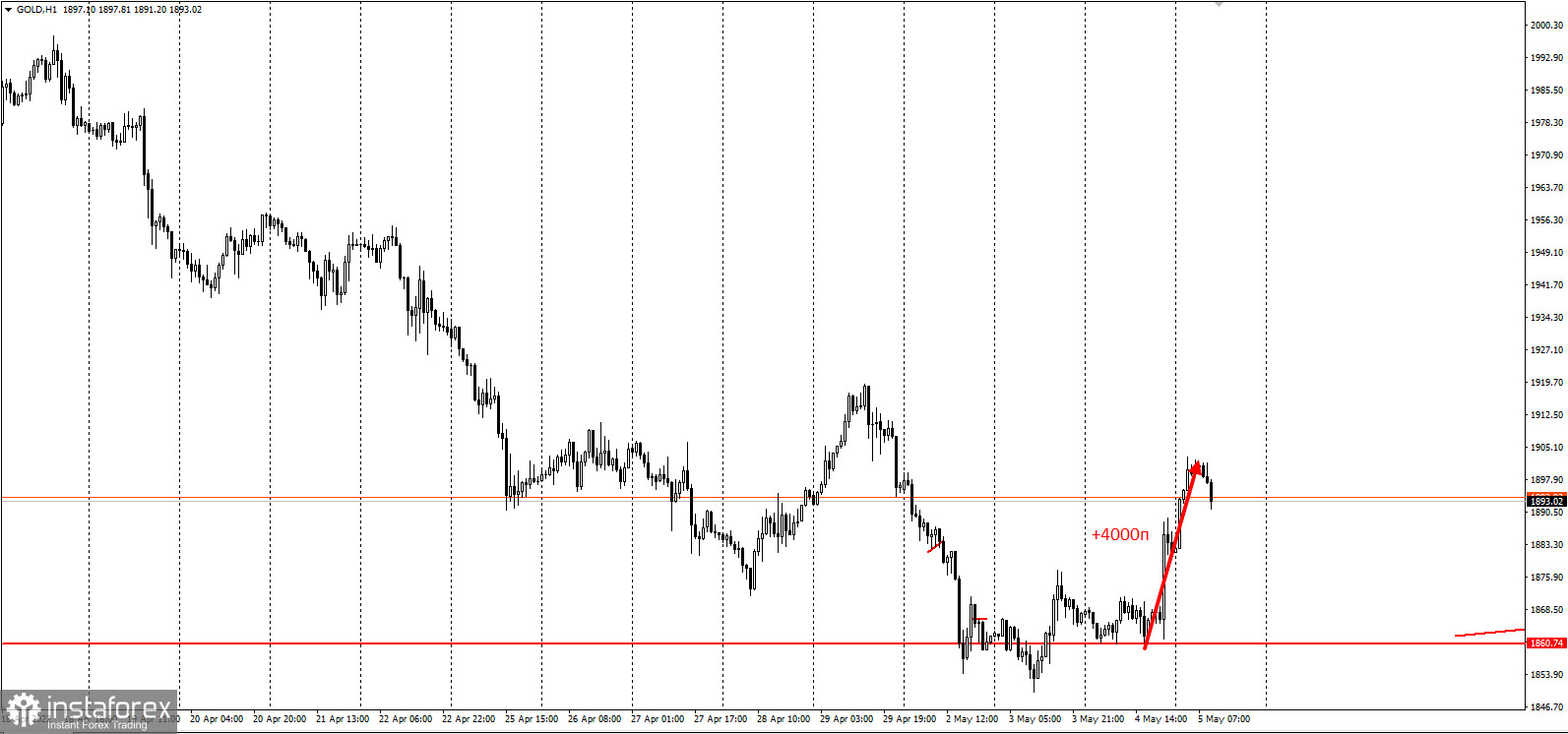

The US central bank increased interest rates by 50 basis points, raising the federal funds rate to a range of 0.75% to 1%. The Federal Reserve will also reduce its balance sheet by a total of $47.5 billion.In its monetary policy statement, the Fed expressed optimism but noted that economic uncertainty remained high due to geopolitical tensions in Ukraine. The US central bank said it was expecting a 1.4% decline in GDP in the first quarter of 2022.The Federal Reserve said that although overall economic activity had declined in the first quarter, fixed-asset investment and household spending had remained strong. The unemployment rate has also fallen significantly in recent months and job growth has been solid.Following the Fed press conference, gold rose by 4,000 points:

The Federal Reserve noted that interest rates would continue to rise until 2022. Markets are now expecting an almost 100% probability of a 75 basis point increase in June.Regarding the balance sheet, the Federal Reserve said it would reduce its Treasury assets by $30 billion and cut its exposure to mortgage-backed securities by $17.5 billion starting in June. Balance sheet outflows will double in three months to $95 billion.As inflation approaches the 2% target, the Federal Reserve will slow the pace of rate hikes.According to Capital Economics' chief US economist Paul Ashworth, the Fed will take two more steps of 50 basis points before it slows down.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română