What can serve as a lifeline for the sinking euro? So far, there are no such factors on the horizon and are not expected. The single currency was not helped either by US inflation, which slowed down, or by the active discussion of the European Central Bank rate hike in July.

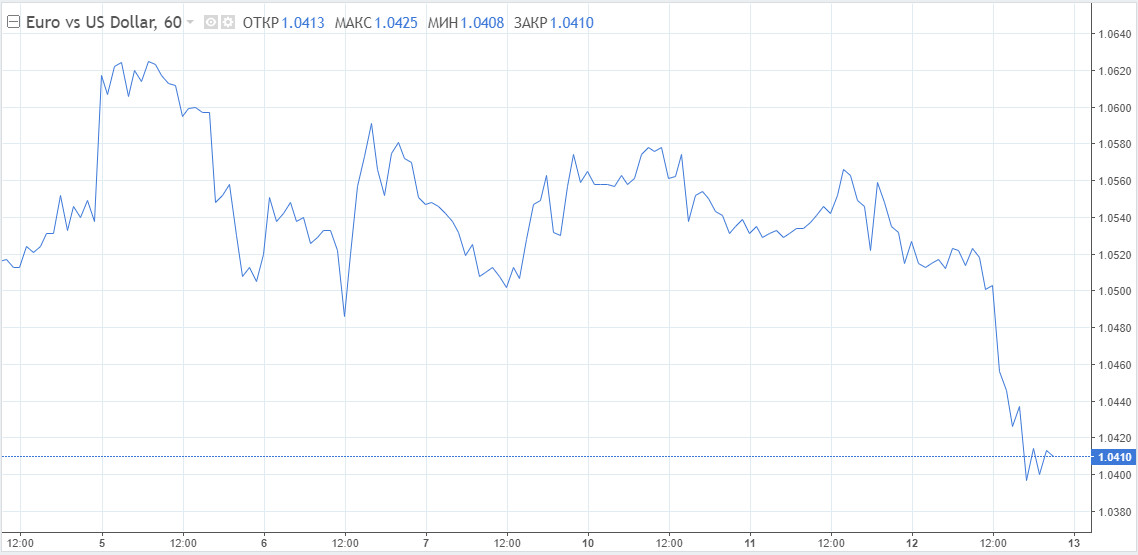

Today, the EUR/USD pair fell below 1.0400 for the first time in five years. Daily losses exceeded 1%, while the bears are not going to stop at the levels reached. Judging by the dynamics and confident movement, their next target is the area of 1.0340.

Such a strong fall in the euro is primarily due to the ascending line of the dollar. Traders sell the euro in favor of the US currency in order to protect themselves from further risky events. The focus is on heightened concerns about tensions between the European Union and Russia against the backdrop of a special operation in Ukraine.

Some countries of the union have decided to abandon military neutrality, as they fear for their own security because of the situation in Ukraine. Finland intends to apply for immediate NATO membership. It is expected to be followed immediately by Sweden.

The Minister of Economics of Germany urged the public and companies to reduce gas consumption. There are concerns about the transit of fuel through Ukraine. Until this week, the filing had not been affected by the fighting.

The bout of euro weakness can also be explained by other factors. Firstly, forecasts for the growth of the eurobloc are being lowered. Second, traders may attribute a higher geopolitical risk premium to the currency.

The key role here is given to the strong dollar, which sweeps away, if not everything, then a lot in its path. On the one hand, inflation data in the US turned out to be moderately positive for risky assets, the indicator slowed down growth. On the other hand, the data fell short of expectations and there are no guarantees that there will not be another jump in inflation in May. Gasoline prices resumed their rise, and this is a negative signal.

The bottom line is that the price pressure has not eased enough to breathe. On the contrary, things can get worse, there is no stability. The Federal Reserve will continue to pursue a hard rate hike. The US bank's hawkish stance towards the ECB and local risks in Europe due to geopolitical and economic factors will not allow EUR/USD bulls to benefit from the ECB's hawkish policy shift of late.

The ECB is rushing for a monetary start in July, but will it help the euro? Additional risks, troubles and fears can neutralize most of the positives for the euro from the ECB.

"The risks of a manufacturing recession are significant, but collectively we expect the economy to avoid it, given the fall in unemployment and the strength of the service sector. Russian gas deliveries are a key uncertainty factor," ANZ Bank said.

Economists maintain their expectations for a rate hike in the third quarter. This is likely to happen in July and the rate will be increased by 25 bp, summed up in the bank.

The start of policy normalization should help the euro set a floor and bounce off the bottom. As it will be in reality, time will tell. For now, the bearish trend remains in place.

Support is located at 1.0450 , 1.0410, 1.0370. Resistance is at 1.0545, 1.0580, 1.0650.

Another victim of the dollar's growth is the Japanese yen. Nevertheless, today it, unlike the euro, has significantly strengthened against the US currency. Intraday growth was almost 1.5%.

The USD/JPY pair tested the support level of 129.60 and went down sharply, breaking through the 128.00 mark at the moment. Given the high uncertainty and volatility, the recommendation for Thursday is to stay out of the market.

Support is at 128.55, 128.05, 127.55. Resistance is at 129.55, 130.05, 130.55.

Further prospects for the Japanese currency are viewed as positive. Goldman Sachs considers the yen undervalued against the dollar by 20-25%. Given the growing crisis in the global economy, the yen can continue to be considered by investors as the most attractive defensive asset in terms of price.

Bloomberg also believes that the massive sales of the Japanese currency have come to their logical conclusion.

In addition, the USD/JPY pair rose to levels that suggest foreign exchange interventions by the country's authorities. The last time Japan used this method to strengthen the yen was in June 1998, in the midst of a currency crisis.

The undervalued yen has every chance to rise against the dollar by 15-20% in the medium term, according to Goldman Sachs.Meanwhile, the topic of differences in the policies of the Fed and the Bank of Japan will not go anywhere. While the US has begun raising rates, Japan is not only in no hurry, but is completely abandoning this method for the time being. The Bank of Japan set a negative interest rate at -0.1% in January 2016.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română