Early in the European session, Gold (XAU/USD) is trading around 1,931.20.

We can see that it is trading near the high reached before the close of yesterday's American session.

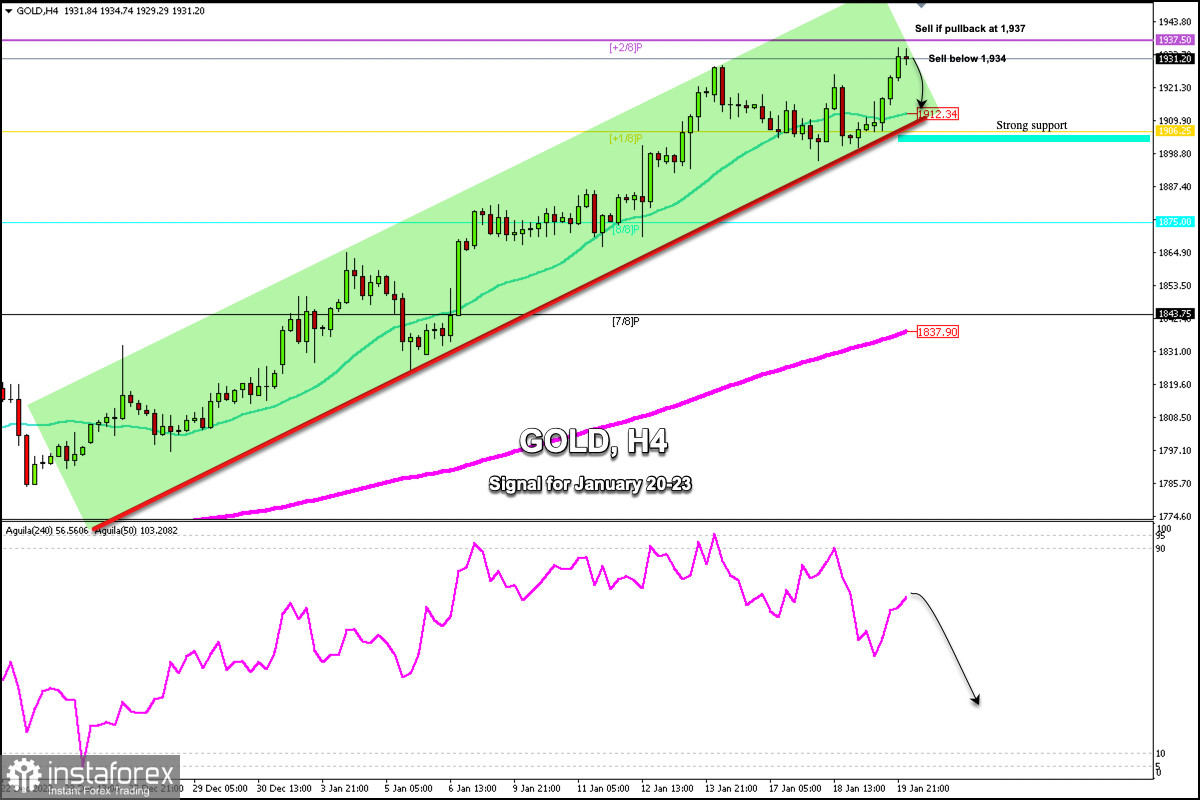

The high reached for now is around 1,935.08, the level last seen on April 25, 2022. According to the 4-hour chart, we can see that gold is very overbought.

The +2/8 Murray line located at 1,937.50 represents a strong technical reversal and as long as it continues trading below this level, gold is expected to fall.

Risk aversion dominates equity markets helping XAU/USD extend gains towards weekly highs. Investors view gold as a safe haven asset amid the deteriorating global economy. Geopolitical risks are also likely to remain elevated for the second year in a row, encouraging investors to take refuge.

The charts of the XAUUSD pair show that a bearish correction could occur in the next few hours. The eagle indicator on the daily chart and on the 4-hour chart shows overbought levels. Hence, investors are likely to take profit and this could favor a technical correction for the next few days.

Given that since January 13 gold is trading around the 1,900 -1,935 area, a technical correction is likely to occur because the market is showing signs of exhaustion.

Our trading plan for the next few hours is to sell below 1,931 with targets at 1,912 (21 SMA) and 1,900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română