Today, traders are looking forward to the release of the ADP report. The figure is expected to total 385,000 in April. If so, it will be a positive sign for the labor market.

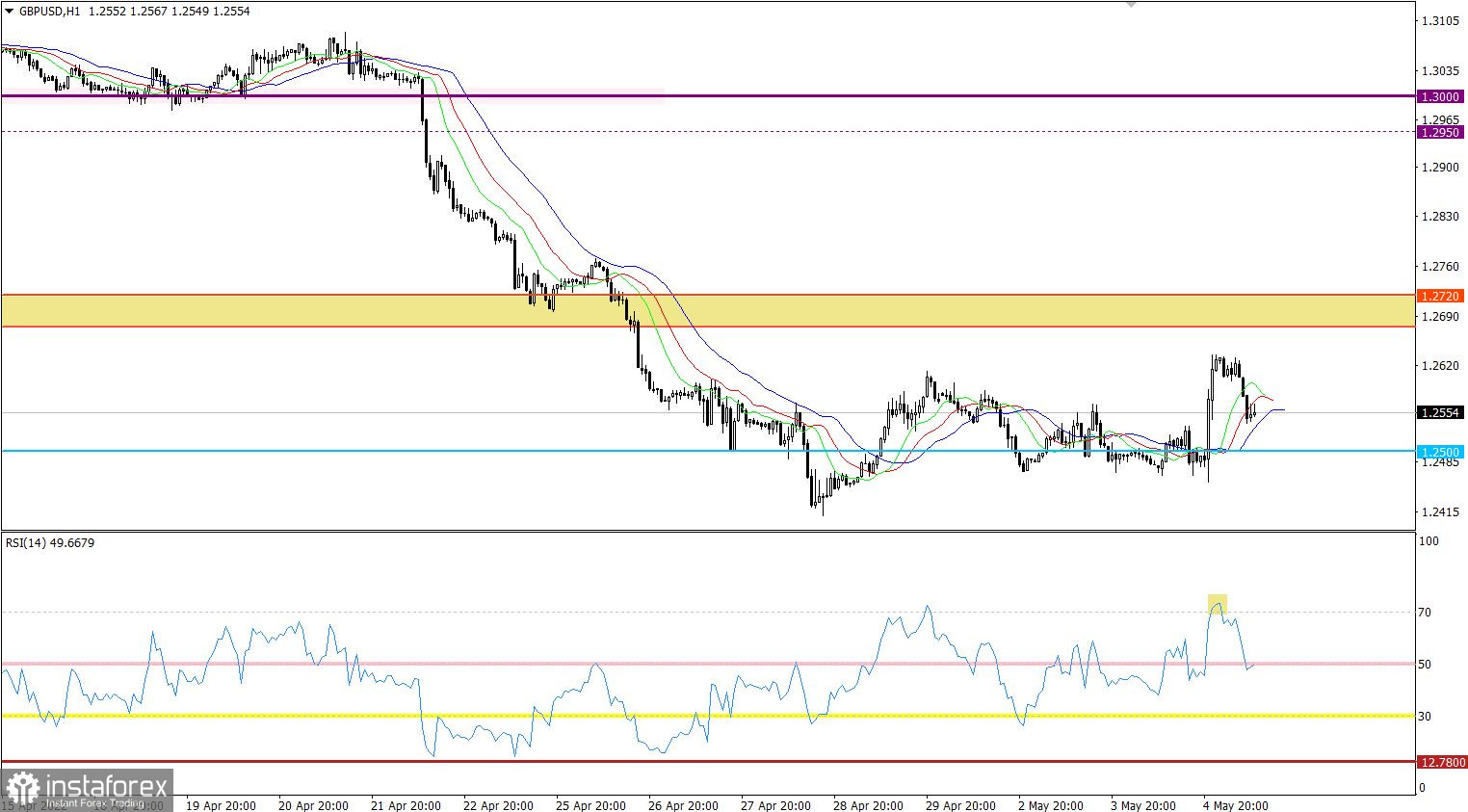

The GBP/USD pair performed an upward reversal as the US dollar lost 150 pips. It triggered a temporary rebound. Yet, the trend did not change. As seen on the chart, there has been already an increase in short positions.

The RSI indicator rose above the overbought line on the 4H chart during the period of speculative activity. It signaled the possibility of a drop in the volume of long positions. Shortly after, this scenario took place.

The Alligator indicator showed that the moving averages also rose sharply within the current trend on the 4H chart. However, the price rebound is likely to be short-lived as it was mainly caused by fundamental factors. In the medium term, the downtrend will persist.

Outlook

At the moment of writing the article, the price retreated significantly after a rebound. It returned to the levels where it started an upward movement. In order to cement the downward movement, the pair needs to decline below the 1.2450 level. In this case, the medium-term downtrend will remain intact, pushing the pair to new lows.

Otherwise, the pair may be stuck in the range of 1.2460/1.2600.

The complex indicator analysis gives a sell signal on the short, intraday, and medium-term charts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română