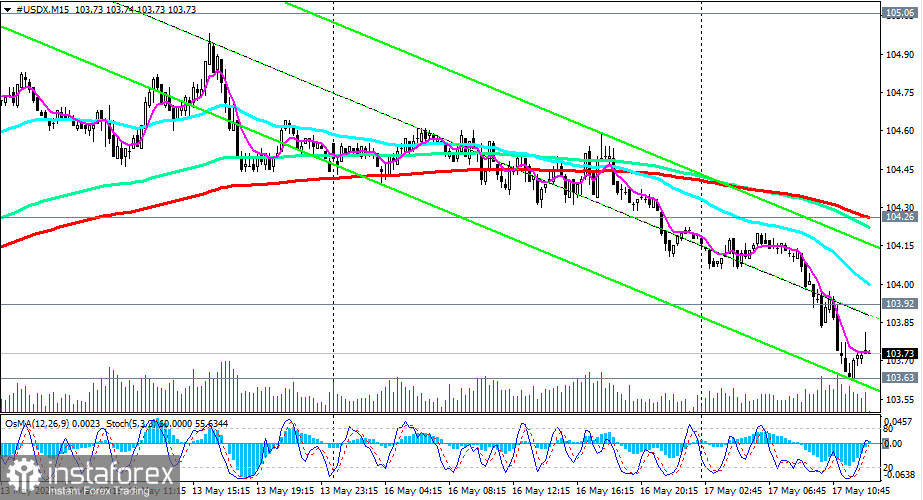

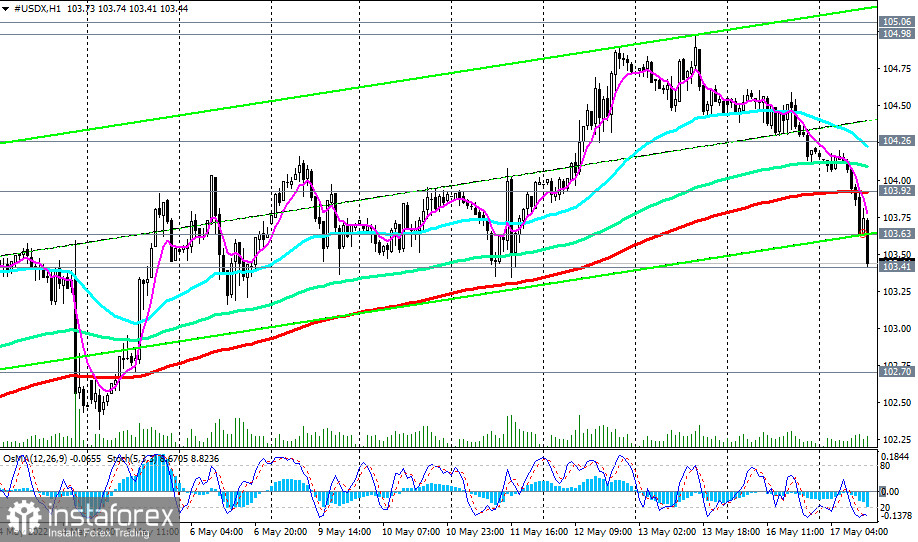

US Dollar Index (DXY) futures are trading near 103.74 as of this writing, continuing to decline for the third consecutive trading day after hitting a new high since January 2003 at 105.06 on Friday. From a technical point of view, the price of the DXY index futures broke through an important short-term support level of 103.92 (200 EMA on the 1-hour chart), placing an order for further decline.

We also assume that the breakdown of today's local bottom of 103.63 may increase the negative dynamics. As of this writing, futures for the DXY index continued to decline, reaching a new intraday low of 103.41. A local support level also passes through this mark, from which the price rebounded three times—on May 6, 9 and 11.

If this level holds again, then we should wait for the next rebound from it and the price to return to the zone above the level of 103.92.

The breakdown of the resistance level 104.26 (200 EMA on the 15-minute chart) will be a confirmation signal for the resumption of long positions.

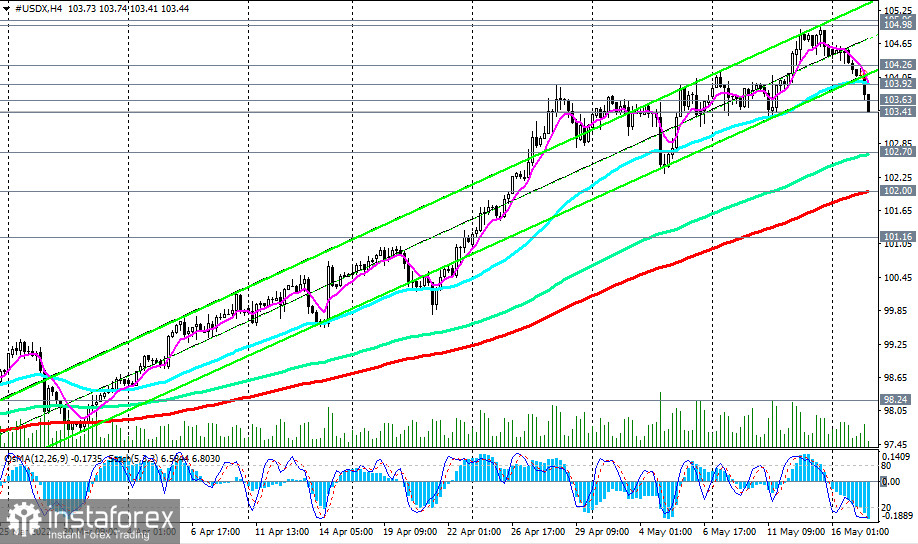

If the support level of 103.41 fails and is broken, then the downward correction may last up to the support levels of 102.70 (144 EMA on the 4-hour chart), and 102.00 (200 EMA on the 4-hour chart and the lower limit of the descending channel on the daily DXY chart).

We consider the current decline as corrective, expecting the resumption of the upward dynamics of the dollar and its DXY index.

Support levels: 103.41, 102.70, 102.00, 101.16, 101.00

Resistance levels: 103.63, 103.92, 104.26, 104.98, 105.06

Trading Tips

Sell Stop 103.30. Stop-Loss 103.95. Take-Profit 102.70, 102.00, 101.16, 101.00

Buy Stop 103.95. Stop-Loss 103.30. Take-Profit 104.26, 104.98, 105.06, 106.00, 110.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română