Huge fluctuations in the price of gold were evident last week, caused by a variety of factors. This week, investors' attention is focused on the FOMC meeting, which will be held on Wednesday. All in anticipation of an increase in the interest rate by a percent.

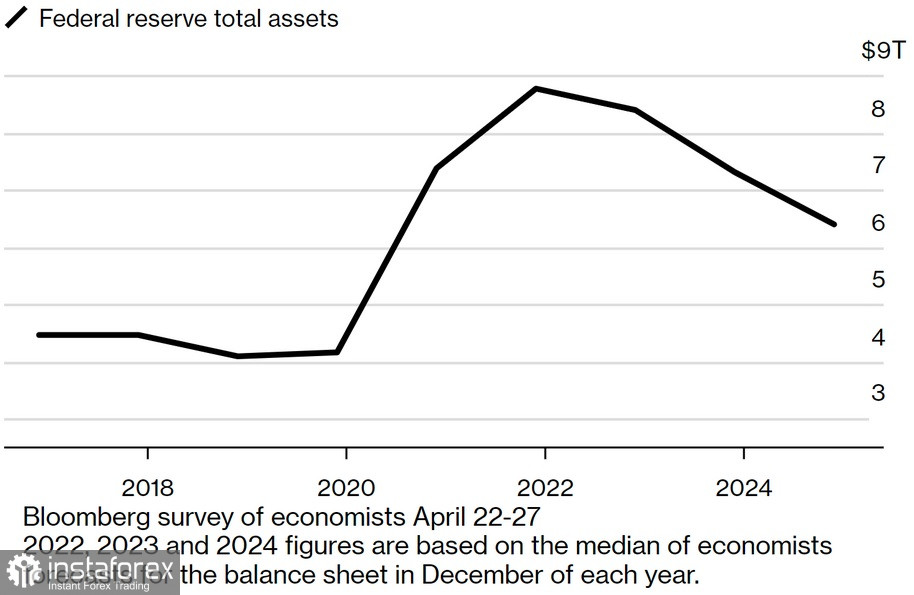

At the same time, it is widely believed that the Federal Reserve will begin to reduce its balance sheet assets over the next three years. Economists polled by Bloomberg News believe the Federal Reserve will cut its balance sheet from its current $8.8 trillion to $6.4 trillion by the end of 2024.

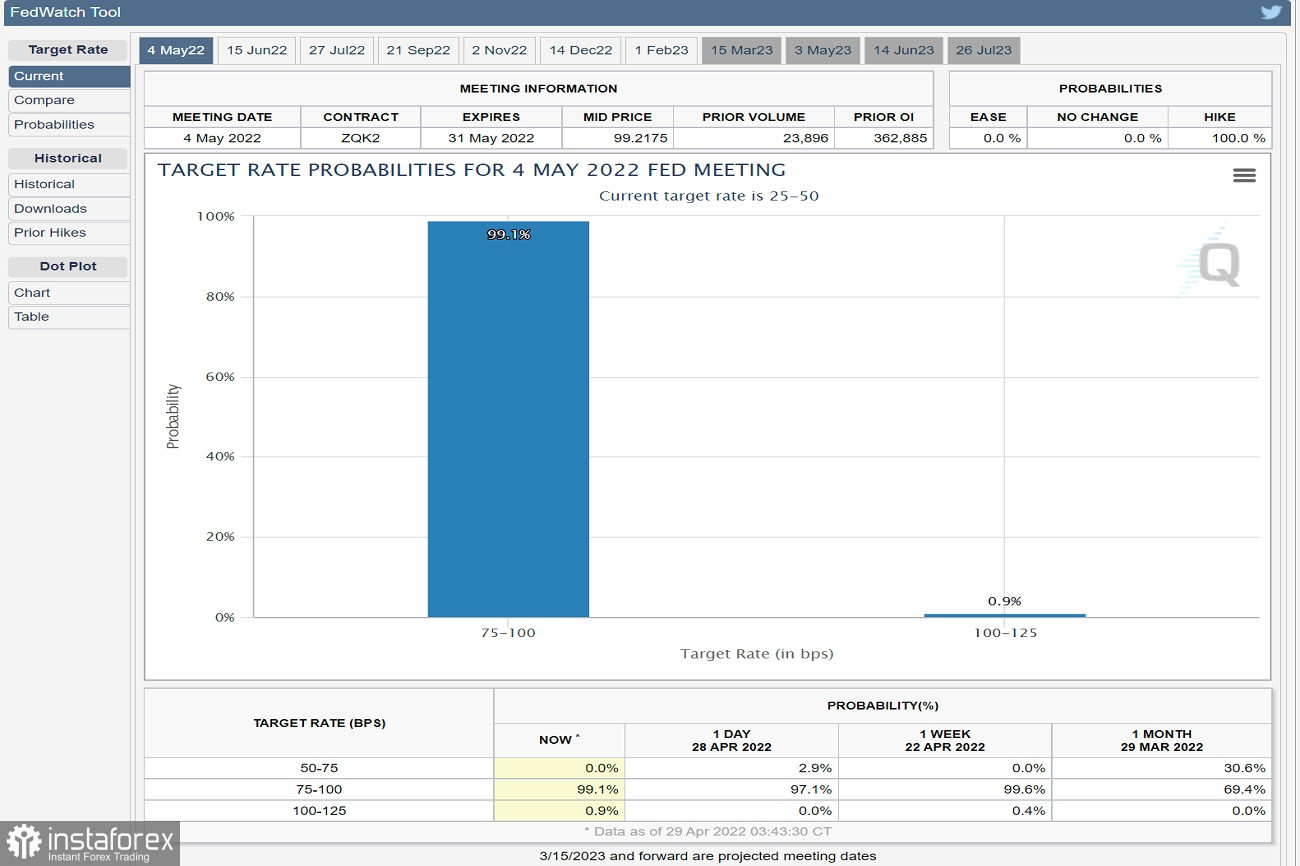

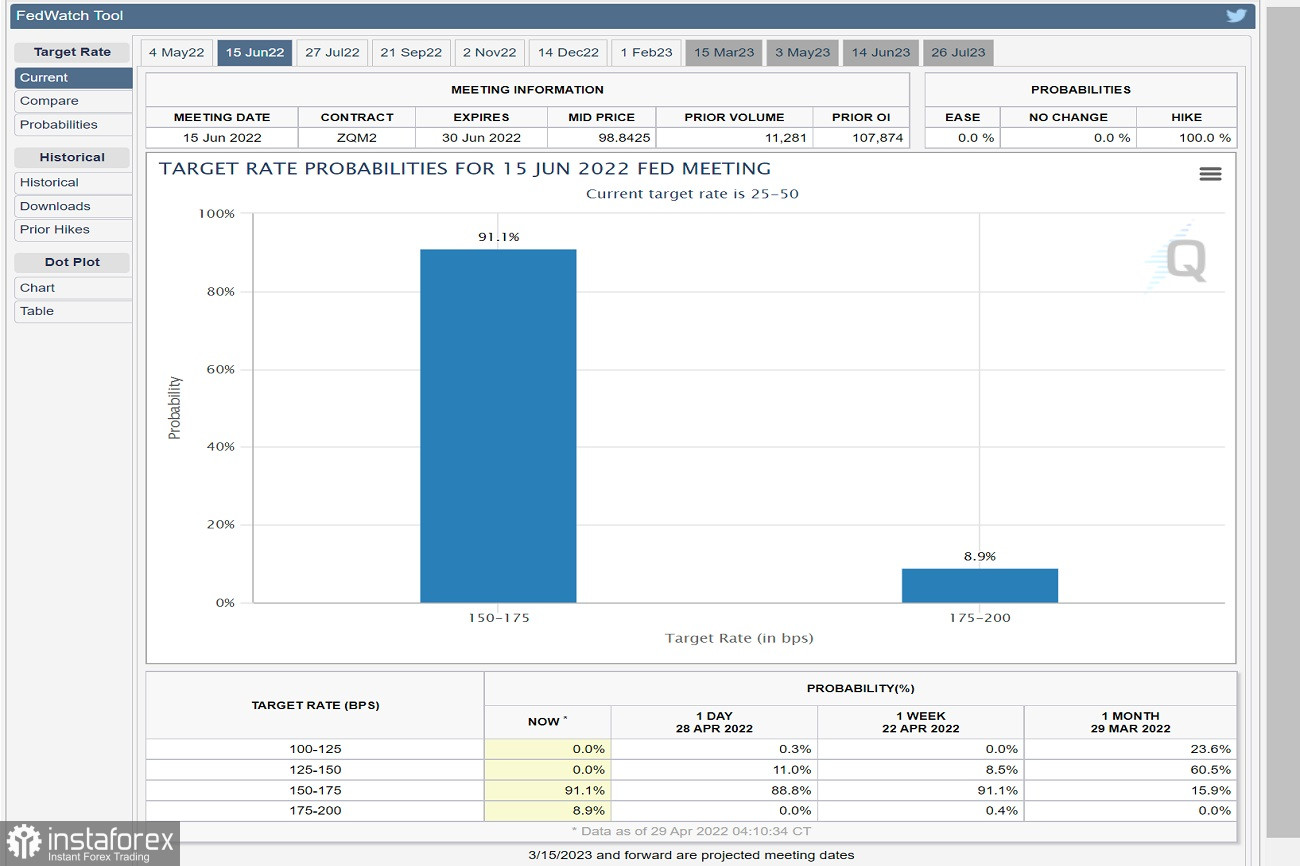

According to the CME FedWatch tool, there is a 99.1% chance that the Federal Reserve will announce a rate hike by a percent. The indicator also predicts a 91.9% chance that another half-percentage rate hike is likely to take place at the June FOMC meeting, following the rate hike this week. The speed at which the Federal Reserve will raise interest rates in an attempt to catch up with rising inflation is creating bearish market sentiment for gold.

Friday's Bureau of Labor Statistics PCE report showed that inflation continues to rise. The Personal Consumption Expenditure Price Index (PCE) rose 0.9% MoM and 6.6% YoY, a 42-year high. This is the highest level since 1980.

The US economy contracted strongly during the first three months of this year. In addition, the ongoing tense geopolitical situation in Ukraine has serious economic consequences. Inflation is high around the world, especially in regard to food prices, because both Russia and Ukraine are major exporters of grains such as corn and wheat. Russia is also a major supplier of energy resources such as oil and natural gas, and is the third-largest oil producer. This continues to support the rise in oil and natural gas prices.

Since the largest components of rising inflation are energy and food costs, geopolitical tensions in Ukraine have had a significant impact on inflation.

Undoubtedly, there are many factors and events that have influenced gold prices. The complexity of all of these components discussed above makes gold both bullish and bearish, and may in fact be the main reason behind the recent price volatility.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română