The GBP/USD pair is moving somehow sideways in the short term. The bias remains bullish, so further growth is natural. Still, the fundamentals could drive the markets today, so we'll have to wait for a fresh opportunity. It's trading at 1.2213 at the time of writing.

Fundamentally, the UK Claimant Count Change was reported at 19.7K compared to the 19.8K expected, Average Hourly Earnings Index rose by 6.4% beating the 6.2% estimates, while the Unemployment Rate remained steady at 3.7%. The US is to release the Empire State Manufacturing Index, while the Canadian CPI could shake the USD.

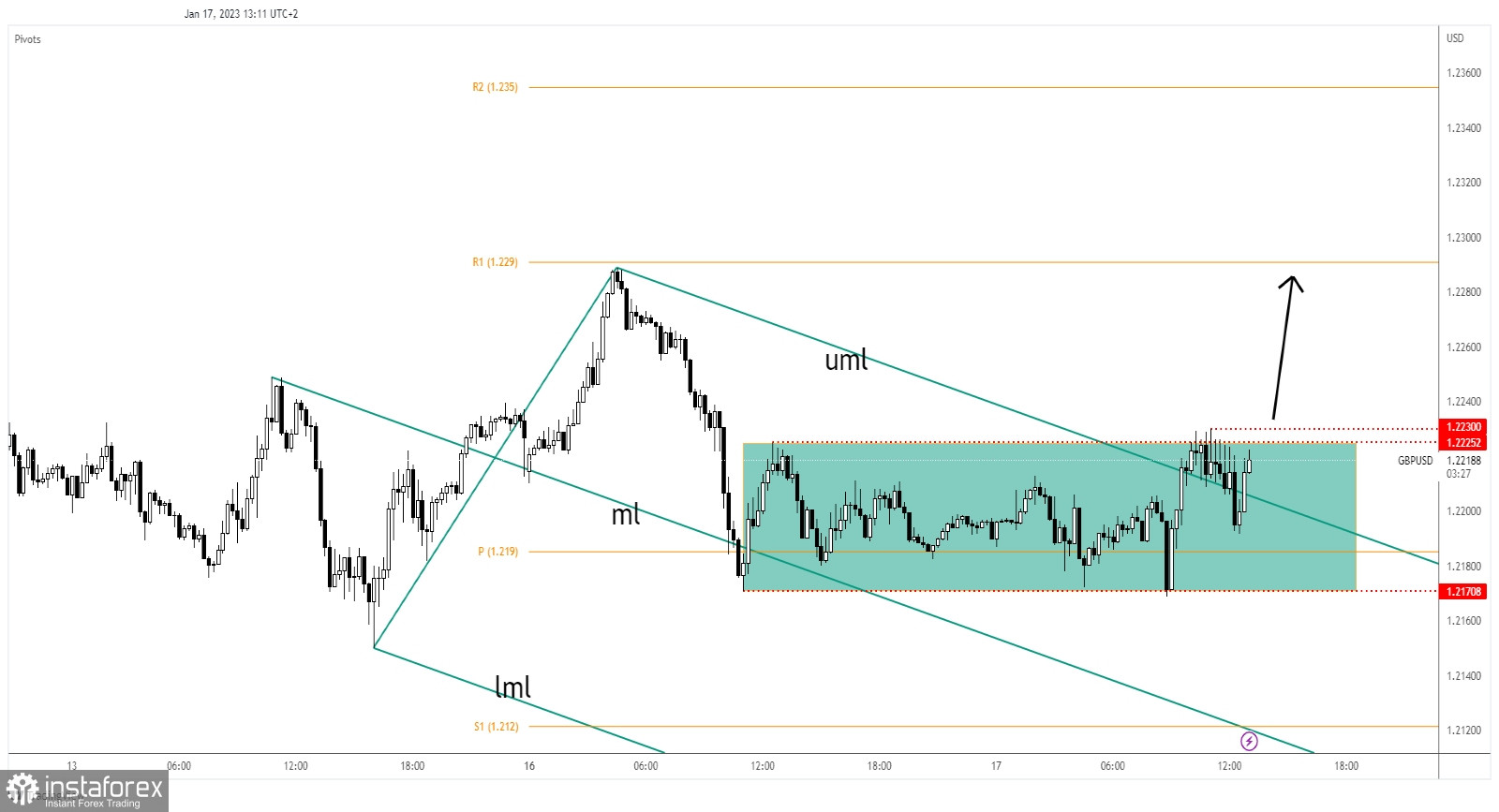

GBP/USD Range Pattern!

Technically, GBP/USD is trapped between the 1.2170 and 1.2225 levels. Now, it tries to stabilize above the broken upper median line (uml) of the descending pitchfork. The upside pressure remains strong after retesting 1.2170 and after failing to stay below the weekly pivot point of 1.2190.

It remains to see how it reacts around the 1.2225 static resistance. The former high of 1.2330 represents an upside obstacle as well.

GBP/USD Forecast!

A new higher high, a bullish closure above 1.2230 activates further growth. This represents a buying opportunity with a potential upside target at R1 (1.2290).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română