Long-term perspective.

The EUR/USD currency pair has not even tried to start an upward correction again this week. This time there was no collapse, but the European currency still fell by 140 points. During this week, there were a lot of different speeches by ECB and Fed officials. Even US President Joe Biden spoke, who also spoke about inflation and the economy. If you try to put together everything you have heard, you will get the following picture. In the USA - no changes. All Fed officials and the US president are confident that inflation remains a key problem for the economy and it needs to be worked with in order to return it to the target level as soon as possible. The Fed made it clear that a 0.5% rate hike in June and July is practically a settled issue. However, all officials note that not all factors affecting the growth of inflation are within the competence of the central bank. In other words, the Fed cannot influence the coronavirus pandemic in China and local lockdowns in any way, cannot end the military conflict in Ukraine overnight so that oil and gas prices stop rising, cannot mend relations between Russia and the West so that sanctions stop destroying the world economy, cannot establish chains deliveries all over the world. Thus, the Fed will try and try to influence the situation by raising the rate and the QT program, but it is far from a fact that these tools will allow inflation to return to 2%.

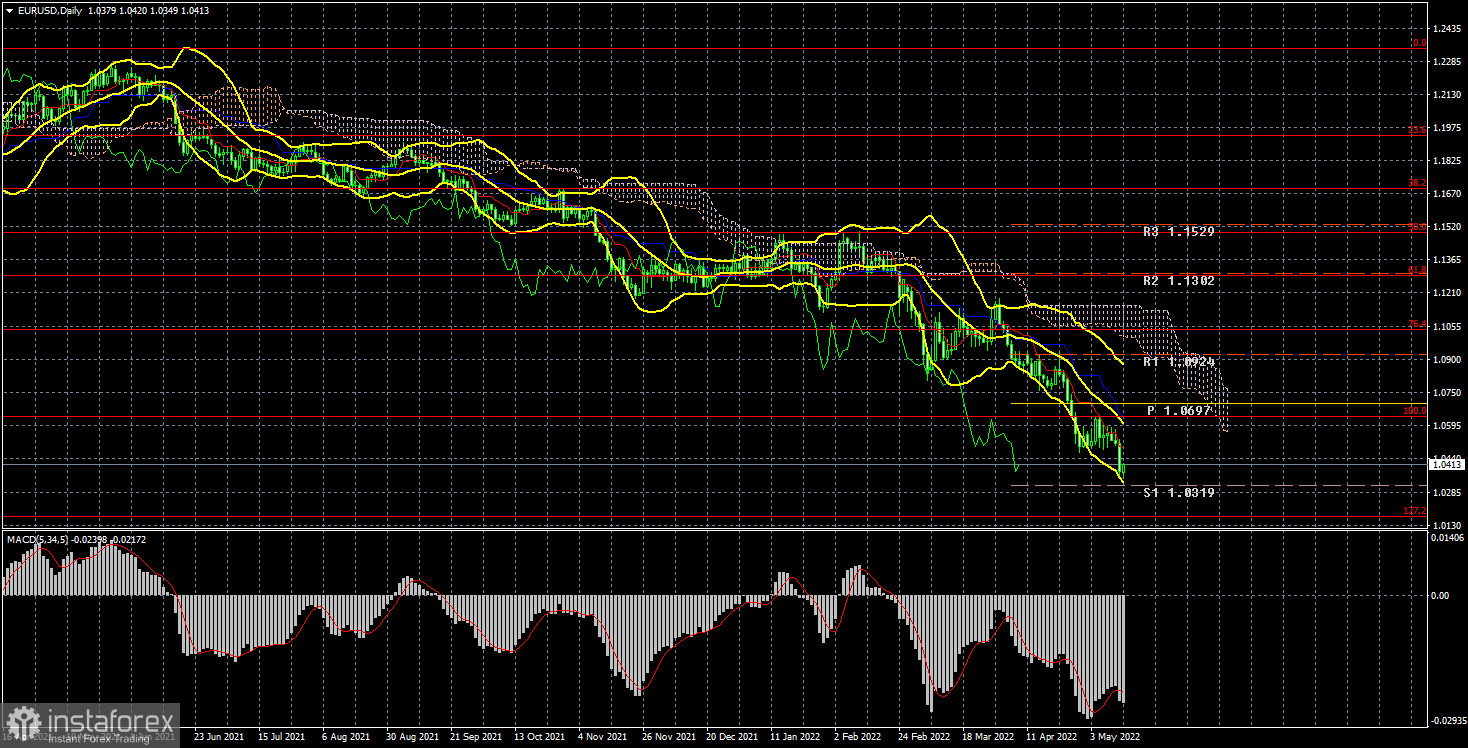

The technical picture of the pair, of course, has not changed this week. What is there to change if the movement, as it was descending, remains so. We haven't seen a single correction or even a hint of a correction for quite some time. At the moment, the euro is racing towards price parity with the dollar at full speed.

COT analysis.

The latest COT reports on the euro currency raised more questions than they gave answers. The week before last, for the first time in a long time, the COT report showed a "bearish" mood of traders, which is logical, given the strongest drop in the euro in recent months. However, the new COT report again showed an increase in the "bullish" mood! During the reporting week, the number of buy contracts increased by 19.8 thousand, and the number of shorts from the "Non-commercial" group decreased by 3.1 thousand. Thus, the net position increased by 23 thousand contracts per week. This means that the "bearish" mood has changed to "bullish", since the number of buy contracts now exceeds the number of sell contracts for non-commercial traders by 17 thousand. As a result, we again have a paradoxical picture in which major players buy euros more than they sell, but at the same time the European currency falls down almost like a stone. From our point of view, this is because the demand for the US dollar is much higher than the demand for the euro currency. Even if someone suggested that it was all about the weakening of the "bullish" mood in recent months (the second indicator is a histogram), we recall that in the week between May 4 and May 10, professional traders opened 20 thousand purchase contracts, and the euro currency increased by 30 points over the same period. Thus, it is still impossible to make a correlation between COT reports and what is happening in the market. Forecasts to build on such data, moreover, do not make sense.

Analysis of fundamental events.

During the current week, the most important event was the report on inflation in the United States. However, there was also a speech by Christine Lagarde, to whom increased attention has recently been focused, since after Luis de Guindos's words about a possible increase in the key rate this summer, everyone was waiting for confirmation of these intentions from the head of the ECB. But they didn't wait. With some half-hints, Lagarde said that the rate could be raised a few weeks after the completion of the quantitative stimulus program. But questions about how much the rate will be raised, how many times the regulator is going to raise the rate, remain open. Of course, the ECB has a small margin of safety for the European economy to raise the rate once or twice. Recall that GDP growth in the Eurozone in the fourth quarter was +0.3%, and in the first - + 0.2%. This is the minimum increase, so it is absolutely not necessary to count on 10 rate increases. If the ECB raises the rate once or twice, at what level will it be? After all, first you need to withdraw the deposit rate at least to a positive area. In general, the maximum for the ECB is now 0.5%. Is such a rate capable of stopping the growth of inflation?

Trading plan for the week of May 16-20:

1) On the 24-hour timeframe, the pair continues its downward movement and this week almost worked out to the level of 1.0340 - the minimum for the last 20 years. The next target is 1.0171 - the 127.2% Fibonacci level. Almost all factors still speak in favor of the growth of the US dollar, but still we believe that the fall of the euro currency is already too strong (this is just a feeling, not a trading signal). The price is below the Ichimoku cloud, so there is still little chance of growth for the euro currency, and sales remain the most relevant.

2) As for purchases of the euro/dollar pair, it is not recommended to consider them now. There is not a single technical signal that an uptrend may begin. We would consider only overcoming the Senkou Span B line as the basis for a new upward trend.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română