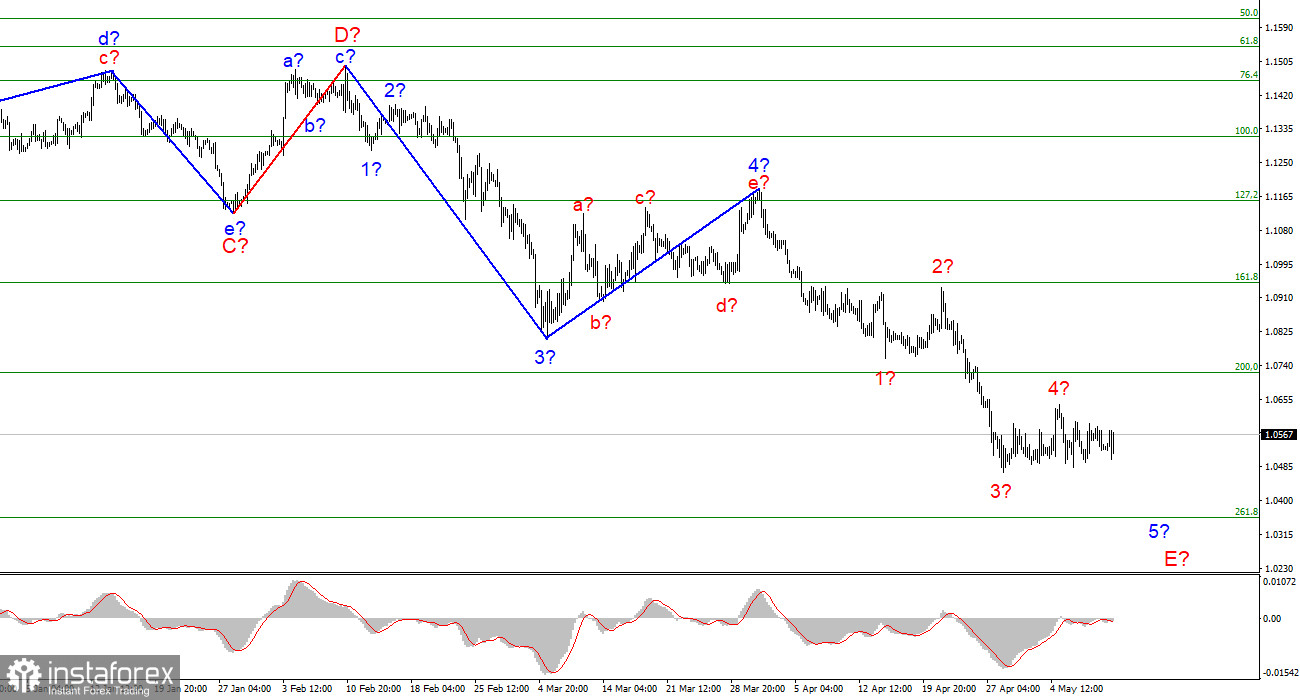

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may continue for another week, since this wave should turn out to be a five-wave in its internal structure. At the moment, four internal waves are visible inside this wave, so I'm counting on building another pulse wave. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, near which the construction of the current downward wave and the entire downward trend section may be completed. If the breakout attempt of 1.0355 turns out to be successful, the instrument will further complicate its wave structure and continue to decline.

The downward trend is at its last gasp, but persists

The euro/dollar instrument rose by 35 basis points on Wednesday. Just an hour ago, such a conclusion could not have been made yet, but the US inflation report led to an increase in the amplitude, as a result of which the instrument first decreased by 70 points, and a little later increased by about the same amount. Thus, the construction of the proposed wave 4 is delayed. And along with it, the construction of the entire downward section of the trend is delayed. Wave 4 can take a three-wave form and only after that the instrument can begin building wave 5. The demand for the dollar should start to grow again so that the wave markup looks more complete than it is now. The resumption of the decline of the instrument doesn't need to be preceded by important data and news. But since the wave marking looks very convincing now, I believe that it is necessary to start from it.

The inflation report came out very unclear. On the one hand, inflation has started to slow down, for the first time in a long time. On the other hand, this slowdown is very weak. Therefore, I believe that the consumer price index remains at almost maximum value. The fact that the market did not run to buy the dollar after this report does not cause any emotions. Recently, it has been shown that it can do this with a missing news background. This week, the most important report was just American inflation, so the most interesting is already over. The instrument may move horizontally for some time. However, sooner or later, the wave marking will either have to become more complicated, change, or end. Thus, we can only expect changes, and while there are none, we should expect a new decline in the euro/dollar instrument.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". The construction of the proposed wave 4-5-E may have already been completed.

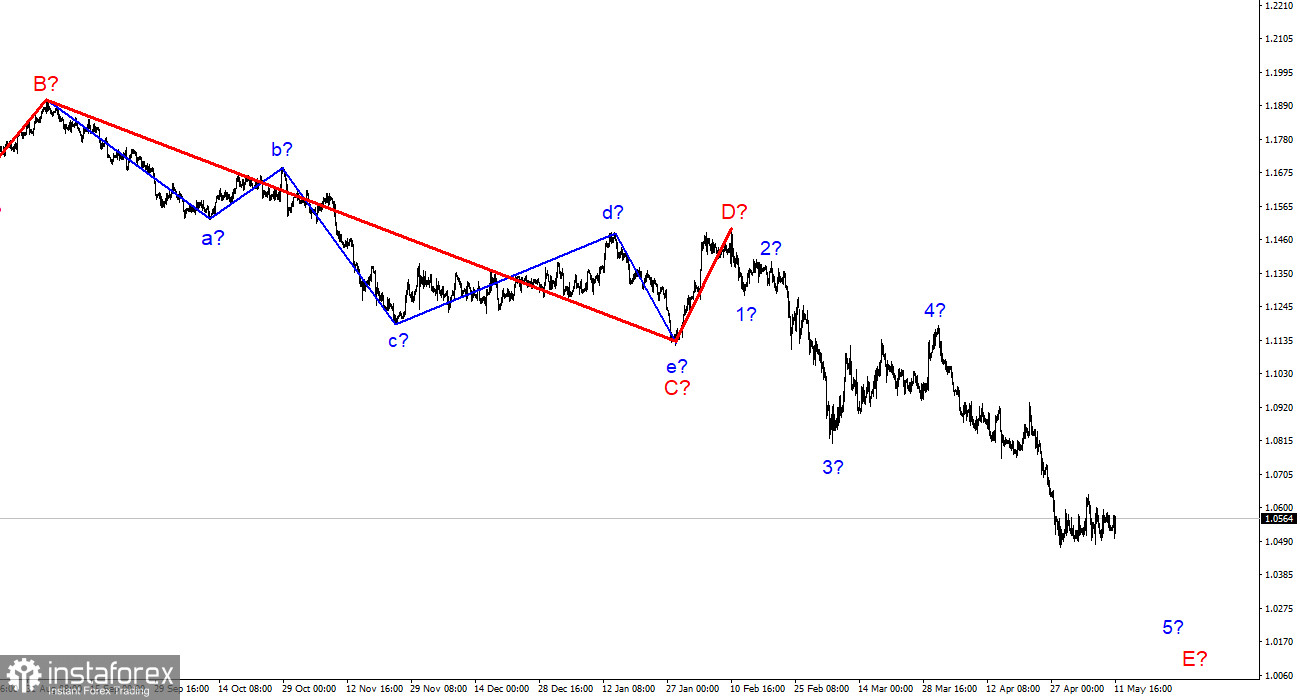

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend segment is being built, which turns out to be as long as wave C. The European currency may still decline for some time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română