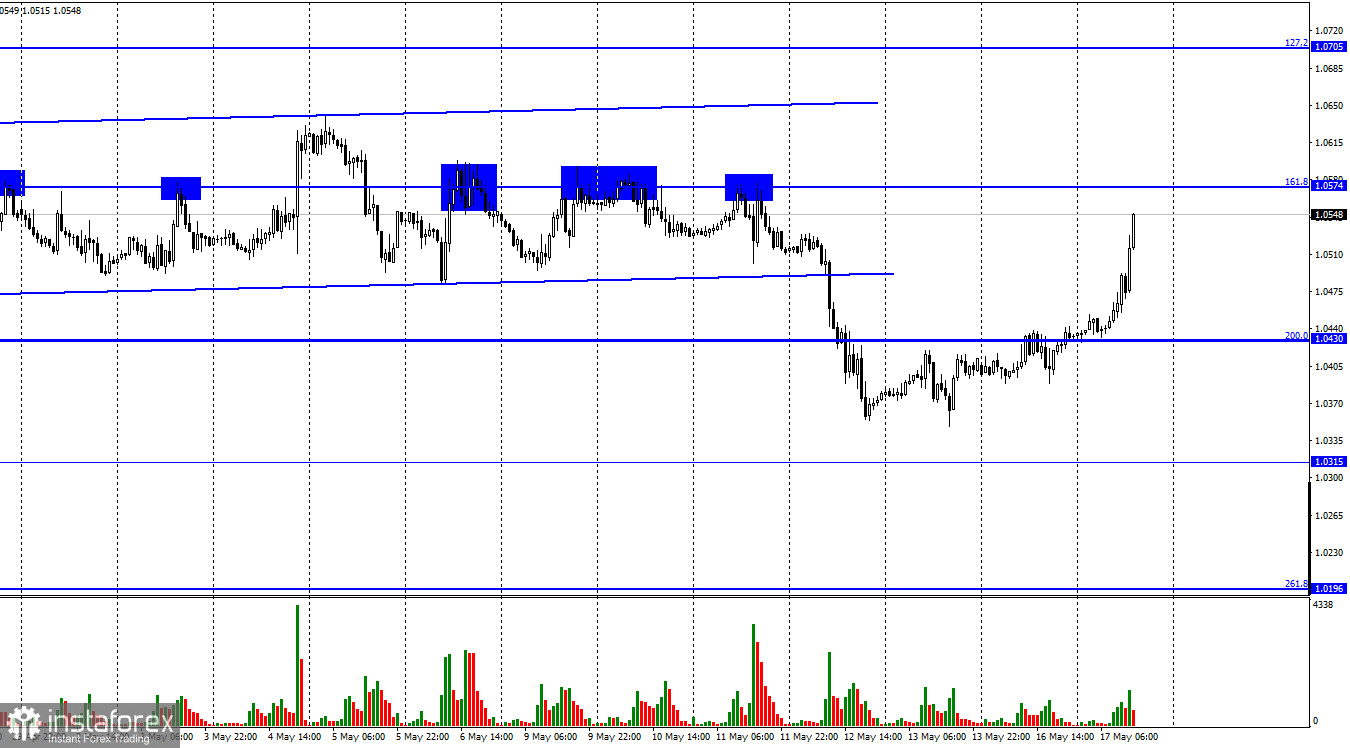

The EUR/USD pair on Monday continued the growth process that it started two days ago, secured above the corrective level of 200.0% (1.0430), and is currently approaching the level of 161.8% (1.0574). In just one day, the currency was able to grow by 120 points, although before that growth of such strength happened extremely rarely. I have several assumptions about the strong growth of the euro and the pound on Tuesday (the pound is also growing). Several reports on the European Union and the UK were released this morning. In particular, the European economy showed growth of 0.3% in the first quarter, although a month earlier this value was 0.2%. I cannot say that this was the only reason for the growth of the euro, but for sure this report influenced the mood of traders, making it more "bullish". I should immediately note that the British statistics also turned out to be much better than expected, so the pound could grow quite reasonably today.

However, there is also news from Ukraine. Yesterday, the storming of the Azovstal plant in Mariupol officially ended, and the Ukrainian military stopped firing. The world media consider this event as the first step towards new negotiations and de-escalation of the conflict between Kyiv and Moscow. Unfortunately, this assumption does not correspond to reality, since both Ukraine and Russia said today that the peace talks have been completed and will not resume in the near future. In Mariupol, an exchange of prisoners of war is simply taking place, of which there have already been many over the past 2.5 months of confrontation. Thus, I think the market could react with purchases of the euro and the pound, hoping that at least active hostilities on the territory of Ukraine would stop or weaken. However, this, unfortunately, also does not correspond to reality. The fighting in the Donbas continues, and it is there that the largest number of Ukrainian and Russian armed forces are concentrated. The growth of the euro currency may be short-term because of this.

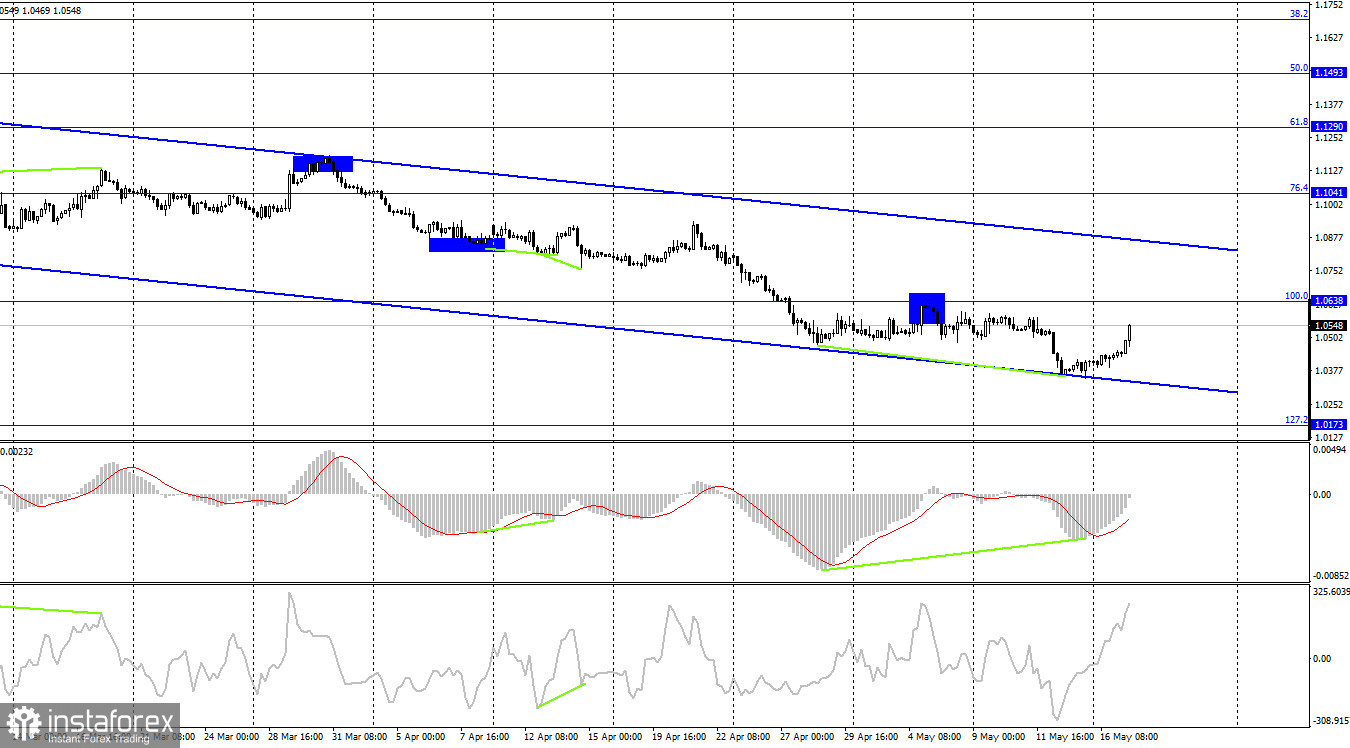

On the 4-hour chart, the pair performed a reversal in favor of the European currency after the formation of a "bullish" divergence at the MACD indicator. The process of growth has begun in the direction of the corrective level of 100.0% (1.0638), but this growth takes place inside the downward trend corridor, which still characterizes the current mood of traders as "bearish". A rebound from the level of 100.0% will work in favor of the US currency and the resumption of the fall in the direction of the Fibo level of 127.2% (1.0173).

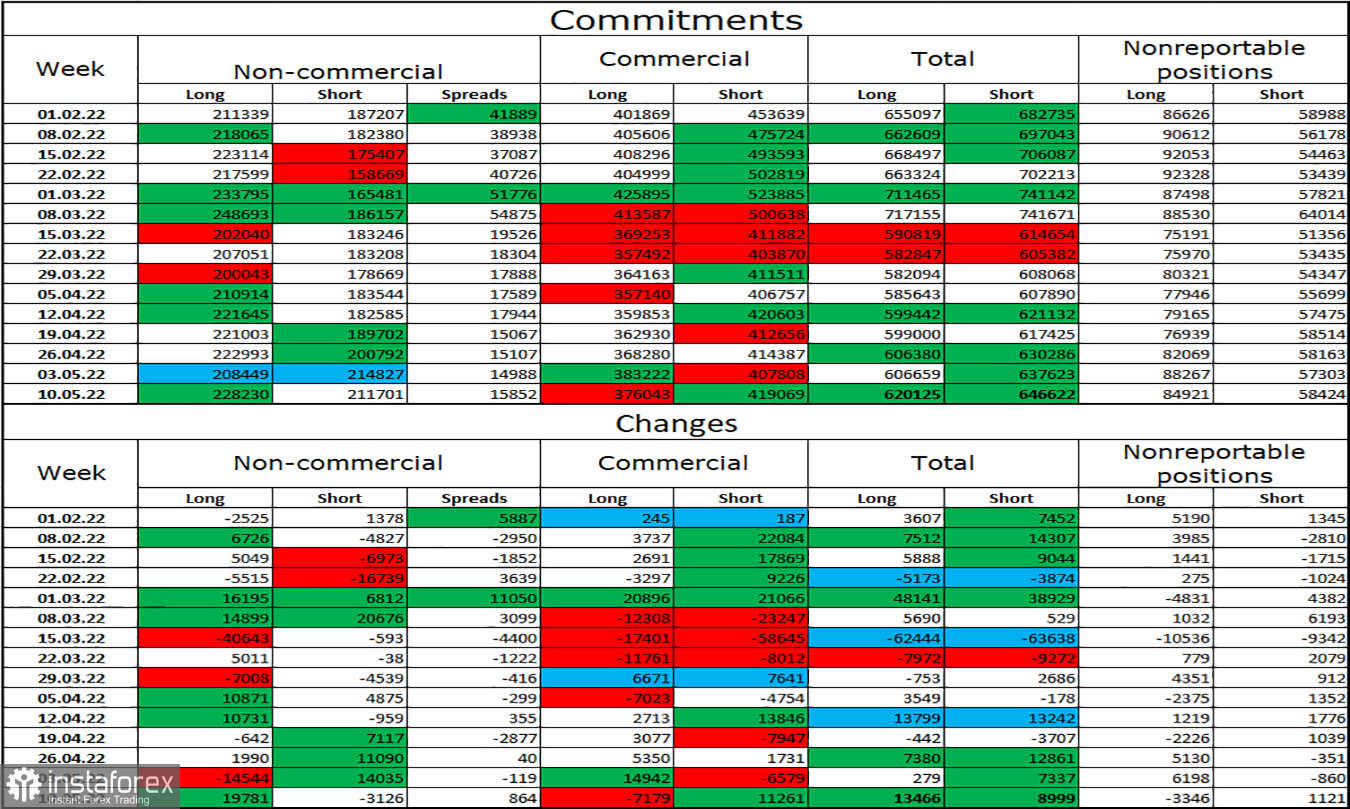

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 19,781 long contracts and closed 3,126 short contracts. This means that the bullish mood of the major players has intensified again. The total number of long contracts concentrated on their hands is now 228 thousand, and short contracts - 211 thousand. As you can see, the difference between these figures is minimal and you can't even say that in the market for the European currency it is a big problem to show an increase of 100 points. In recent months, the euro has mostly remained bullish, while the currency itself has been falling, falling, and falling. Thus, now the situation is approximately the same. The COT report continues to say that major players are buying euros, and the euro, meanwhile, is falling. Therefore, the expectations of COT reports and the reality now simply do not coincide.

News calendar for the USA and the European Union:

EU - change in GDP (09:00 UTC).

US - change in retail trade volume (12:30 UTC).

US - change in industrial production (13:15 UTC).

EU - ECB President Christine Lagarde will deliver a speech (17:30 UTC).

US - chairman of the Fed Board of Governors Jerome Powell will deliver a speech (18:00 UTC).

On May 17, the calendars of economic events in the European Union and the United States are full of important events. The GDP report looks secondary against the background of other events. The most interesting thing ahead is the speeches of Lagarde and Powell. The information background today can have a strong impact on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if there is a rebound from the 1.0574 level on the hourly chart with the goal of the 1.0430 level. Or in case of a rebound from the 1.0638 level on the 4-hour chart. I recommended buying the euro currency when closing above the 1.0430 level on the hourly chart with a target of 1.0574. Now, these transactions can be held.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română