XAU/USD slipped lower after its last rally which was natural. It's trading at 1,916 at the time of writing far below today's high of 1,929. The bias remains bullish, so temporary retreats could bring us new long opportunities. The rate could come back to test and retest the near-term support levels before jumping higher as the Dollar Index remains under pressure.

Fundamentally, XAU/USD retreated slightly as the US Prelim UoM Consumer Sentiment came in at 64.6 points on Friday versus 60.8 points expected and compared to the 59.7 points in the previous reporting period. Yesterday, the US banks were closed, while today, the Chinese GDP, UK Claimant Count Change, and most importantly, the Canadian inflation figures could really shake XAU/USD.

XAU/USD Temporary Retreat?

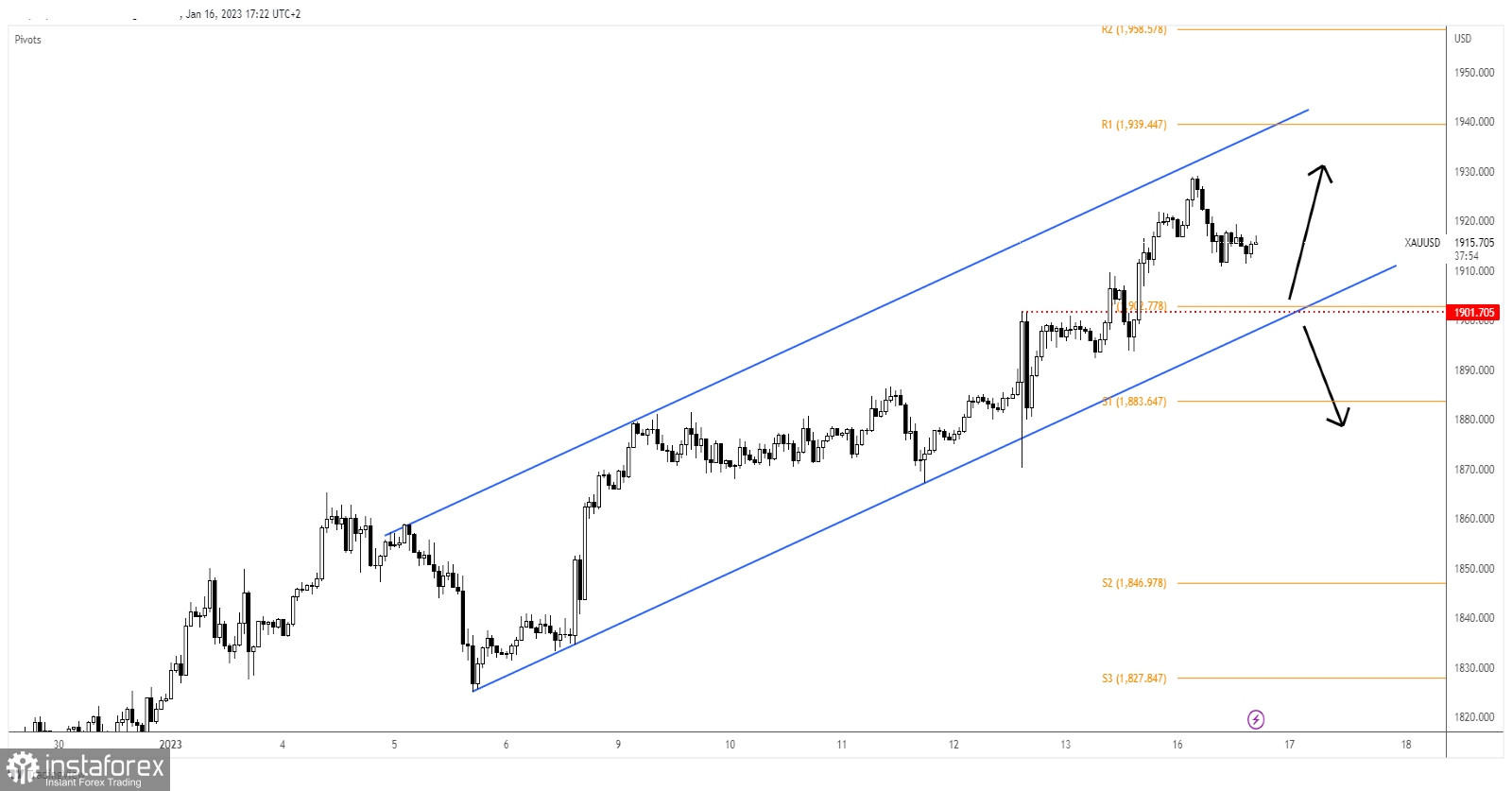

Technically, XAU/USD extended its growth after taking out the 1,901 static resistance. It has failed to reach the channel's upside line and now it has dropped a little. The weekly pivot point of 1,902, the 1,901 key level, and the uptrend line represent downside obstacles.

As long as it stays above these levels, the bias remains bullish, so further growth is natural. Actually, the current retreat could bring us new longs.

XAU/USD Outlook!

Coming back to test and retest the support levels (downside obstacles), registering false breakdowns may announce a new bullish momentum. This is seen as a new buying opportunity. The weekly R1 (1,939) and the channel's upside line represent potential targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română