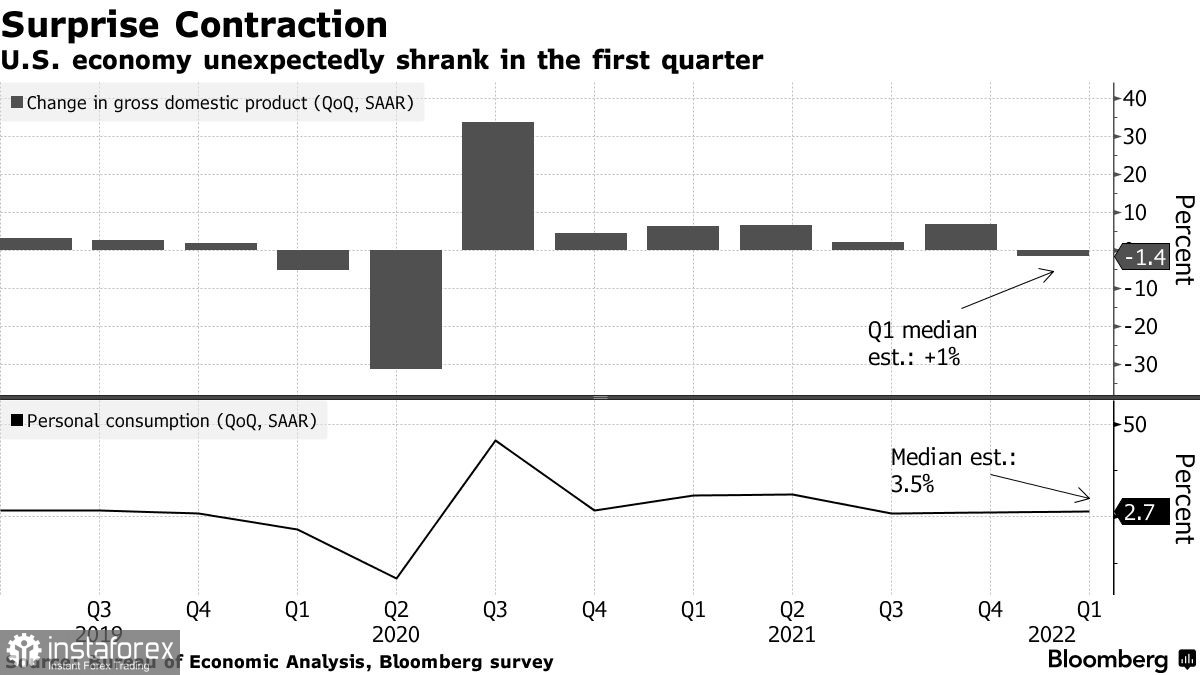

The US economy contracted for the first time since 2020. Experts say the trade balance and the surge in imports, which occurred due to strong consumer demand, are to blame. For this reason, there is no need to take these figures seriously. Leading US experts believe so, suggesting that growth will soon resume as early as the second quarter of this year. Although this is unlikely, given persistently high inflation and a sharp tightening of monetary policy together with rising interest rates.Notably, the unexpected economic slowdown further exacerbates President Joe Biden's political problems. It has become obvious to all that he has done a poor job of strengthening the US economy.

Gross domestic product fell 1.4% year-on-year in the first quarter after rising 6.9% at the end of last year, data from the US Department of Commerce showed yesterday. Economists' average forecast was for growth of 1%. As I noted above, a number of economists believe that the report is more an illustration of the volatility of GDP calculations from quarter to quarter, which does not necessarily indicate economic weakness or a sign of recession. The reaction of the US dollar and its subdued fall against a number of risky assets is proof of that. However, we might see a delayed fall of the US dollar in the near future on the back of profit taking and the closing of a number of long positions at the end of the month.The key to the decline in GDP was a surge in imports and a fall in exports. The situation was also exacerbated by a slower buildup of corporate inventories. Together, trade and inventories reduced overall GDP growth by around 4 percentage points. Government spending declined, which also affected GDP. However, retail sales, a measure of underlying demand that excludes trade and inventory components, accelerated to an annualised rate of 2.6%. On an annualised basis, the economy grew by 3.6%.It is now clear that officials need to balance tighter policy with risks that could lead to a sharp slowdown in demand. Despite all this, against a backdrop of fast-growing inflation and solid spending, monetary policy at the Fed is expected to continue to aim for a half-point interest rate hike as early as next week.It should not be forgotten that the US economy also faces other potential challenges, such as the aftermath of the Russian military operation in Ukraine, a sharp slowdown in Europe's growth prospects, a lockdown in China and supply disruptions. All this will slow down the global economy and have a negative impact on US GDP growth as early as the second quarter of this year. It is therefore unlikely that the fall in the first quarter will be temporary. All hope lies in strong growth in consumer spending, business investment and high employment, with which the USA has no problem so far. However, high inflation and higher interest rates could make a big difference.

Data from the Ministry of Commerce also showed that personal consumption, the largest part of the economy, grew at an annual rate of 2.7% in the first quarter compared to 2.5% at the end of 2021. Clearly, costs soared earlier this year as the number of Covid-19 cases declined and social restrictions were lifted. Nevertheless, many corporate executives advertised the resilience of the American consumer in recent earnings reports.Today we will take a look at how things are going in European countries. GDP growth reports are expected for the key eurozone countries. The situation is likely to be the same as in the US.As for EUR/USD technical pictureFollowing another renewal of the yearly low, the euro has corrected slightly. Despite this, expectations of a more aggressive policy from the European Central Bank are not helping, as everyone is waiting for the Federal Reserve meeting in May where interest rate could be increased by as much as 0.75% against the previously announced 0.5%. Deteriorating geopolitical tensions due to Ukraine's refusal to negotiate, as well as supply chain problems in eurozone countries will continue to limit the upside potential of risk assets. In the short term, it is best to bet on a major upward correction of the pair, which occurred amid profit taking after US economic data. The slowdown in GDP growth in Q1 this year is a major concern for the central bank. To stop the bear market, buyers need to protect the nearest support at 1.0500. If that is missed, the bears are likely to take the trade to new lows of 1.0470 and 1.0420. Support at 1.0390 will be a further target. The Euro can correct only after the bulls gain back control of the resistance at 1.0560. From there we might expect an upside surge to 1.0620 and 1.0695.As for GBP/USD technical pictureBuyers of risky assets defended 1.2420 and now the pound is trying to find the bottom. There will be upside rebounds like yesterday's one. However, it is worth noting that the medium-term bearish trend continues to gain strength. In the short term, I advise to buy the pound, as a stronger bullish presence amid profit taking at the end of the month is possible. The nearest resistance levels are now around 1.2550 and also just above, around 1.2600 and 1.2640. A break of 1.2480 would strengthen the bear market, which would open the way to new lows: 1.2420 and 1.2370. The furthest target in current conditions would be the support of 1. 1.2320, which will be renewed should the UK economy deteriorate.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română