The euro and the British pound collapsed against the US dollar after Federal Reserve Chairman Jerome Powell fully supported a half-point interest rate hike next month and leaned towards further aggressive monetary policy tightening to curb inflation.

"I would say that 50 basis points will be on the table for the May meeting," Powell said at an IMF meeting in Washington on Thursday. He also shared his plans with the President of the European Central Bank, Christine Lagarde, and other officials. "The big issue that we're very focused on is inflation, and getting inflation back down to our 2% goal," Powell said.

At the moment, interest rate futures are already fully taking into account the planned half-point change during the central bank meeting, which will be held on May 3-4. But, in addition, a similar increase by half a point is expected in June of this year. Investors are also betting on a third half-point increase in July, despite the fact that some members of the Federal Reserve system, particularly St. Louis Fed President James Bullard, are talking about the need for a more aggressive increase of 75 basis points.

Powell also noted that the minutes of the Fed's March meeting fully traced the policy of the central bank, as many officials supported several half-point rate hikes to curb inflation. It is obvious that the aggressiveness of the Fed's policy does not hold. Many experts criticize Powell for delaying too long in responding to the first signs of high inflationary pressures that the Fed chairman thought were temporary. As time has shown, it was necessary to act earlier.

The argument in favor of Powell that he was trying to achieve complete recovery of the labor market no longer works, since even against the backdrop of an unemployment rate of around 3.6%, problems have become no less. And if earlier there were problems with the lack of jobs, now the problem is that no one wants to work "for a penny."

As noted above, the US labor market is now back to pre-coronavirus levels, showing near full employment. At the same time, Powell gave the labor market a not too positive assessment, noting its unhealthy image in the current economic conditions. And it's not about the lack of jobs, but quite the opposite – now there are more than 1.7 vacancies for every unemployed person. This fuels inflation very much, forcing employers to offer higher and higher wages to new hires, or raise wages to old ones so they don't leave in search of better deals.

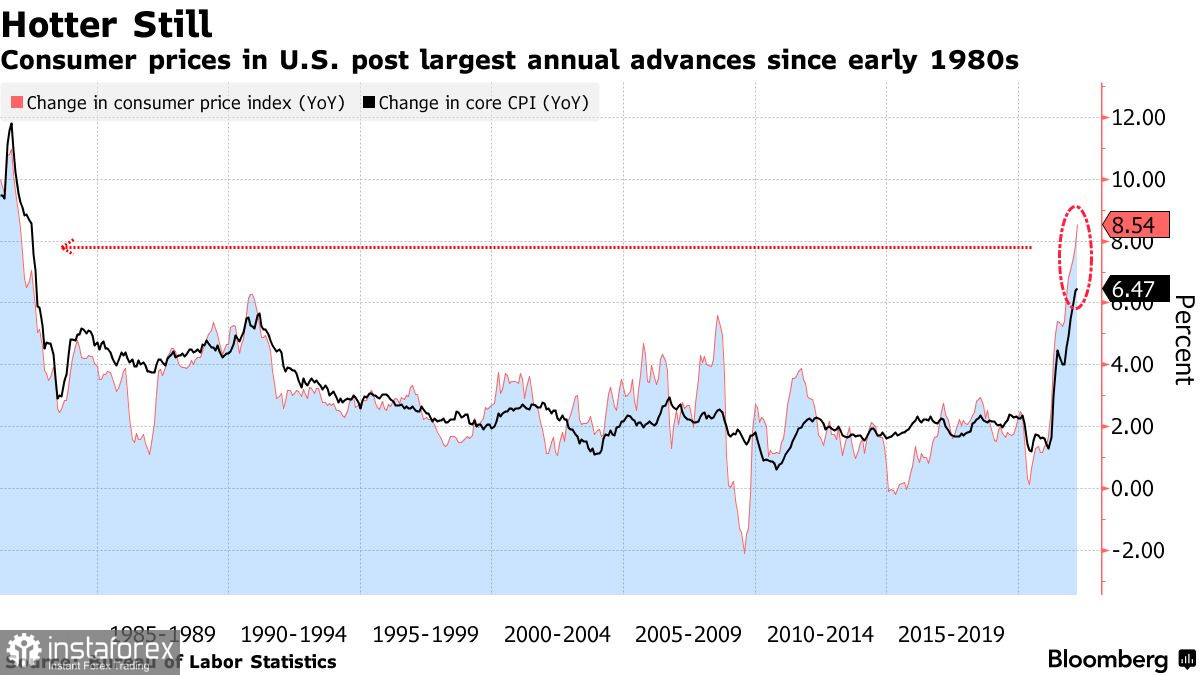

US consumer price index (CPI) rose 8.5% year-over-year in March, the highest since 1981. Immediately thereafter, Fed officials began to tighten up, preparing the markets for the committee to act more aggressively to return rates to a neutral level this year, which does not speed up or slow down the economy – this level is in the 2.0% region.

It also became clear that in May the Fed would give the green light to a plan to reduce its balance sheet, while the outflow would be capped at $95 billion a month, including Treasuries and mortgage-backed securities.

As for the technical picture of the EURUSD pair

The euro is rapidly losing its positions amid expectations of a more aggressive policy of the Federal Reserve. Worsening geopolitical tensions due to Ukraine's refusal to negotiate will further limit the upside potential of risky assets. Therefore, when the hassle with rates subsides, the pressure on risky assets will most likely return. Given the aggressiveness of the Fed's policy, it is best to bet on the further strengthening of the dollar.

To bring back the market under their control, euro buyers need a break above 1.0860, which will allow building a correction to the highs: 1.0930 and 1.0970. In case of a decrease in the trading instrument, buyers will be able to count on support around 1.0800. Its breakdown will quickly push the trading instrument to the lows: 1.0760 and 1.0720.

As for the technical picture of the GBPUSD pair

The pound has no chance of further growth, as the silence from the Bank of England and the aggressiveness of the Fed are pushing for another sell-off of the British pound. Now the bulls need to properly focus on the breakdown and consolidation above the resistance of 1.3050. Going beyond this range will lead to a continuation of the correction and will give an opportunity to update new local highs in the area of 1.3080 and 1.3130.

When the pressure on the trading instrument returns, buyers will most likely prefer to act more actively around 1.2980, but their appearance only in the area of 1.2910 is not ruled out. Larger support is seen around 1.2860.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română