The release of data on the growth of US inflation failed to push the EUR/USD pair out of the flat range of 1.0500-1.0590, within which it has been trading for the second consecutive week. The inflation report left more questions than answers. On the one hand, inflation showed the first signs of a slowdown (especially if we talk about the core CPI). On the other hand, the release came out in the green zone: in fact, the main indicators slightly deviated from the March values. Therefore, in this case, everything will depend on how the members of the US central bank interpret today's figures. Here you can say that the glass is half full, and that it is half empty. That is, either inflation really began to level off (thus confirming the assumptions of Federal Reserve Chairman Jerome Powell), or we are talking about the CPI taking root at an unacceptably high level - Powell also spoke about such a possible scenario earlier.

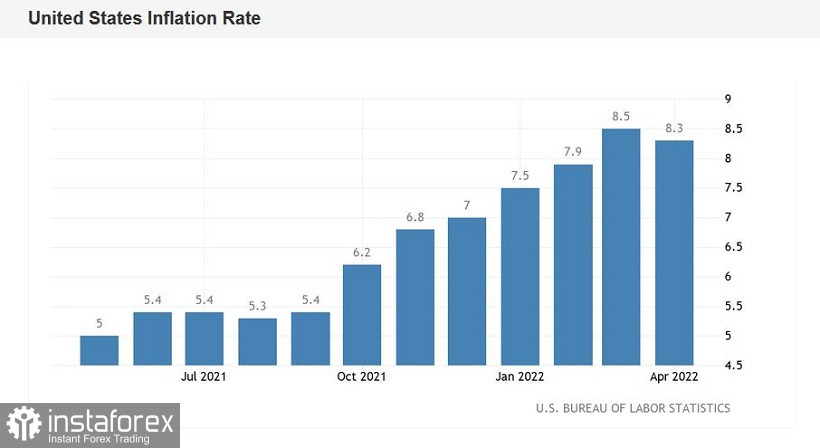

In annual terms, the overall consumer price index came out at around 8.3%, while the growth forecast was up to 8.1%. On the one hand, this is a fairly strong result (US inflation in annual terms is above 8% for the first time in the last 40 years), but on the other hand, it is somewhat weaker than the March result (8.5%). It should also be noted here that this component has shown consistent growth over the past seven months, but has now retreated from the high reached last month. Whether this fact can be considered as the first sign of stabilization (or growth slowdown) of inflation or whether we are talking about a temporary retreat is an open question.

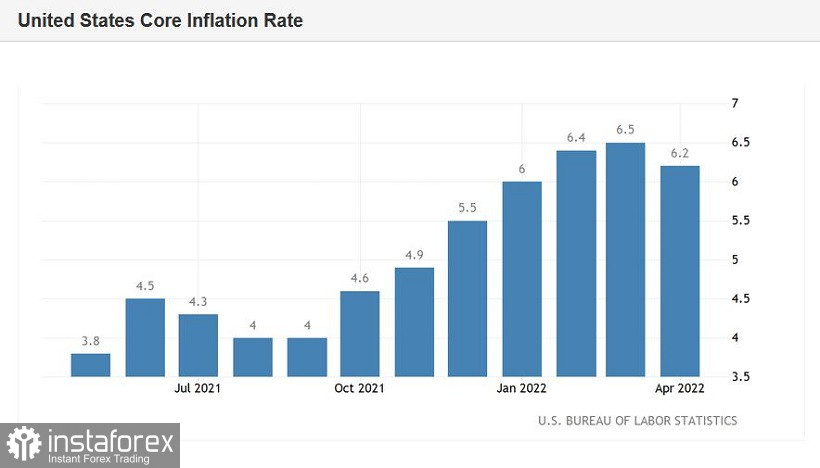

As for the core consumer price index, excluding food and energy prices, a similar trend can be traced here. In the first half of last year, the core index increased very gradually, rising from 1.3% to 4%. But since September 2021, there has been consistent growth, with the result peaking in March at 6.4%. The April result was a little more modest (6.2%), but experts predicted a more significant slowdown - up to 5.9% -6.0%.

In other words, inflation has indeed interrupted its consistent growth, but at the same time, the pace of slowdown can be said to be symbolic: on an annualized basis, the CPI remained almost at the level of March, when a 40-year high was recorded. This fact, in my opinion, allows the representatives of the Fed to implement aggressive actions in terms of tightening monetary policy. We are talking about a 50-point increase in the rate following the results of the June meeting and, possibly, following the results of the July meeting.

However, the formal fact of slowing inflationary growth today made EUR/USD traders doubt that the Fed will maintain its ultra hawkish mood, especially in light of Powell's latest statements. Such doubts allowed bulls to organize a corrective rollback to the upper limit of the price range of 1.0500-1.0590. But at the same time, they were unable to enter the area of the 6th figure and, moreover, to settle there. All this suggests that market participants are skeptical about the prospects for further growth - and therefore take profits when approaching the resistance area of 1.0590-1.0600. However, bears are also still not confident in their abilities in the context of a possible decline to the area of the 4th figure. De facto, the pair remained in the flat - in anticipation, so to speak, of the "explanatory team". Traders now need comments from the Fed representatives, who will assess the dynamics of April inflation in the context of further actions of the central bank.

I think most of them will keep the position that they voiced before today's release. In this case, the option of a 50-point rate hike at the June meeting will again be on the agenda. Also, a similar step following the results of the July meeting will not be ruled out. If among the members of the Fed there are doubts about the advisability of aggressive actions, the dollar will sink throughout the market. But, in my opinion, this scenario is unlikely.

In any case, the dollar will retain its appeal against the euro. The European Central Bank is clearly not keeping up with the Fed, although some representatives of the ECB are increasingly urging their colleagues to raise the interest rate. Speaking at an international conference today, ECB President Christine Lagarde said that the first rate hike "could happen in a few weeks after the end of the bond buying program." According to her, the APP program should be completed at the beginning of the third quarter.

It is obvious that the ECB will act very slowly and cautiously, so the mere fact of hawkish intentions does not "save" the euro. And here we can also recall the GBP/USD pair, which has been within the framework of a pronounced downward trend for the fourth consecutive week, despite the Bank of England raising the rate.

Therefore, despite the controversial inflation report that was published today, short positions on the EUR/USD pair still remain a priority. It is advisable to use corrective upward rollbacks to enter short positions- from the first and so far the main target of 1.0500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română