In today's article on the GBP/USD currency pair, we will touch on the main topics that affect and may continue to do so on the price dynamics of this trading instrument, and in the technical part of the review, we will pay attention to the results of the closing of last month. Since the week that started seems to be archived, we will identify its most important events.

So, the external background is now definitely represented by geopolitical and economic components. Naturally, the main geopolitical threat to the world remains the military conflict in Ukraine, where Russia continues to conduct its military special operation. There is still no obvious progress in the settlement of the confrontation between the two Slavic peoples, from which it can be concluded that the conflict will acquire the status of a protracted one, and for a long time. The increasing likelihood of an impending energy and food crisis is now more relevant than ever since we can expect an even greater disruption in the supply chain, and a general decline in economic growth in the world due to the harsh quarantine measures that the Chinese authorities were forced to introduce due to the increased number of infections with the Omicron strain of the COVID-19 pandemic. So, in the last days of April, the number of infections in China jumped to 10,700 cases per day. The main focus of the new outbreak of the epidemic is the giant city of Shanghai. And in Beijing, there are already obligations for citizens to present a negative test and a special certificate for COVID-19 when traveling on public transport and visiting many institutions and public places. However, as noted by virologists, the number of infections in China has decreased significantly in recent days.

Nevertheless, the restrictions may partially paralyze the second world economy, and if we consider that the latest GDP data came out frankly disappointing, there is something to think about. Do not forget about high inflation, which many of the world's leading central banks have joined the fight against. That's how imperceptibly we approached the main events of the current week, which for the pound/dollar currency pair will be the decisions on the rates of the Fed and the Bank of England and, of course, the comments of the heads of these departments. The expectations are that the Fed will raise the rate by 50 basis points, and the Bank of England by 25 bp. I believe that the actual decisions and rhetoric of both regulators will have a significant impact on the subsequent price dynamics of GBP/USD. Although it's no secret that the Bank of England is unlikely to be able to compete with the Fed in terms of the degree of tightening of monetary policy. Well, these events will take place in the middle of the week, and at its very end, on Friday, data on the US labor market will also be published. As you understand, we are in for an extremely important week according to the rating of upcoming events.

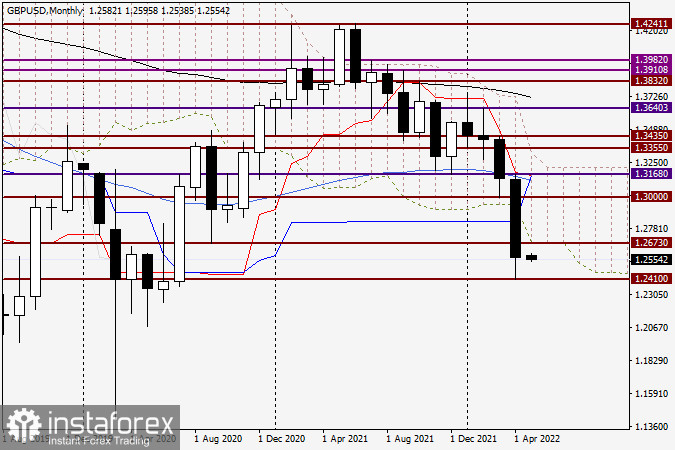

Monthly

In April, the GBP/USD currency pair showed a very strong downward trend. During the decline, the bears on the instrument tried to break through the strong and important psychological and technical level of 1.2500. However, having dropped to 1.2410, the pair found strong support there and bounced up, ending April trading at 1.2570. It should be noted that such a strong fall was preceded by a meeting with the blue 50 simple moving average and the red Tenkan line of the Ichimoku indicator. After that, the quote turned sharply in the south direction, confidently went down from the Ichimoku cloud, and also passed the blue Kijun line. Theoretically, the lower shadow of the April candle and the closing price above 1.2500 leave chances for some adjustment of the exchange rate, but in practice, given the continued strong demand for the US dollar, it will be very difficult to do this.

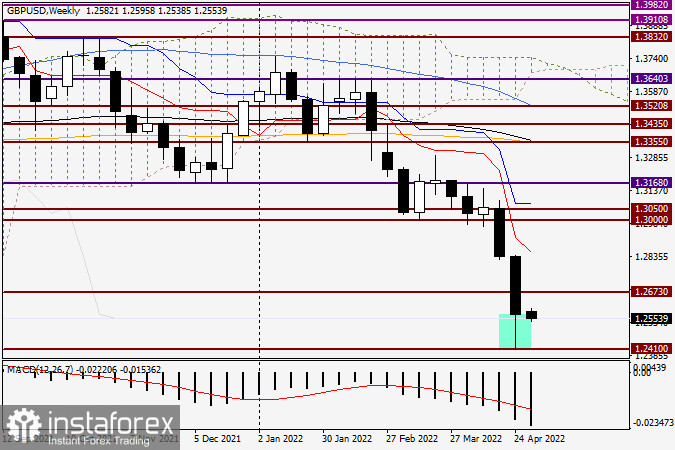

Weekly

The lower shadow of the last weekly candle is even more significant. But whether it will be able to influence the subsequent direction of the quote will depend on the decisions on the rates of the Fed and the Bank of England, the rhetoric of the leadership of these departments, as well as the reaction of market participants to these key events. If we also take into account Friday's Nonfarm, then this week the pound/dollar will be at the mercy of the designated events and the technique may not be as relevant as usual. Nevertheless, selling GBP/USD still looks like the main trading idea. However, now their relevance will depend even more on course adjustments. At this stage of time, the levels of 1.2675, 1.2700, 1.2750, and possibly the 1.2800 mark look like benchmarks for opening short positions. Purchasing is much more problematic. First, they are against the main and rather strong downward trend. Second, when opening long positions, it is most safe to take out a stop loss under the minimum values of last week 1.2410, and this will be too much. In tomorrow's article on GBP/USD, we will consider smaller time intervals and, if necessary, adjust today's trading recommendations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română