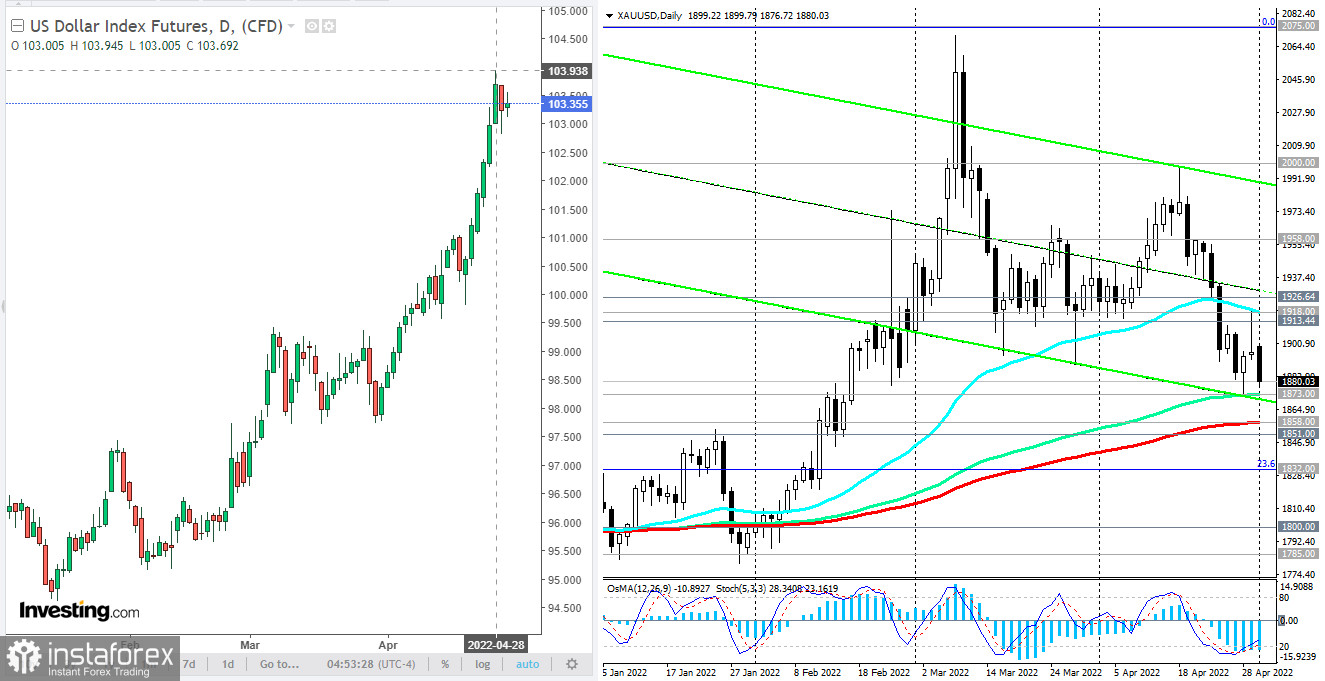

Despite being a popular defensive asset in a situation of rising inflation, and geopolitical and economic uncertainty, gold prices are currently falling, and the XAU/USD pair is moving towards important support levels of 1873.00, 1858.00, 1851.00.

Investors are waiting for the results of the Fed meeting, which will end on May 4 with the publication of the interest rate decision at 18:00 GMT. Federal Reserve officials are likely to tighten the existing monetary policy parameters and raise the interest rate by 50 basis points, as well as announce the beginning of a reduction in the bank's balance sheet. Market participants also take into account in the quotes an increase in the Fed's key rate by another 2% over the next four months.

Gold quotes are extremely sensitive to changes in the policy of the world's largest central banks, primarily the Fed. When their interest rates increase, gold quotes usually decrease. Nevertheless, gold has a prospect for growth. As the World Gold Council reported last week, demand for gold jumped by 34% in the first quarter of 2022, and demand growth during the quarter was 19% higher than the five-year average.

"An uneasy environment of persistently high inflation and elevated geopolitical risks drove investors to gold, helping to propel prices higher," said the council, noting a 5% increase in the average dollar price both quarterly and year-over-year.

Investors will now be keeping a close eye on the Fed's actions and how it handles inflation without hindering the growth of the US economy and a significant increase in unemployment. Thus, data released last week indicated the first contraction in US GDP since the start of the pandemic, while inflation accelerated and reached its highest level in 40 years.

If market participants see that inflation continues to grow despite the efforts of the Fed to contain it, and geopolitical tensions worsen in the world and economic conditions worsen again, they will again return to active purchases of gold, preferring it to other protective assets, including the dollar.

It continues to strengthen totally, including in relation to other popular safe assets, such as the yen, and the franc.

At the time of writing, the DXY index was near 103.35, returning to growth again after falling last Friday, when market participants fixed long positions on it at the end of the week and month. Last week, DXY reached a new 2-year high of 103.94.

Most likely, DXY may soon exceed the level of 104.00 and continue to grow. Increasing divergence of the curves reflecting the direction of the monetary policies of the Fed and other major world central banks will continue to encourage purchases of the rising dollar, especially on the part of investors who prefer, albeit low, but stable long-term income.

Today's news, which is worth paying attention to, includes the publication of the US Manufacturing PMI index at 14:00 GMT. This indicator, published by the Institute for Supply Management (ISM), is an important indicator of the state of the American economy as a whole. Forecast: 58.0 in April (against 57.1 in March, 58.6 in February, 57.6 in January). The index is above the 50 level and has a relatively high value, which is likely to support the dollar. The data above the value of 50 indicate an acceleration of activity, which has a positive effect on the quotes of the national currency. If the indicator falls below the forecast and, especially, below the value of 50, the dollar may sharply weaken in the short term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română