The power of downtrend

Hi, dear traders!

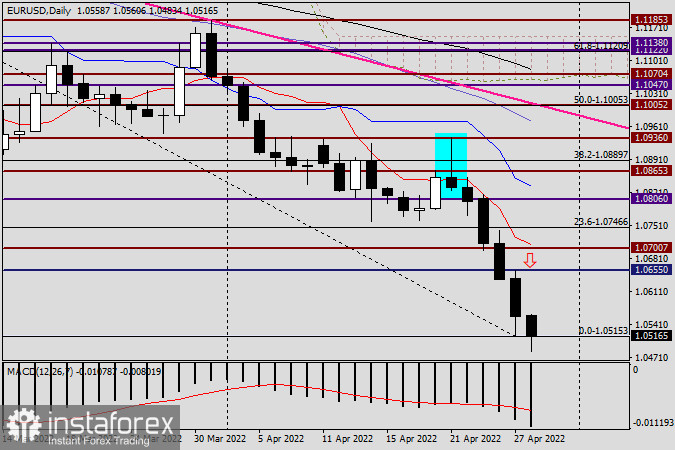

EUR/USD continues to move downwards under the power of the ongoing downtrend. Earlier, traders were recommended to open short positions only after an upward correction. However, the pair has not rebounded and continues to push new lows. There is no shortage of bearish outlooks at this point. Some currency strategists of major commercial banks see EUR/USD fall to the psychological level of 1.0500, while others predict it would reach the lows of 2017 at 1.0341. Today, US GDP data for the first quarter of 2022 will be released. According to consensus estimates, the US economy is expected to grow by 1%. Some major market players see the US GDP increase by 0.6%. This is the key data release on this week's light economic calendar. If the data matches or exceeds expectations, it could determine the Fed's interest rate hike at its long-anticipated meeting in May. The market is pricing in a 75 basis point increase. However, raising the interest rate by 50 basis point and repeating the hike at the following meeting could be more sensible. The US dollar is likely to continue to rise against other major currencies due to the hawkish stance of the Federal Reserve, the COVID-19 outbreak in China, and the continuing war in Ukraine.

Daily

According to the daily chart, EUR/USD continued to sink yesterday, despite a brief correction to 1.0655. The pair finished Wednesday's trading at 1.0558 - it did not remain at the key technical level of 1.0700, as predicted earlier. EUR/USD tested the psychological level of 1.0500 early on Thursday. It is unclear whether the market would react to US GDP data or not, if they turn out to be weak. However, this data release is the only event that could trigger a correction at this point.

Opening short positions at the current level would be inadvisable. Yesterday's daily candlestick had a sizeable lower shadow, suggesting that the pair's downward movement could cease. Furthermore, it would be risky to go short on EUR/USD when the quote is testing 1.0500, despite the significant bearish momentum in the market. In addition, the US GDP data release could trigger an upward correction, which has been long overdue. At this moment, traders are advised to stay out of the market and wait until EUR/USD rebounds into the 1.0650-1.0700 area before opening short positions.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română