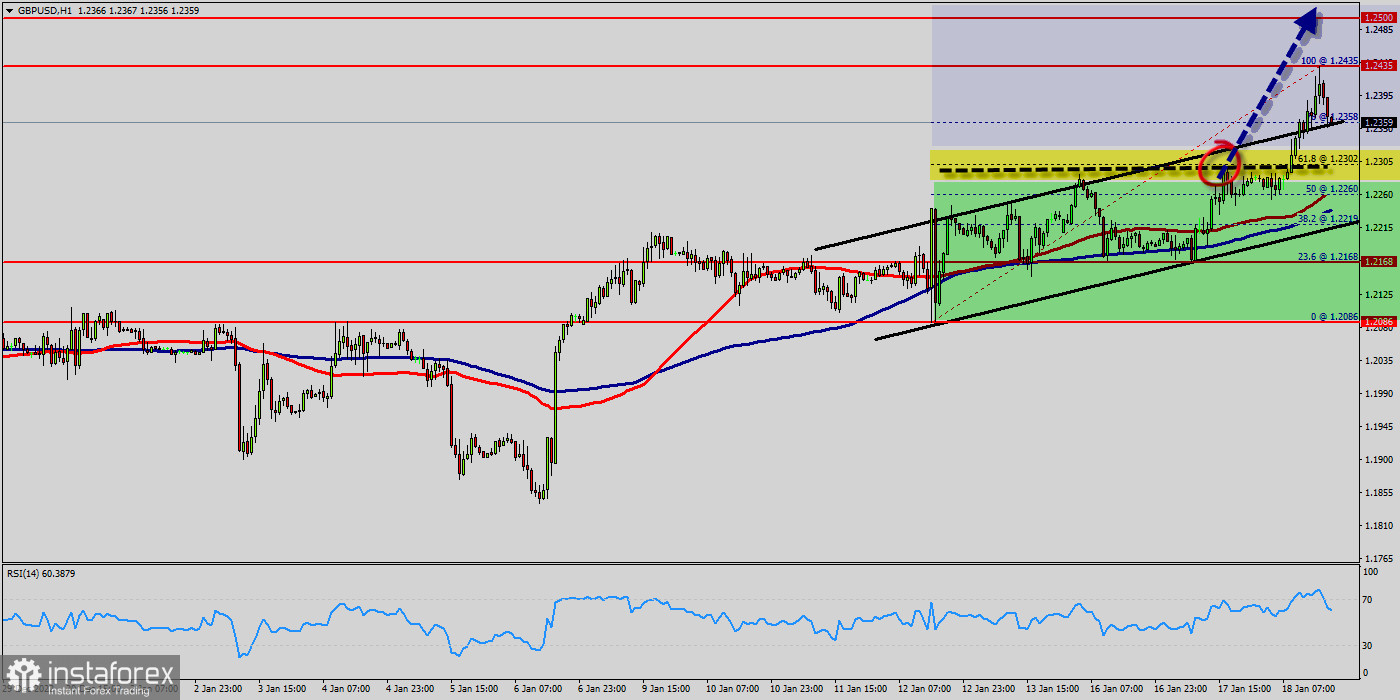

The GBP/USD pair remains up for the day, trading at around 1.2336. Renewed US Dollar demand pushed the pair away from an intraday high of 1.2435, its highest in a month. The UK annualized Consumer Prices Index came in at 10.5% in last month easing from 10.7% nowadays. Current price sets at the price of 1.2336.

The GBP/USD pair can still form an ascending impulse, it continues to rise upwards. The major support is seen at 1.2302 which coincides with the ratio of 61.8% Fibonacci Expansion. According to the main scenario, it may start forming correctional structures. Today, we foresee the price to move towards the level of 1.2336 and then reach a new maximum again around the price of 1.2435.

Please, note that the strong resistance stands at the level of 1.2435. If the price breaks the level of 1.2435, we expect potential testing of 1.2500. The current ascending structure implies that the market may reach the level of 1.2500.

In this area, the trend is challenging a major resistance level. The ascending impulse is strong enough to buy above the support of 1.2302.

Additionally, the RSI is still calling for a strong bullish market as well as the current price is also above the moving average 100. Therefore, it will be advantageous to buy above the support area of 1.2302.

Therefore, the price is expected to reach a high once again. It is rather gainful to buy at 1.2302 with the targets at 1.2435 and 1.2500.

So, it is recommended to place take profit at the price of 1.2500 as the second target today.

The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

On the contrary, stop loss should be placed at the price of 1.2302 (below the daily support). The bullish outlook remains the same as long as the RSI indicator is pointing to the upside on the one-hour chart.

However, if the GBP/USD pair fails to break through the resistance level of 1.2435 today, the market will decline further to 1.2168 in coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română