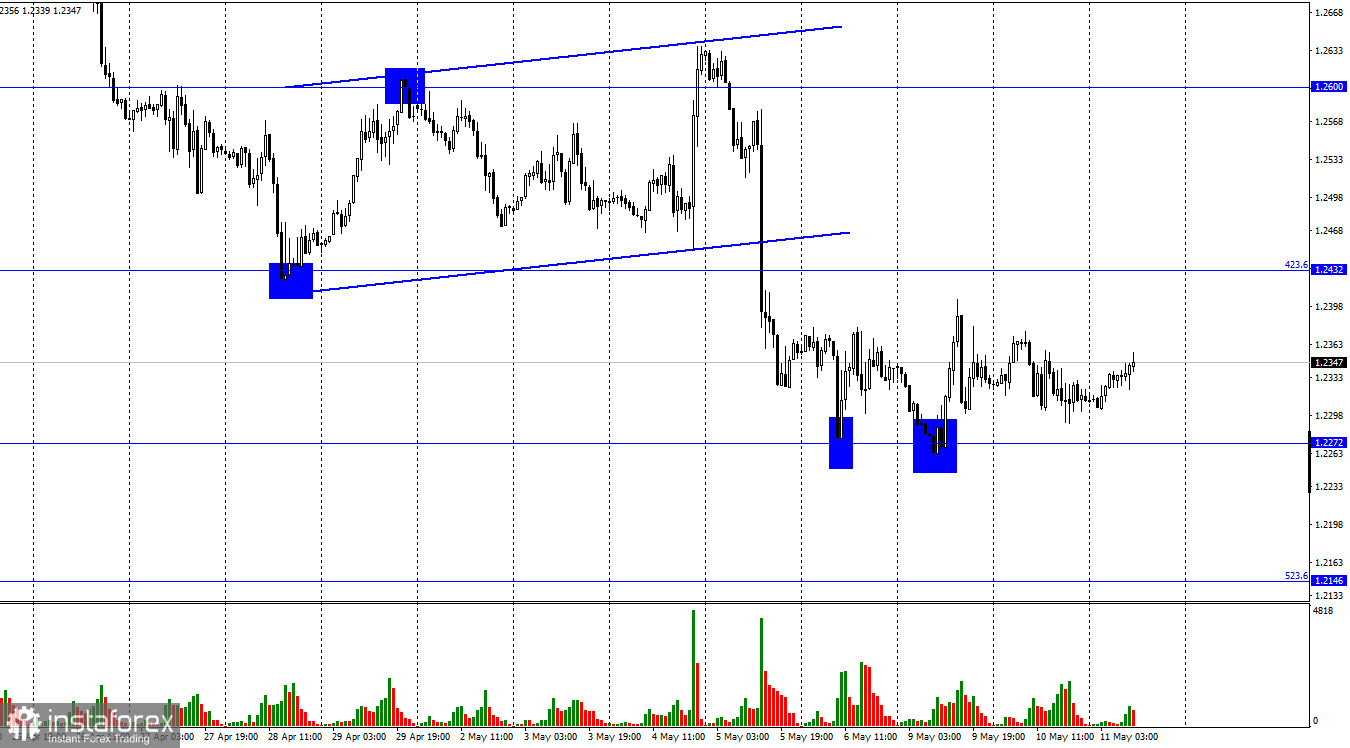

According to the hourly chart, the GBP/USD pair performed a slight drop towards the level of 1.2272 on Tuesday, but this time it did not reach it. Last night, a reversal was made in favor of the British, and new growth was started in the direction of the corrective level of 423.6% (1.2432). The rebound of quotes from this level will work in favor of the US currency and a new fall in the direction of the level of 1.2272. Consolidation above 1.2432 will increase the probability of further growth towards the next level of 1.2600. In the UK, all the most interesting events of the week will be tomorrow. And today, traders can only see the US inflation report for April. Expectations at the moment are 8.1%, which is lower than the March inflation by 0.4%. If expectations are met, then the US dollar, which has shown enviable growth in recent weeks, may fall slightly. I cannot say that the decline in inflation to 8.1% is the beginning of the process of its return to 2%. As some Fed members have stated, a return to 2% may take 1.5 years or more.

Thus, the forecast may not come true or the decline in inflation in April may be an isolated case. It is important to look at the trend here. If inflation declines for at least two months in a row, then it can already be assumed that it will not continue to grow. After all, the Fed is going to raise the rate at every meeting of 2022. In such conditions, it will be very difficult for inflation to grow. But even if inflation decreases today, it will not mean 100% that there will be a decrease in May. The pound can get the support of traders on this news. If inflation rises again and exceeds 8.5% (which also cannot be completely ruled out), then the dollar may resume growth, as this will mean that the Fed needs to raise the interest rate even stronger and faster. In this case, it is possible that in June or July the rate will be raised immediately by 0.75%.

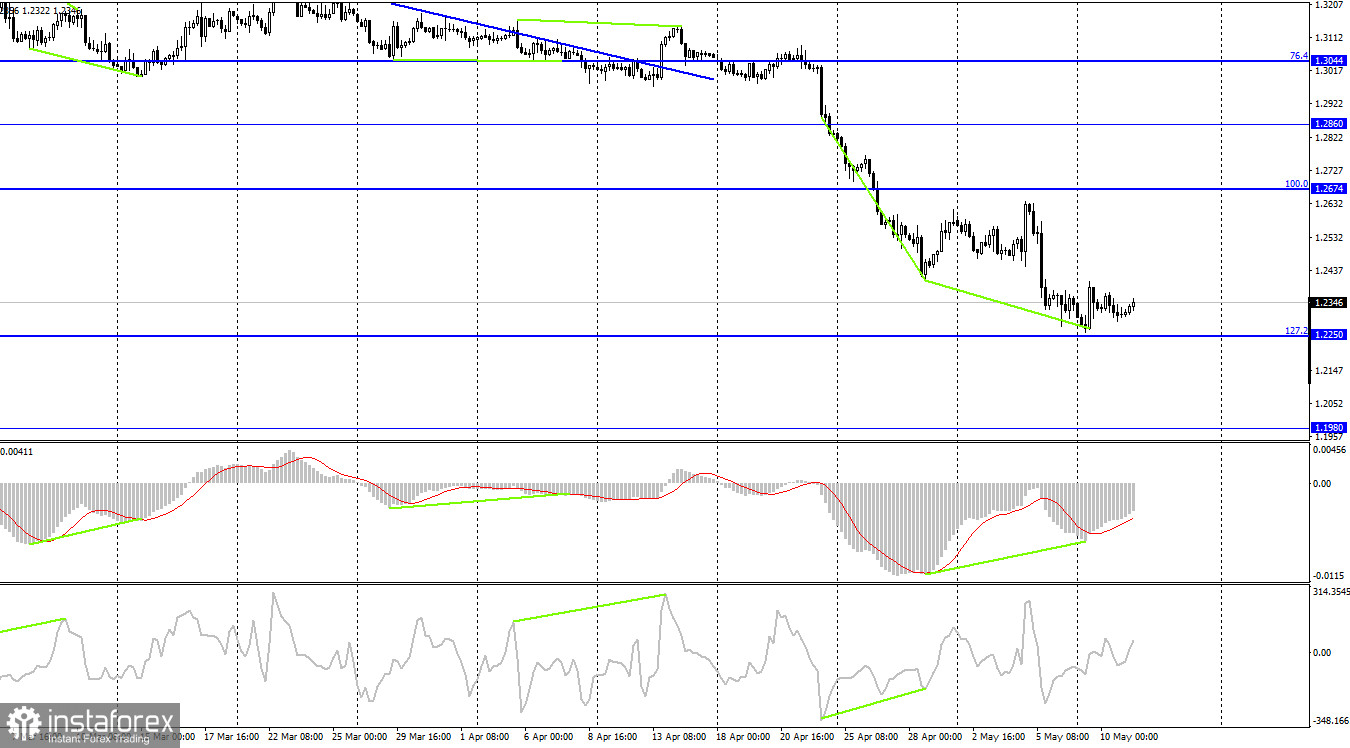

On the 4-hour chart, the pair performed a reversal in favor of the British currency near the corrective level of 127.2% (1.2250) after the formation of a "bullish" divergence at the MACD indicator. The growth process began in the direction of the corrective level of 100.0% (1.2674). Fixing the pair's exchange rate below the level of 1.2250 will work again in favor of the US currency and resume falling towards the level of 1.1980. There are no new brewing divergences today.

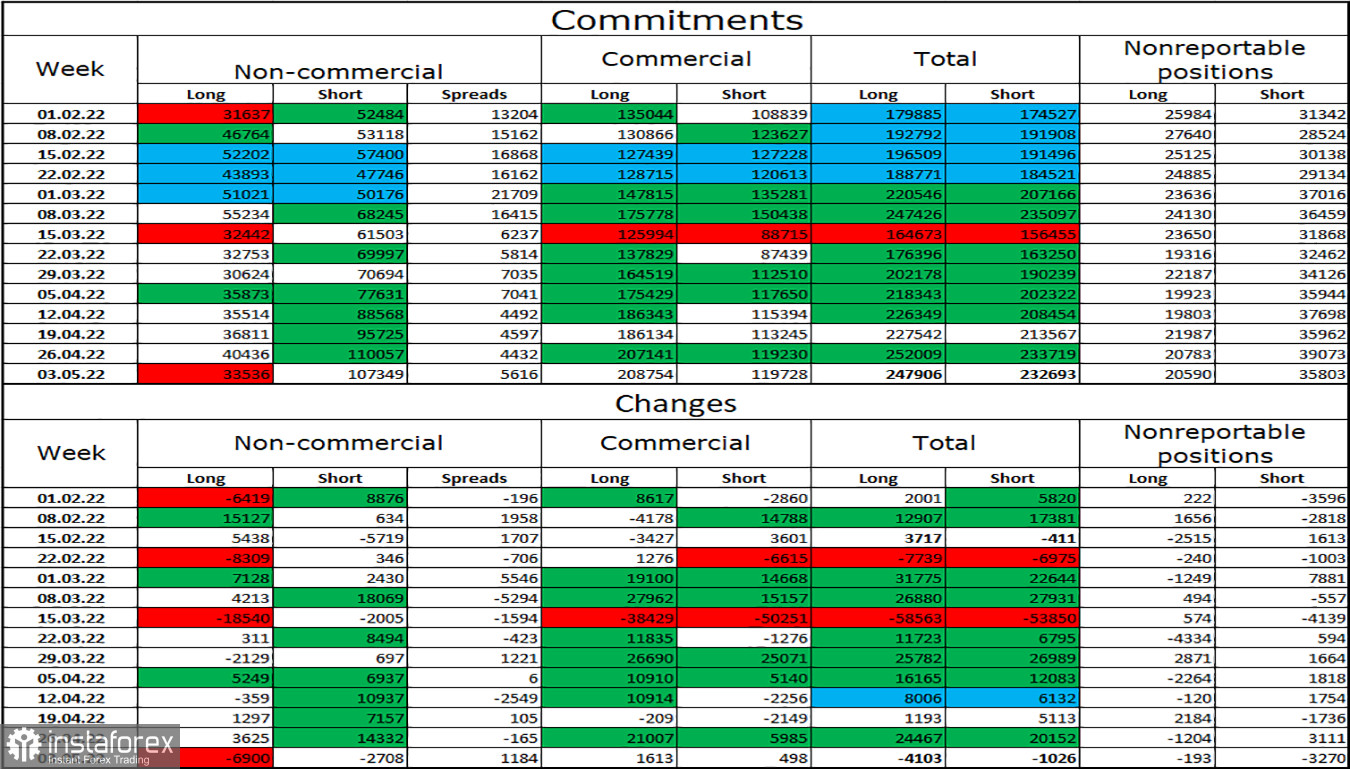

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot again over the past week. The number of long contracts in the hands of speculators decreased by 6,900 units, and the number of short - by 2,708. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 3 times more than shorts (107,349-33,536). The big players continue to get rid of the pound. Thus, I expect that the pound may continue its decline over the coming weeks. But also such a strong gap between the number of longs and shorts may indicate an imminent change of trend in the market. I do not rule out that the British will end its long fall this week.

News calendar for the USA and the UK:

US - consumer price index (12:30 UTC).

On Wednesday, the calendar of economic events in the UK is empty. However, one important report will be released in the US - on inflation. Thus, the influence of the information background on the mood of traders today can be quite strong.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British with a target of 1.2272 when rebounding from the level of 1.2432 on the hourly chart. Or with a target of 1.2146 when closing below the level of 1.2272. I recommended buying the British when rebounding from the level of 1.2272 with a target of 1.2432. Now, these deals can be kept open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română