So the time has come for the last trading day of April. Today is quite an important and difficult day when the market will close monthly and weekly trades, as well as today's session. It should be noted right away that this month the US dollar gave heat and very seriously strengthened against the vast majority of its competitors. However, we will consider the results of the April auction in more detail on Monday, taking into account the actual closing of the ending month. However, it can already be stated that the US dollar is simply unsinkable. Another proof of this conclusion was yesterday's preliminary data on US GDP for the first quarter. If you remember, in yesterday's article on EUR/USD, it was suggested that this indicator may surprise, and it is unpleasant to surprise. The actual value exceeded even the most pessimistic expectations. Let me remind you that according to forecasts, the GDP of the leading world economy was supposed to show growth of 1.1%, the actual figure was minus 1.4%. Such a serious drop in gross domestic product smacks of a recession. Why the indicator turned out to be so weak and fell into the negative zone, economists will still have to figure out. We are now interested in the reaction of the US Federal Reserve System (FRS) to this frankly disastrous report, as well as the steps that the US Central Bank will take at its May meeting.

Let me remind you that market expectations are very high and foresee that in May the Fed will raise the federal funds rate by 0.75% at once. However, after yesterday's extremely negative data on US GDP for the first quarter, the "hawkish" attitude and such aggressive intentions may be revised towards a more moderate pace of monetary policy tightening. In this scenario, the "American" risks encountering serious problems and falling under the wave of sales. However, this is not happening yet, and even the failed GDP reports for the first quarter could not prevent the US dollar from continuing its strengthening against the single European currency. Before proceeding to the consideration of price charts, I note that today the baton on GDP reports will be picked up by the eurozone, which will also publish the consumer price index. Quite important indicators will also come from the USA, among which it is worth noting the personal income and expenses of Americans, the basic index of prices for personal consumption, as well as the indices of purchasing managers of Chicago, and consumer sentiment from the University of Michigan. In general, there will be no shortage of fundamental events on the last day of April trading, but whether they can affect the price dynamics of the euro/dollar, the course of trading will already show.

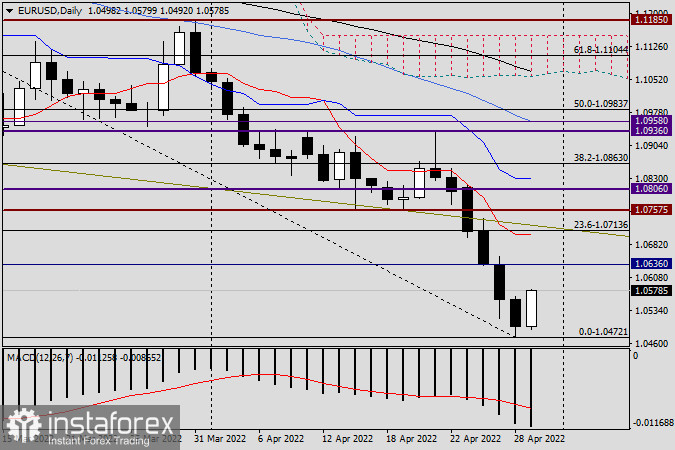

Daily

The fact that the market continues, to put it mildly, to be cool about macroeconomic data is clearly shown by the results of yesterday's trading. Ignoring the surprisingly disastrous figures for US GDP, the pair continued to decline and closed Wednesday's trading at 1.0498, that is, just two points below the landmark psychological mark of 1.0500. I think this is very symbolic, since today, on the last day of weekly and monthly trading, the fight will unfold precisely for the closing price relative to this most important level. At the time of writing, the pair is strengthening, and trading is conducted near 1.0540. I fully assume that on the last day of monthly and weekly trading, against the background of profit-taking, the main currency pair will adjust slightly and slightly reduce the losses incurred before. We can assume a rise and attempt to return above another important technical level - 1.0600, but it will not be easy to do this. Given such an ambiguous day as today, I do not recommend opening fresh positions at the end of the month and week. Let them close the auction without us, and we will return to the consideration of the results of today's closing of the month and week on Monday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română