EUR/USD

Higher timeframes

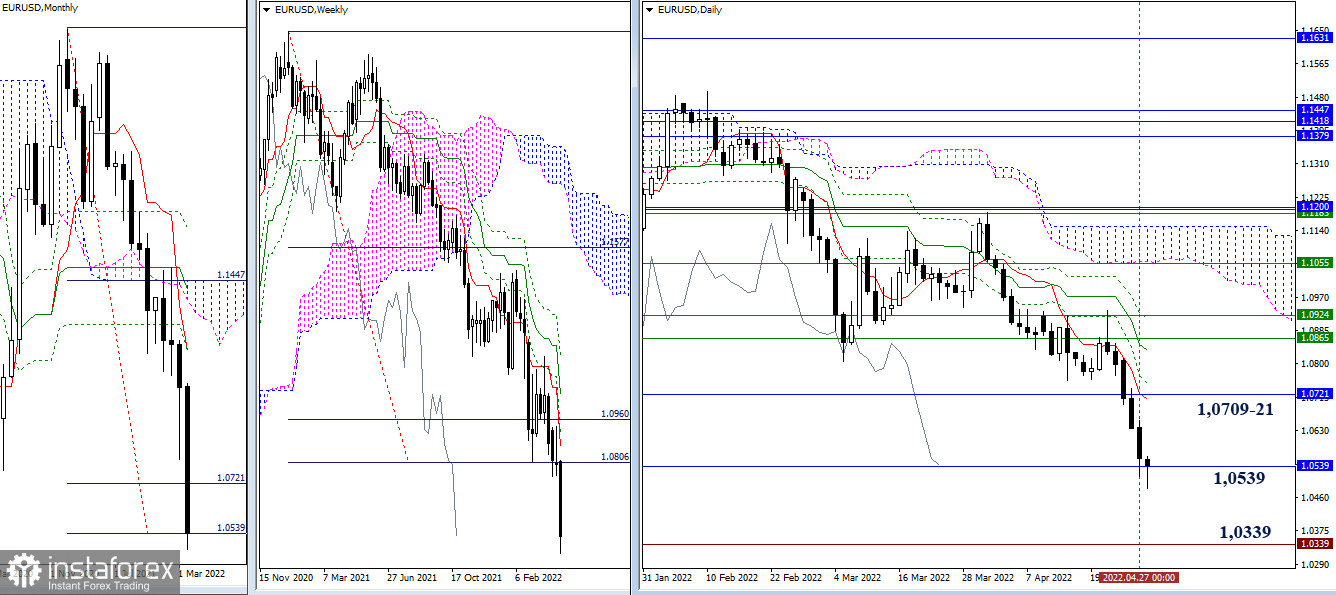

At the moment, the level of 100% fulfillment of the monthly target for the breakdown of the cloud (1.0539) is being tested. We are now approaching the end of the month, and the result is important. The breakdown of the target and the dominance of bearish sentiment may lead to a continuation of the decline in May. The downward reference point, in this case, will be the minimum extremum of 2017 (1.0339). If bulls decide to issue a rebound from the met support, then the nearest resistance and reference point for restoring positions now is the combination of the levels of the daily short-term trend (1.0709) and the first reference point of the monthly target (1.0721).

H4 - H1

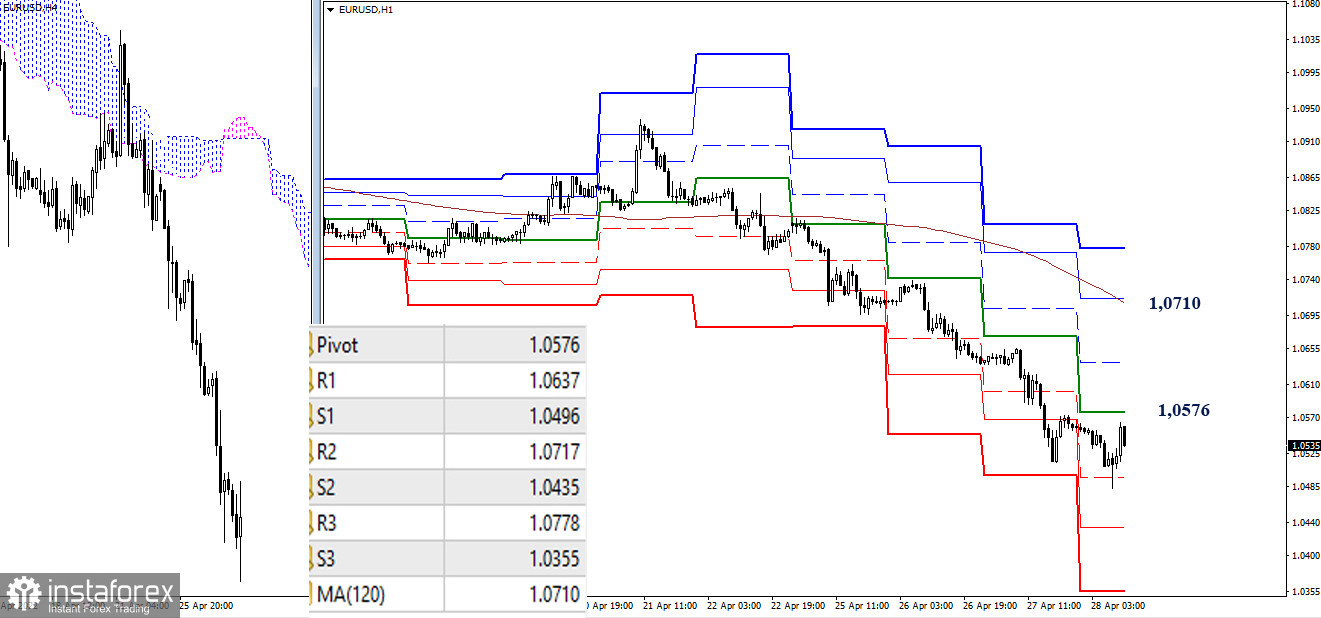

In the lower halves, we observe the development of a downward trend. At the moment, the first support for classic pivot points (1.0496) has been tested. Two other supports retain the status of intraday references (1.0435 - 1.0335). The central pivot point of the day (1.0576) is now forming the nearest resistance in case of an upward correction. Further resistance may be provided by 1.0637 (R1), but the result of interaction with the weekly long-term trend (1.0710) will have the greatest impact on the distribution of the balance of power.

***

GBP/USD

Higher timeframes

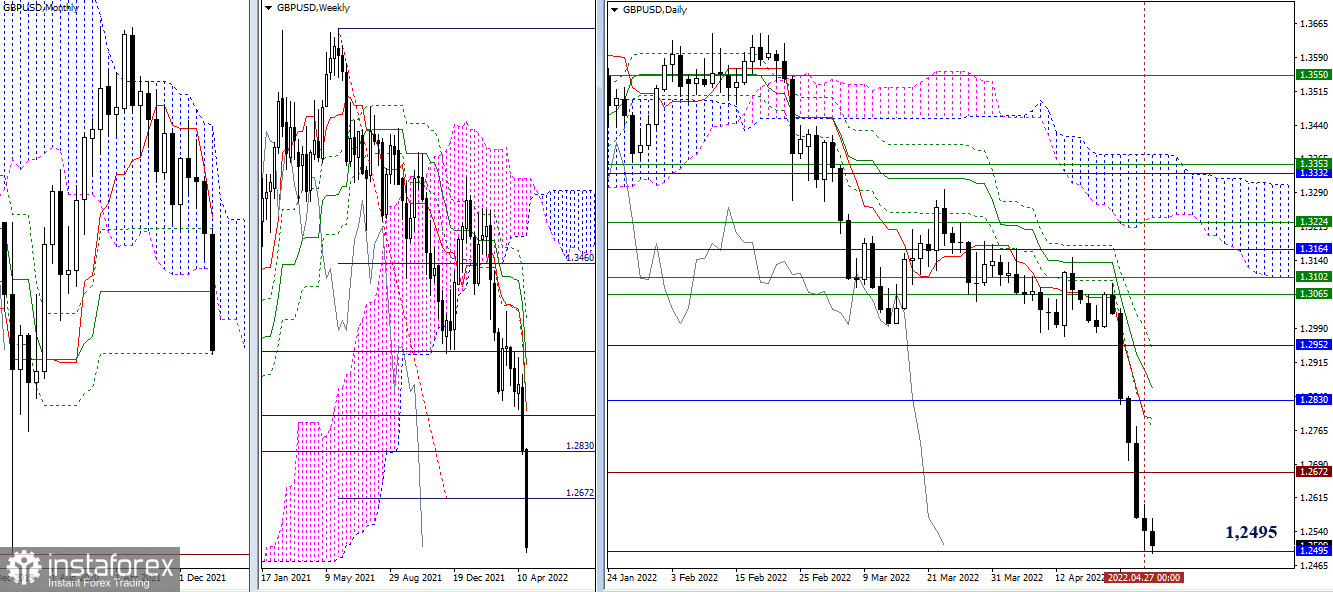

The bears executed a decline to the final level of the monthly Ichimoku cross (1.2495). Now the result of this interaction is important and interesting. There are very few days left before the end of the month. The most optimistic bearish nature of the monthly April candle will most likely lead to a continuation of the decline in May. The next downward reference point, in this case, will be the 2020 low at 1.1411.

H4 - H1

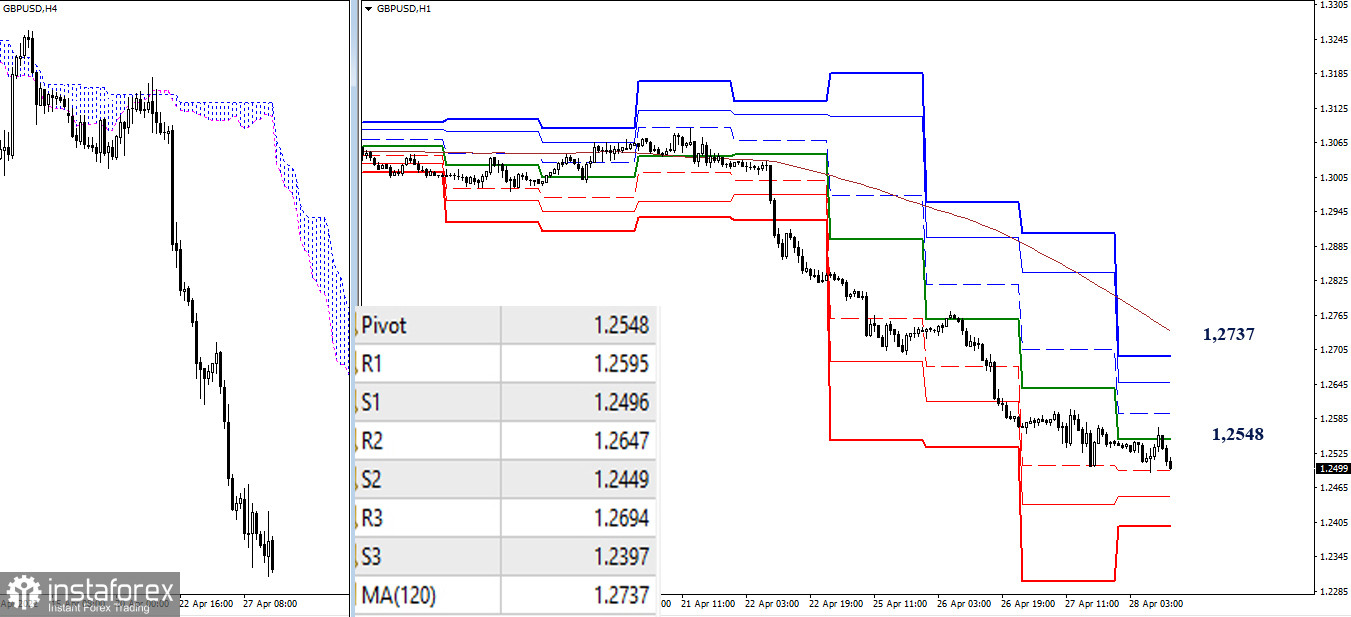

In the lower halves, the development of a downward trend continues. Now the first level of support for the classic pivot points (1.2496) is being tested. Further, bears will meet 1.2449 (S2) and 1.2397 (S3). If a correction develops, the bulls can quickly capture the central pivot point of the day (1.2548), but on the way to the key level, which is the weekly long-term trend (1.2737), it will be necessary to pass all the resistance of the classic pivot points, which today are located at 1.2595 - 1.2647 - 1.2694.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română