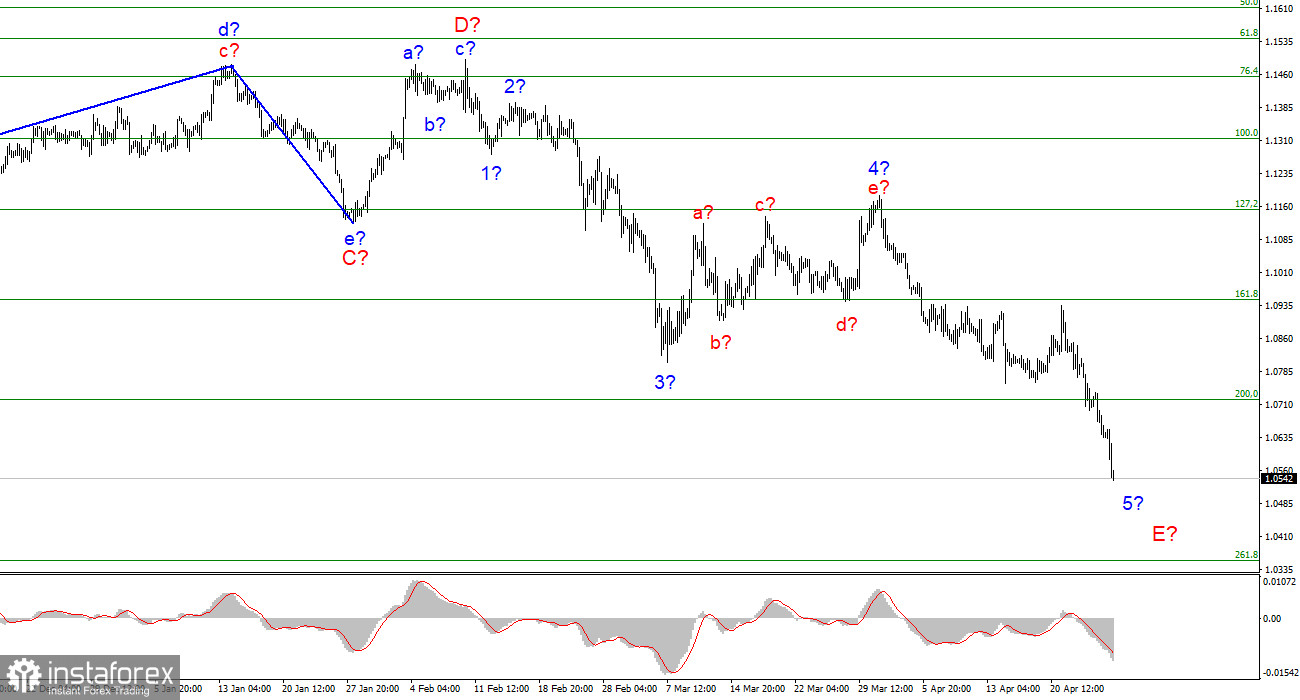

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing, despite several attempts to build a corrective upward wave. The instrument continues to build a descending wave 5-E, which may be the last in the structure of the descending trend segment. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since this wave may turn out to be a very long, five-wave in its internal structure. At the moment, this wave no longer looks shortened, and five waves are not visible inside it. Therefore, I believe that it will still turn out to be a five-wave, which means it will continue its construction for some time. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for new sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, and there only 350 basis points will remain to price parity with the dollar.

There was little news on Tuesday, but demand for the euro continues to fall

The euro/dollar instrument declined by another 100 basis points on Wednesday. Market activity remains high, and the demand for the euro currency is decreasing every day. I can assume that today the euro currency was pressured by the announcement of the termination of gas supplies to Poland and Bulgaria from the Russian Federation. Moscow said that the refusal of supplies occurred due to the "unfriendliness" of the countries towards Russia. In addition, Poland and Bulgaria refused to pay for gas in rubles, as Vladimir Putin personally demanded. Thus, Moscow did not even wait for Europe to start abandoning gas and oil itself and decided to be the first to take this step. It should be noted that almost all EU countries refused to pay in rubles, except Hungary. From my point of view, this has been going on for quite a long time. Europe does not want to give up oil and gas from Russia overnight, because there is simply nothing to replace them with. However, oil and gas are still available not only in Russia, so it is not impossible to establish supplies from other countries. It will cost more, it will be more difficult logistically, but still, the European Union has taken a position in the Ukrainian-Russian conflict. And when claims began to sound in the European Parliament that the European Union helped Ukraine with one billion euros and paid Russia 40 billion euros for oil and gas, the issue of refusal was already practically resolved. However, the rejection of gas and the reorientation of Europeans to other energy markets will only complicate the situation in the markets themselves. Oil and gas prices are already going through the roof, which causes an increase in inflation around the world. And inflation is something that will be extremely difficult for Europe to fight now. It is its economy that is on the verge of recession and if the ECB starts raising the rate, it could further slow down its economic growth. And if the ECB abandons plans to raise the rate, this may lead to a strong disappointment in the market, and demand for the euro currency may continue to fall until the currency itself is near parity.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". The internal correction wave of 5-E quickly ended.

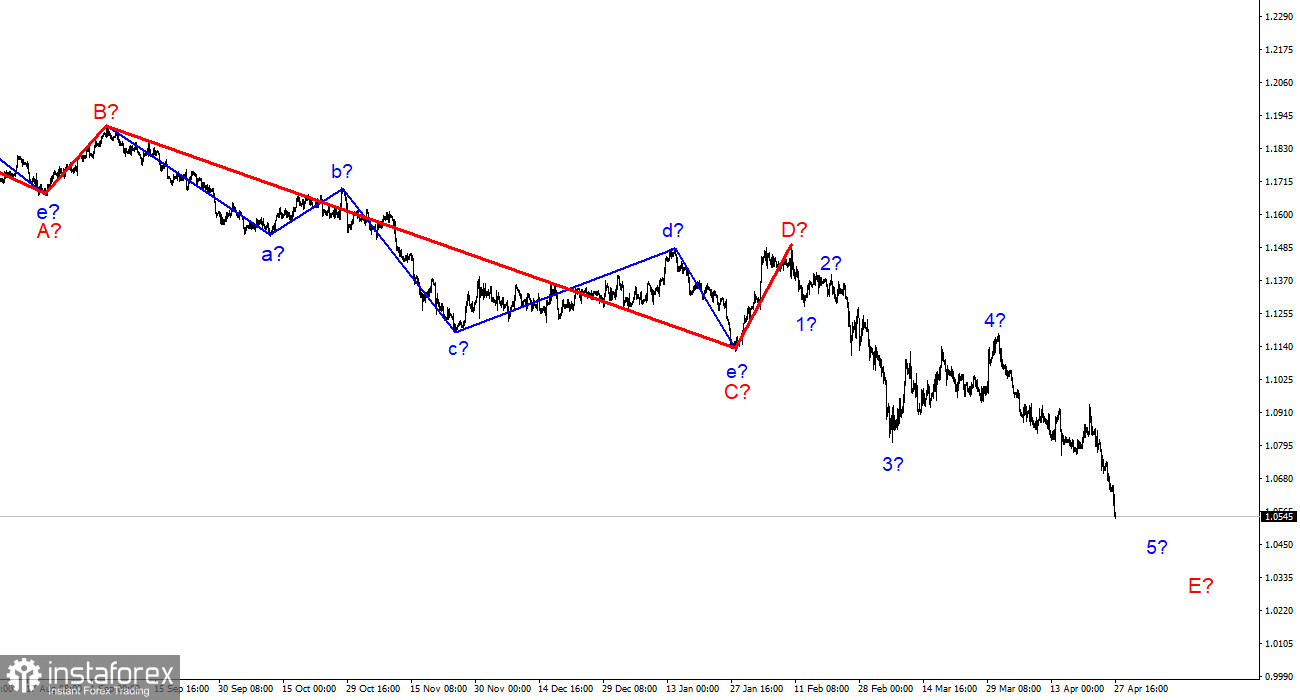

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română