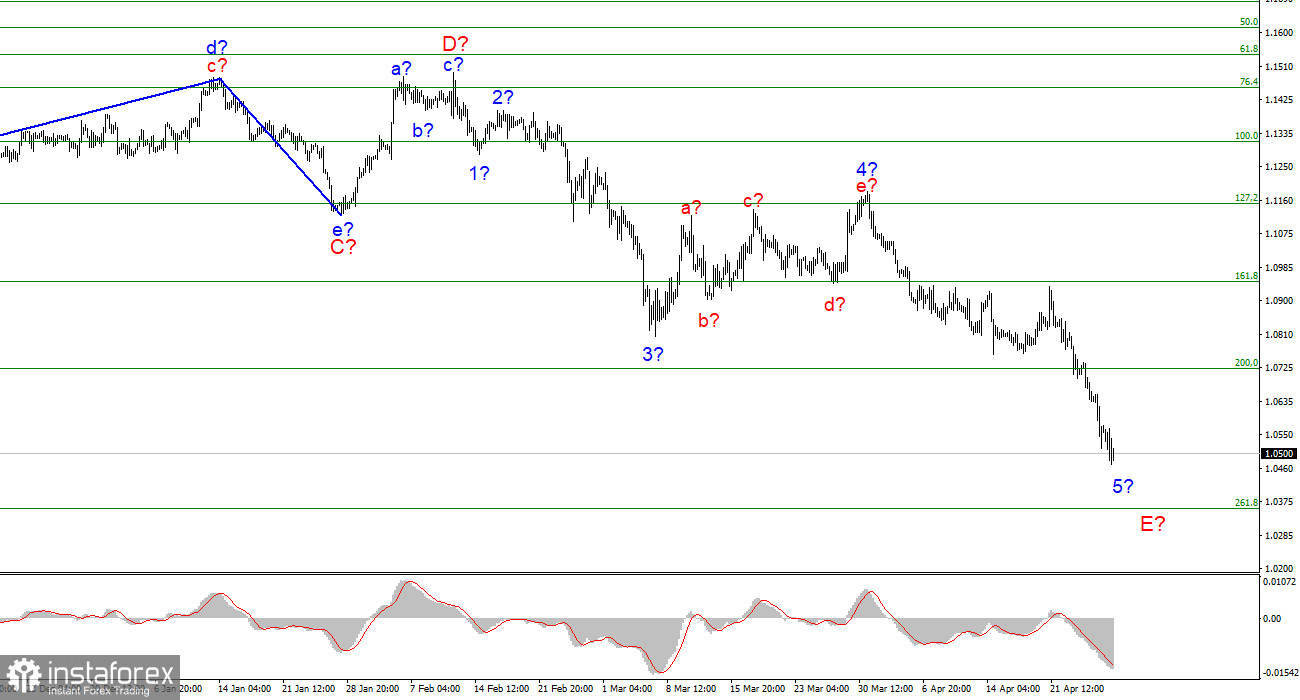

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues to build a descending wave 5-E, which may be the last in the structure of the descending trend segment. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since this wave may turn out to be a very long, five-wave in its internal structure. At the moment, this wave no longer looks shortened, and five waves are not visible inside it yet. Therefore, I believe that it will continue its construction for some time. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, and there only 350 basis points will remain to price parity with the dollar. An unsuccessful attempt to break through the 1.0355 mark may mean that the market is ready to build a corrective wave of 5-E. I am not considering alternative wave marking options yet.

The American economy was shocked, but the demand for the dollar did not decrease

The euro/dollar instrument declined by another 70 basis points on Thursday. Market activity remains high, and the demand for the euro currency is decreasing every day. In the last few days, a lot of questions related to the fact that there was no news background, but the market still almost massively fled from the euro and the pound, why? Today, we received an indirect answer to this question. Just an hour ago, the US released a report on GDP for the first quarter. Despite forecasts of more than 1% growth, the real value was -1.4% q/q. It's a drop, and it's a very unexpected value. Such a value in normal times would cause a drop in demand for the US currency. Today, after the release of this report, the US currency declined by 10-20 points. This suggests that the market is not paying any attention to economic statistics at all right now. Even if it becomes known tomorrow that the Fed has changed its mind and will not raise the rate, the dollar will continue to increase. With a 99% probability due to geopolitics, which continues to become more complicated, and worsen, call it what you want.

The conflict is growing every day like a snowball. Russia has already refused to supply gas to Bulgaria and Poland. Several more EU countries are in line. The European economy is likely to plunge into recession and stagflation. And now the American economy is starting to show not a stable state, but a contraction. This GDP report now casts serious doubt on the Fed's intentions to raise interest rates at every meeting in 2022. Calls into question the expediency of raising the rate by 50 basis points at the May meeting. It interferes with a lot of things. I am now paying the most attention to the wave markup since economic reports do not affect the market. I believe that in the coming weeks, the construction of the downward trend section will be completed, and the instrument will move to the stage of constructing a correction section. While this is a hypothesis, much will depend on further events in Ukraine, the European Union, and Russia.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". In the near future, the construction of a new internal correction wave of 5-E may begin, which may be the fourth.

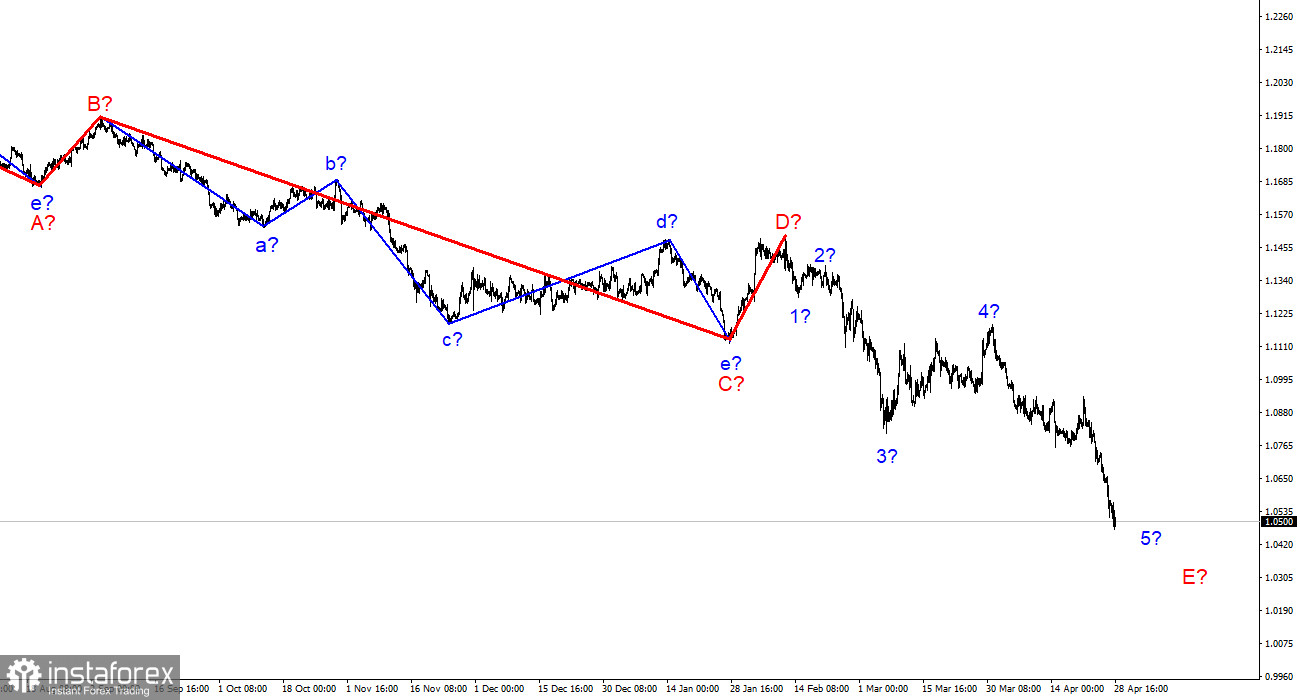

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română