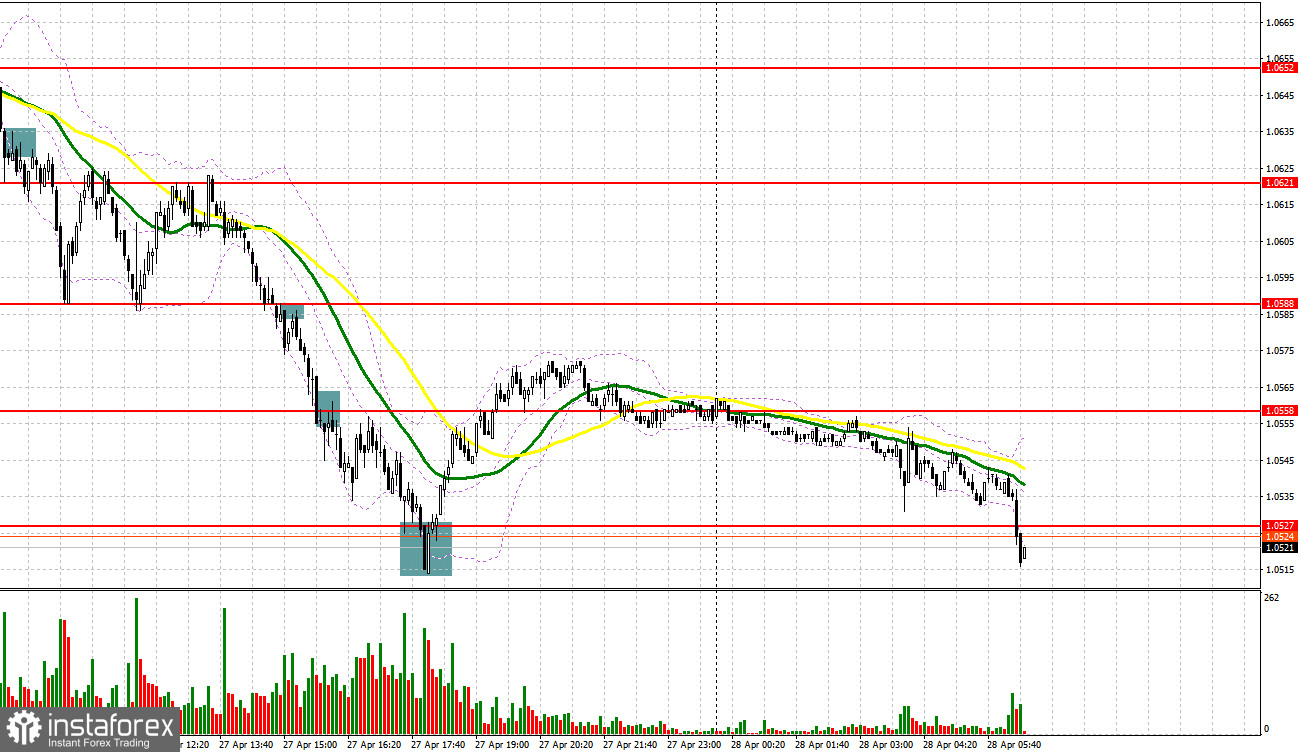

A fairly large number of excellent signals for entering the market were formed yesterday. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the 1.0633 level in my morning forecast and advised you to make decisions on entering the market from it. A breakthrough and consolidation below 1.0633 with exactly the same reverse test as the day before, from the bottom up, had resulted in creating an excellent entry point for short positions on the euro in continuation of the bear market, which resulted in a major sell-off in the area of the next support of 1.0605, which is about 30 points of profit. In the afternoon, a breakthrough and a reverse test of 1.0588 led to another sell signal, which only strengthened the bear market and allowed us to reach 1.0558 – plus another 30 points of profit. A similar breakthrough of this range also led to another sell signal, followed by a movement of the euro down to 1.0527 – and another plus 30 points. A false breakout at 1.0527 in the middle of the US session forced the bears to take profits, which formed a signal to buy the euro, which quickly recovered back to the 1.0558 area by the end of the day.

When to go long on EUR/USD:

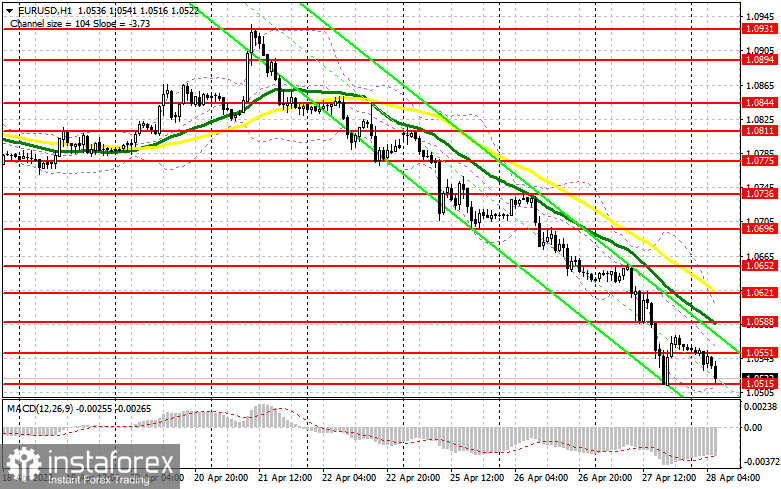

Serious problems in the global economy continue to push the euro down, which leads to the renewal of annual lows everyday. The bulls' failure to cling to anything indicates a rather complicated attitude towards risky assets on the part of investors, even despite the European Central Bank president's attempts to stabilize the situation with her statements on the topic of raising interest rates in the eurozone this autumn. Problems with supply chains due to coronavirus and quarantine in China, as well as a serious geopolitical situation, only spur prices in the eurozone up - worsening the quality of life of the population and causing a recession in the economy. Several important indicators for EU countries will be published today. First of all, we will talk about the indicator of consumer confidence in the eurozone. If the indicators disappoint even more, then the euro will be under pressure again. Also no less important will be the report on the German consumer price index for April. Its growth is expected to slow down. If this is the case, the euro will receive support in the morning, and the bulls will have an opportunity to find the low. The bulls' main task is to protect the next annual support of 1.0515. The optimal scenario for buying from there is to form a false breakout in order to return the initiative, which bulls have completely lost. In my opinion, the most that we can expect is pushing the pair back to 1.0551 and to the test of 1.0588, where the moving averages are playing on the bears' side. It will be very problematic to get out of this range just like that. Only a breakthrough and a test of 1.0551 and 1.0588 from top to bottom can create new signals for entering long positions. This will open up the possibility of returning the pair to the area of 1.0621, where I recommend taking profits. If EUR/USD declines and there are no bulls at 1.0515, and this is more likely, especially given the Federal Reserve's policy and the state of the European economy, it is best to postpone long positions. The optimal scenario for buying will be a false breakout near the 1.0474 low. It is possible to open long positions on the euro immediately for a rebound only from 1.0426, or even lower – around 1.0394, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Bears control the market, which was proven in yesterday's US session, even without relying on fundamental statistics, as the latest US report turned out to be worse than economists' forecasts, but who cares now. Bears now face a rather difficult task to maintain the initiative, and for this they need to update the annual lows below 1.0515, where euro bulls were quite active yesterday. Of course, the optimal scenario for opening short positions will be forming a false breakout at 1.0551, which will provide the first sell signal and return the pressure to the pair as we count on pulling it to 1.0515. But considering how rapidly we are moving towards this level, most likely the whole fight will unfold for it in the morning. A breakthrough and consolidation below this range, together with a reverse test from the bottom up and an inflationary jump in Germany for April this year – all this will lead to a new sell-off of the euro, followed by the pair hitting new annual lows in the area of 1.0474 and with the prospect of updating 1.0426, where I recommend taking profits. The next target will be the 1.0394 area, but such a scenario is possible only if we observe a bullish reaction from dollar bulls towards the US data, which we will talk about in the run for the US session. If the euro rises in the first half of the day and there are no bears at 1.0551, nothing terrible will happen, but I expect a sharper upward jerk. In this case, the optimal scenario will be short positions when forming a false breakout in the area of 1.0588, where the moving averages are playing on the bears' side. You can sell EUR/USD immediately on a rebound from 1.0621, or even higher – around 1.0652, counting on a downward correction of 25-30 points.

COT report:

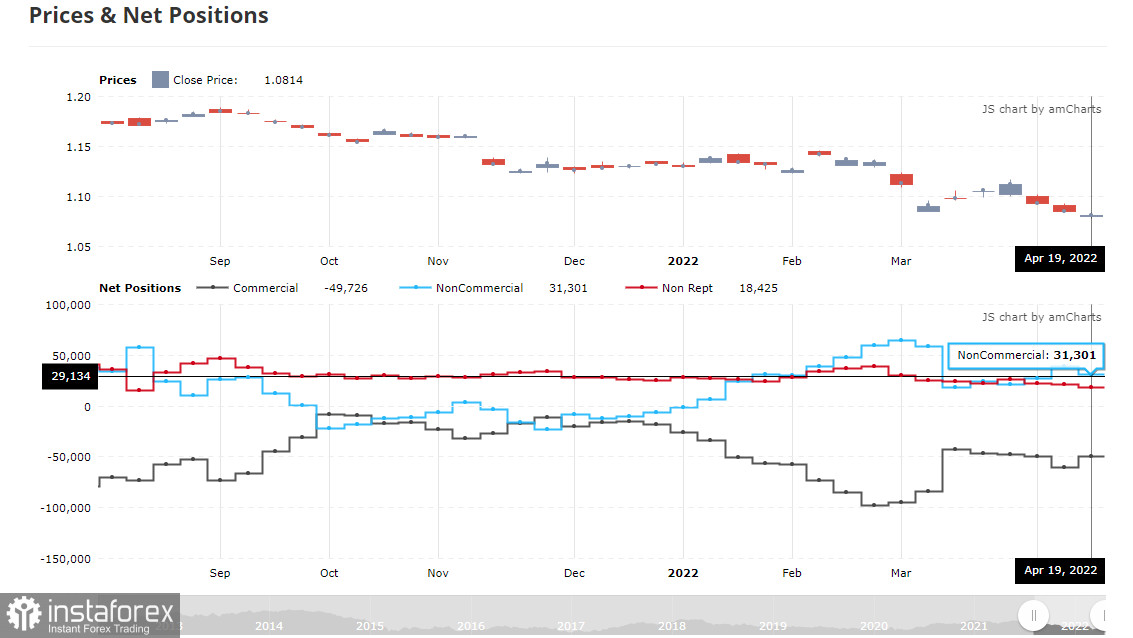

Before talking about the further prospects for the EUR/USD movement, let's look at what happened in the futures market and how the Commitment of Traders (COT) positions have changed. The COT report for April 19 logged a sharp increase in short positions and a decline in long positions. Recent statements by representatives of central banks have led to a sell-off of risky assets, as it became clear to everyone that serious problems in the economies of developed countries cannot be avoided this year. And although the president of the European Central Bank noted that the regulator plans to fully complete the bond purchase program by the end of the second quarter of this year, hinting at a rate hike in early autumn, this was not enough to support the euro. A more aggressive policy of the Federal Reserve and expectations of a 0.75% rate hike in May are supporting the dollar. Another concern is the threat of another economic paralysis due to severe quarantine restrictions in China against the backdrop of a new wave of Covid-19, which has already led to a massive disruption in the supply chains of European and Asian countries. As a result, the US dollar continues to be in demand, which will continue to push the EUR/USD pair down. Russia's new active actions on the territory of Ukraine and the lack of progress in resolving the conflict also put pressure on the euro, and will continue to do so. The COT report shows that long non-commercial positions decreased from 221,645 to 221,003, while short non-commercial positions rose sharply from 182,585 to 189,702. It is worth noting that the euro's decline makes it more attractive to investors, therefore, the closure of long positions is not surprising. As a result of the week, the total non-commercial net position decreased and amounted to 34,055 against 39,060. The weekly closing price collapsed and amounted to 1.0814 against 1.0855.

Indicator signals:

Trading is conducted below the 30 and 50-day moving averages, which indicates the continuation of the bearish trend.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper indicator in the area of 1.0610 will act as resistance. A breakthrough of the lower limit of the indicator in the area of 1.0515 will increase pressure on the euro.

Description of indicators- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română