Catastrophic fall of Japanese yen

In the USD/JPY pair, the dollar bulls are displaying all their strength. In a spectacular bullish rally, the pair has already reached the highs last seen 20 years ago. Yesterday and the day earlier, the dollar/yen pair advanced by 4 levels in the course of its bullish run. This does not happen very often. The main factor to drive the US dollar higher against the yen is the different approach to the monetary policy of the Fed and the Bank of Japan. While the US regulator is set to take aggressive measures, the Bank of Japan traditionally has a dovish stance on its monetary policy. Recent comments by BOJ Governor Haruhiko Kuroda confirm the already evident trend. Interestingly, the Japanese yen, which is usually considered a highly popular safe-haven asset, completely gave up this status to the US dollar. In the previous geopolitical crises, the yen was the asset that everyone would flee to. However, today, the US dollar is the absolute leader in this regard.

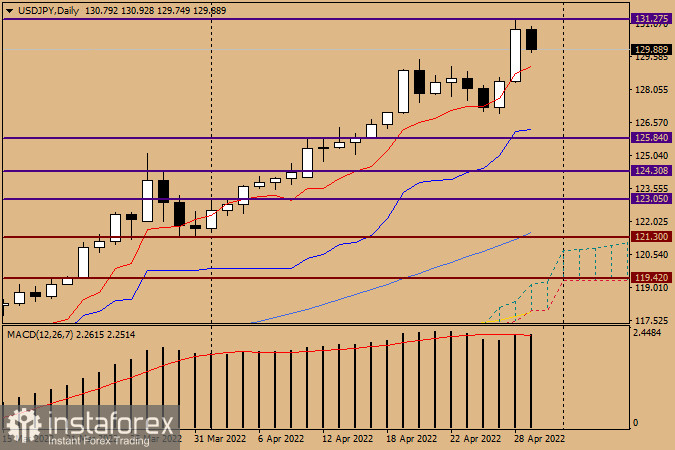

Daily chart

As mentioned above, after a rapid rise yesterday, the pair reached a high at 131.27 even despite disappointing data on the US GDP for the first quarter. I would like to say that this does not happen often as USD/JPY is very sensitive to important macroeconomic data from the US. So, this is absolutely surprising! At the moment of writing, the quote was declining in what is likely to be a corrective pullback. However, the pair needs a break after such a wild run. Profit taking at the end of the month and week is exactly what will help the correction to develop. By the end of the analysis, the dollar/yen pair was trading near 129.80. In case the decline continues to the red Tenkan line at 129.13, we can consider opening long positions. Anyway, after such a rapid and aggressive growth, the pair bulls will do their best to close this month not lower than the historical level of 130.00. Therefore, any corrective pullback of the pair should be used to open fresh long positions. But I'm not sure that today is the best day for this. I suggest that we wait until Monday and develop a more detailed trading plan based on the actual monthly and weekly close. However, everything is already clear for the USD/JPY pair.

Have a good weekend!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română