European stocks increased on Friday, as China's pledge to increase economic stimulus maintained optimism in the market. Strong earning reports boosted stock indexes as well.

Shares of Tesla Inc. gained 4.2% in US premarket trading after Elon Musk stated he did not plan to sell more stock of the EV manufacturer following his acquisition of Twitter Inc.

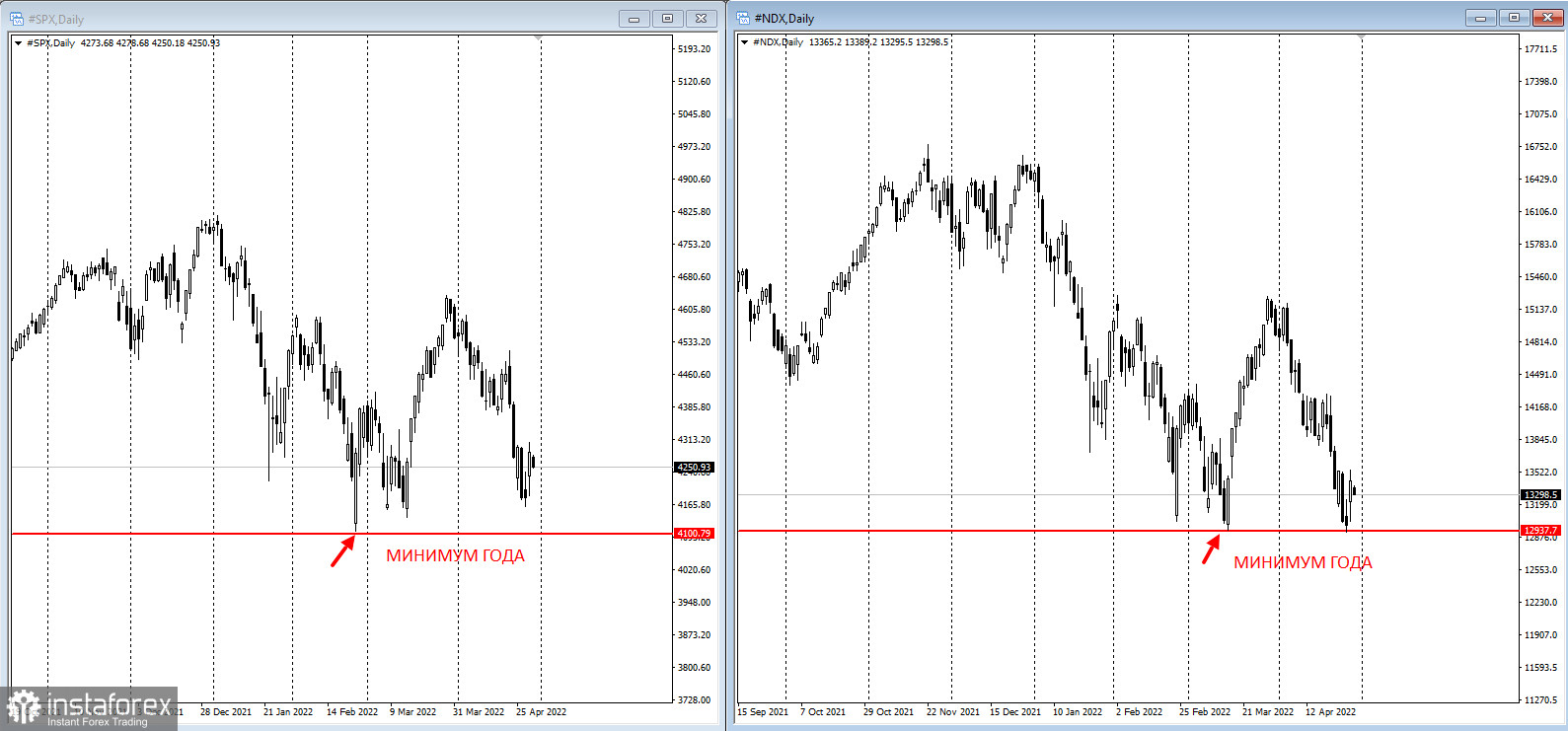

US stock indexes are trading at their yearly lows, indicating they could break below them in the future.

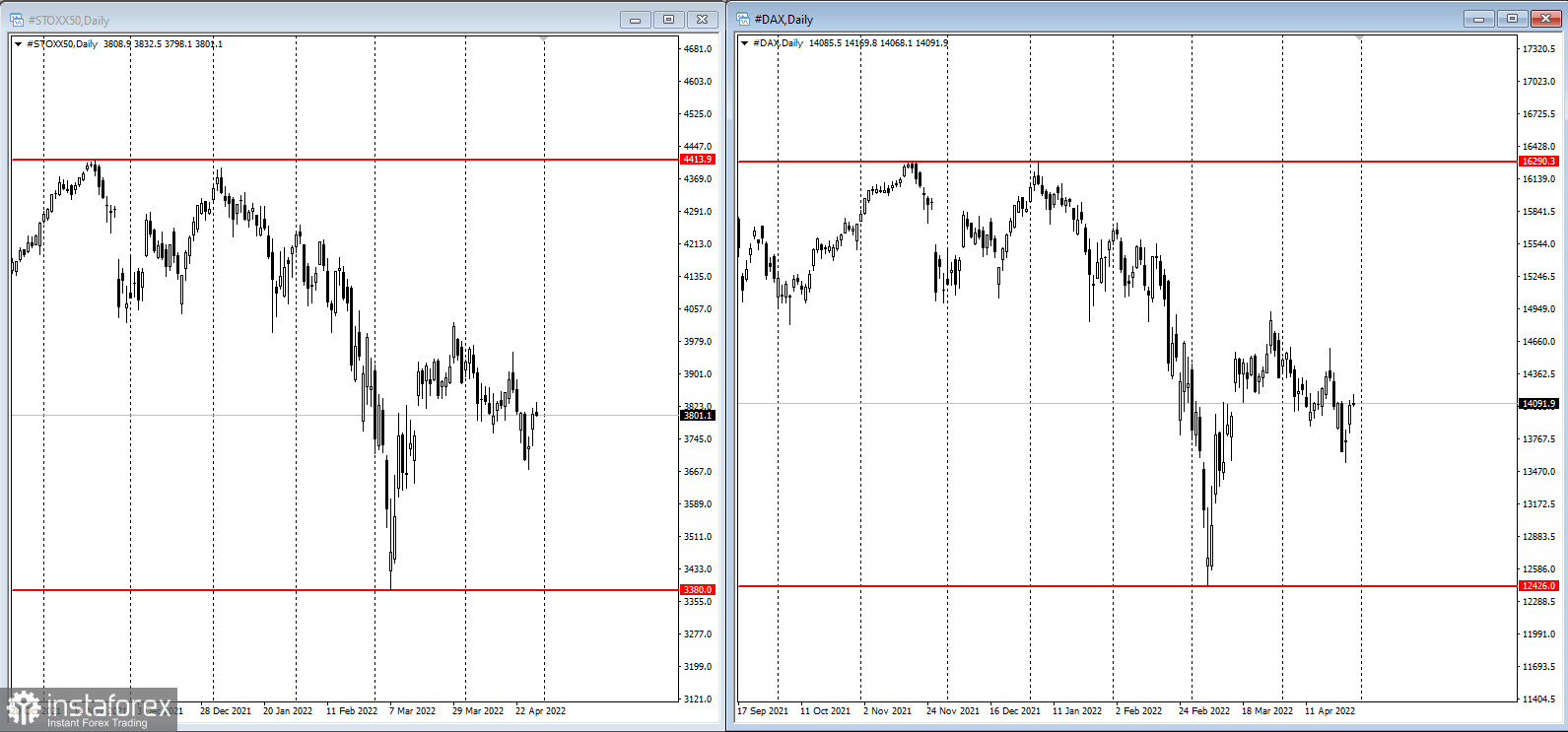

The STOXX Europe 50 gained 1% thanks to Chinese demand for commodities boosting regional exporters. The quarterly earning report season helped European stocks recover some losses they have sustained in April. The index is projected to decrease by 1.2% in April.

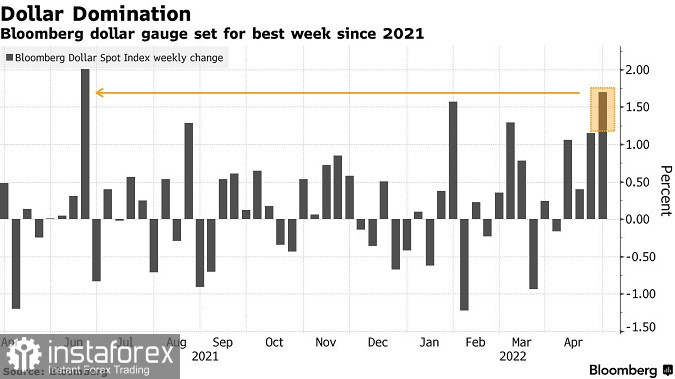

US Treasuries decreased, pushing the yield of 10-year bonds up to 2.85%, as investors brace themselves for the aggressive interest rate hike by the Federal Reserve, which is striving to bring high inflation under control.

According to the latest data, the US economy has shrunk unexpectedly for the first time since 2020. Consumer goods imports have surged upwards on expectations of economic growth resuming in the future.

Jimmy Chang, Chief Investment Officer at Rockefeller Financial LLC, stated that the yield of 10-year US Treasury bonds could be lower in 2023 compared to today. According to Chang, the Fed could ease its hawkish policies in the future as the US economy gets weaker. The Fed could even put monetary tightening on hold in early 2023, he predicted.

West Texas Intermediate traded near $105 per barrel as traders assessed a prospective EU ban on Russian oil imports in responce to Russia's war against Ukraine.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română