Long term outlook

During the current week, the EUR/USD pair failed to start an upward correction. In the middle of the week, the euro received support from ECB Vice-President Luis de Guindos, who said that the key rate could be raised in July. Earlier, ECB President Christine Lagarde had announced the weakness of the European economy, high risks due to the pandemic, military conflict in Eastern Europe, and unwillingness to follow the Fed's course. After the last ECB meeting, Lagarde noted that it could be weeks to months from the time the stimulus programs wind down until the first rate hike. Then, de Guindos says that rates will be raised in July. The next day, Lagarde, who spoke at the IMF summit, did not confirm this information, which confused the market even more. The euro eventually fell to its swing and 15-month lows. The market believes Lagarde's words. Thus, the euro is left with an extremely unsightly array of factors, none of which supports it. Even a possible key rate hike this summer would not mean anything good for the euro. By that time, the Fed could raise its rate already to 1.5%, so a serious divergence between the monetary policies of the US and EU central banks will persist in any case. Moreover, the deposit rate is currently at -0.5%. Thus, the first hike could be to 0%. In addition, it is unlikely that the euro will receive strong market support.

COT report analysis

The latest COT reports on the euro raised more questions. The big players have been maintaining bullish sentiment since January 2022. The Euro has been trading within a downtrend since January 2022. During the reporting week, the number of Buy-contracts decreased by 600, while the number of Non-commercial positions increased by 7,000. Thus, the net position decreased by 6,000 contracts. This means that the bullish sentiment has weakened a bit. However, it is still bullish, since the number of buy contracts now exceeds the number of sell contracts of non-commercial traders by 32,000. Accordingly, the paradox is that professional players buy more euros than they sell, but the euro keeps falling almost continuously, which can be seen in the screenshot above. We already explained earlier that this effect is due to a higher demand for USD. The demand for the US dollar is higher than the demand for the euro, which is why the US currency is growing against the euro. This situation arises due to the geopolitical conflict in Ukraine. Therefore, the COT reports on the euro do not allow predicting the further movement of the pair now. The longer the phase of active hostilities in Ukraine persists, the higher the probability that the EU will face a food and energy crisis, and the US dollar will continue to rise because of its safe-haven status.

Fundamental events analysis

During the current week, only the inflation report for March was published in the European Union. And even then, only its final value, so traders were ready for the value of 7.4%. According to the results of March, inflation accelerated by 1.5%. The index of business activity in the service sector and manufacturing remained in the green zone above the level of 50.0, so no reaction was triggered. So, everything for the euro this week came down to the speeches of Lagarde and de Guindos. Initially, nobody expected de Guindos's speech to be interesting. There has been less and less geopolitical news lately. "The battle for the Donbas" has begun, and many military experts believe that it will determine the outcome of this conflict. The UK and the US intelligence do not see Russian troops advancing deep into Ukraine. Boris Johnson has stated that the military conflict will continue at least until the end of 2022. The EU may announce the sixth package of sanctions next week, which should include restrictions on oil imports. All this indicates an escalation of the conflict and deterioration of relations between the EU and Russia.

Trading plan for April 25 - 29:

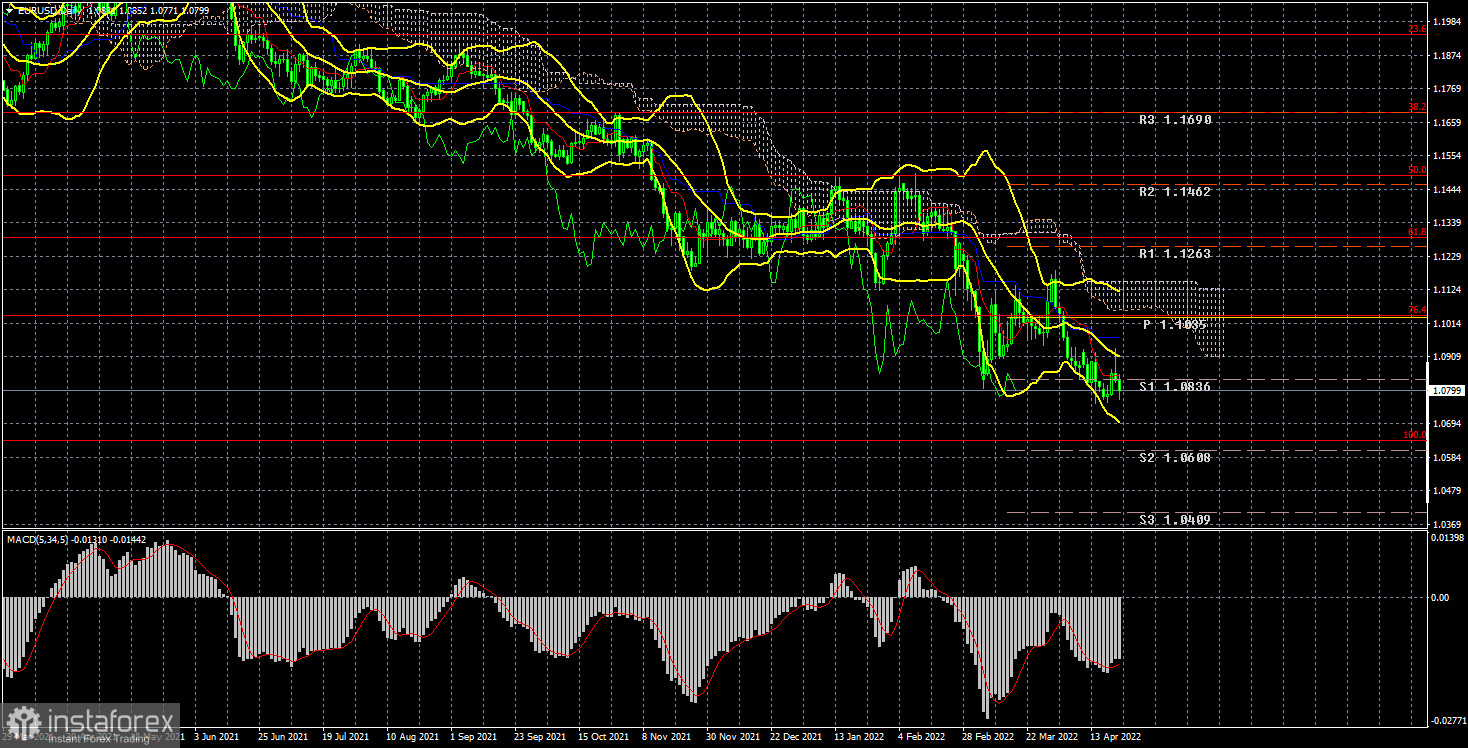

1) On the daily chart, the pair has resumed its downward movement and is preparing to descend to 1.0636, the 100.0% Fibo. All factors still speak in favor of a rising US dollar. The price is trading below the Ichimoku cloud, so there is still not much chance for the growth of the euro. At the moment, short positions remain the most relevant.

2) As for long positions on the EUR/USD pair, it is not recommended to consider them now. There is no technical signal that an uptrend can begin. Fundamentals and macroeconomic data continue to put strong pressure on the euro. The geopolitical situation may continue to put pressure on traders and investors, who continue to believe that they should buy the US dollar in any uncertain situation. Europe is on the verge of an energy and food crisis. Only a breakthrough of the Senkou Span B line we would consider as a basis for a new uptrend.

Notes to screenshots:

Price levels of support and resistance, Fibonacci levels, which are targets for the opening of purchases or sales. Take-Profit orders can be placed near them.

Ichimoku Indicator (standard settings), Bollinger Bands (standard settings), MACD(5, 34, 5).

Indicator 1 on the COT charts - the size of the net position of each category of traders.

Indicator 2 on the COT charts - the size of the net position for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română