Chairman Powell's rhetoric and inflated market expectations

Hello, dear colleagues!

Let's now analyze the outcome of yesterday's most expected event, the May FOMC meeting. So, the US regulator announced it would raise interest rates by 50 basis points and reduce the balance sheet by $47.5 billion a month starting on June 1st. In 3 months, the monthly size of the reduction will have already reached $95 billion. Notably, the decision almost came in line with market forecasts. Why almost? Because the Fed had been expected to announce a monthly $95 billion reduction in May. In the previous overview, it was suggested that the regulator's decision would come in line with market expectations. All in all, this is what actually happened. Now, it is time to discuss Chairman Powell's rhetoric at the press conference.

Here is what Mr. Powell focused his attention on. Thus, he noted that further tightening made sense and it would not be harmful to the American economy. He also talked about record inflation in the country, which is now much higher than the Fed's target level of 2%. This is actually what made the central bank resort to tightening in the first place. Mr. Powell saw the Ukrainian conflict and the Covid-19 lockdown in China as the main driving force for inflation. Nevertheless, the regulator is prepared to tame persistent inflation and has already made the first steps. The chairman believes that the progress on the issue allows the Fed to keep the labor market strong. At the same time, Jerome Powell does not rule out the possibility of a slowdown in employment although the unemployment rate may fall even more. Mr. Powell additionally mentioned high labor demand and rapid wage growth. Meanwhile, the supply chain issue, which harms economic growth, still remains a fly in the ointment.

Although interest rates are now being raised to neutral levels, they can hardly be accurately determined at this stage. Chairman Powell hinted that there could be rate hikes at the upcoming meetings. However, they could be just 50 basis point increases as the Fed is not ready to raise the benchmark rate by 75 basis points. Several 50 basis points hikes should be enough to bring inflation under control, the chairman asserted. Interestingly, major market players partially expected the central bank to raise the interest rate by 75 basis points. However, the Fed was simply not ready to be that aggressive. Generally speaking, the regulator maintained its hawkish stance, but market expectations were too high. Now, let's see how the quote moved on the daily chart yesterday.

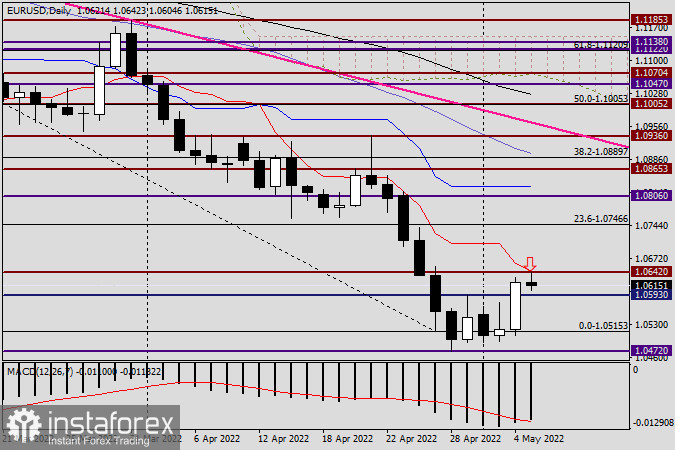

Daily

It has been repeatedly noted that higher expectations could affect the dollar. This is what actually happened, according to the daily chart. Market participants were disappointed with the outcome of the meeting and sold the dollar. Similar developments took place after the first 25 basis points rate hike. So, it is time to remember the well-worn expression "Buy the rumor, sell the news." As we can see history has repeated itself. The market traditionally has one peculiar feature, it prices events long before they actually unfold.

From the technical point of view, the price broke through resistance at 1.0593, closed above the important and strong technical level of 1.0600, and settled at 1.0621 yesterday. Today, the pair has already increased to 1.0642. However, at the moment of writing, it traded around 1.0612. The red Tenkan Line is slightly above the current highs. If the bullish trend extends, and the price breaks the Tenkan Line, the quote may well show further growth. If a bearish candlestick pattern emerges below the Tenkan Line, a bearish reversal may occur. Due to ongoing uncertainty, it would be unwise to enter the market at this stage.

Have a nice trading day!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română