The GBP/USD currency pair also showed no desire to trade actively. The pair stood in one place all day waiting for two central bank meetings at once. We will not consider the results of the Fed meeting in this article. Now we will have to analyze the technical picture no earlier than Friday, since very strong movements are also possible today, which will be a consequence of both the Fed meeting and the Bank of England meeting. In general, it is best not to jump to conclusions, because the pair can trade in different directions today and is very volatile. What to expect from the Bank of England? In general, nothing special should be expected. The main intrigue is whether the British central bank will signal its readiness to continue raising the rate in 2022? If not, then the British pound can only strengthen its fall. Recall that the BA has already raised the rate three times and it is now higher than that of the Fed. But even with this state of affairs, it is the pound that is falling, and it is falling quite strongly. Thus, if BA refuses to further tighten monetary policy or its rhetoric changes to a more "dovish" one, then this could be an additional blow for the pound.

In general, the technical picture is now almost unambiguous. Bulls have no desire to buy the pound and it is unlikely that even two meetings of central banks will change it to the opposite. Therefore, we believe that the downward trend will continue. At the same time, we remind you that the pair cannot constantly move in only one direction, even without corrections. Perhaps the market will try to use two meetings as an impulse to form a strong upward correction. Unfortunately for the British currency, the geopolitical background remains very difficult. Negotiations between Kyiv and Moscow have failed, so there is no hope that the conflict will end in the coming months. Consequently, military actions will continue, and they already threaten to go beyond the borders of Ukraine. According to rumors, Moscow may declare martial law or full mobilization, as Ukraine failed to achieve its objectives. It is unlikely that the Kremlin will retreat from its goals. The best option for everyone now may be to freeze the conflict in the style of "Donbas 2.0", and then hold lengthy peace talks with the participation of Western countries. But this option, it seems, is not even considered either in Ukraine or in the Russian Federation.The oil and gas embargo forces the UK to refocus on nuclear energy.

The issue of energy carriers is also acute for the UK. This country is not so much dependent on Russian oil and gas, so it is relatively easy to impose a ban on the supply of these, which implies a complete refusal by the end of 2022. It is already known that London will start receiving more hydrocarbons from the North Sea and Norway. There will also be deliveries from the USA. In addition, Boris Johnson said that his country intends to build one nuclear power plant per year, although earlier plans were to build one nuclear power plant in 10 years. "Nuclear power plants will wean us off fossil fuels, including Russian oil and gas. We will provide clean, safe, and reliable energy at home without financing Russia," the British Prime Minister said. By 2030, 8 nuclear power plants are going to be built in the UK.It is difficult to say whether this is good news for the British currency. It should be clearly understood that if there was no military conflict in Ukraine, Europe would continue to buy oil and gas from Russia. This option suited absolutely everyone. Now the problems in the energy sector will be observed in the UK. A shortage of energy can lead to an increase in the cost of this very energy, which can provoke an even greater increase in inflation and an increase in the cost of living in the UK. After all, it will take 8 years to build 8 nuclear power plants. That is, there is no question of a quick and painless transition from Russian energy carriers to nuclear energy. So far, the fundamental picture for the British pound remains very unpleasant.

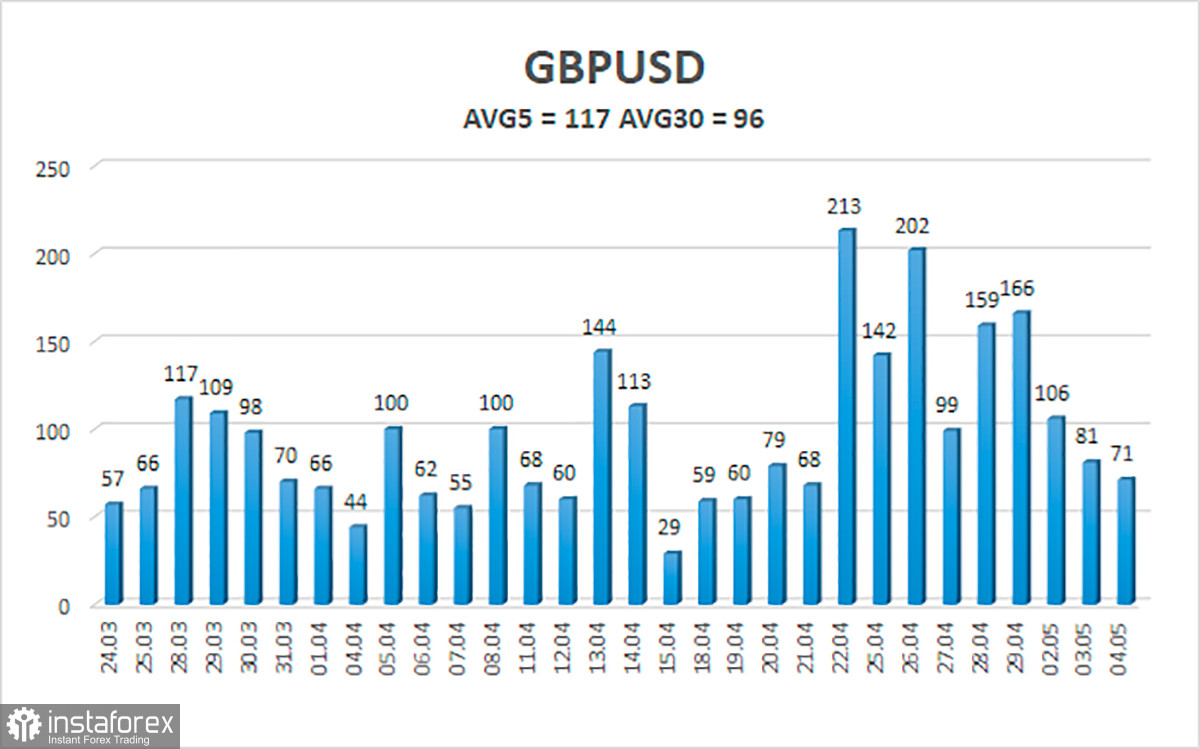

The average volatility of the GBP/USD pair over the last 5 trading days is 117 points. For the pound/dollar pair, this value is "high". On Thursday, May 5, therefore, we expect movement inside the channel, limited by the levels of 1.2382 and 1.2617. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.2451

S2 – 1.2329

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2695

R3 – 1.2817

Trading recommendations:

The GBP/USD pair failed to adjust on the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2382 and 1.2329 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.2695 and 1.2817.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română