The GBP/USD currency pair failed to overcome the 1.3000 level on Thursday. Or the level of 1.2980. Or continue the downward movement. Moreover, during the day there was not even movement in a certain direction. If the European currency has started at least a weak correction, which has little chance of developing into an upward trend, then the pound price has painfully doubled above the moving average and is now just standing still. Even before the previous local maximum, the pair needs to go up about 100 more points. And over the past two days, it has managed to grow by 60-80 points. Plus, there was some support for the European currency yesterday in the form of a speech by Luis de Guindos, but there was no de Guindos in the UK. And what would he be talking about if the Bank of England has already raised the key rate to 0.75% and may increase it to 1% at the next meeting? There are no problems with monetary policy in Britain, and the economy allows raising the rate to have a slowing effect on inflation. But, as we can see, even understanding this point does not provide strong support for the pound.

But in the UK, there is Boris Johnson, who this week, we can say, finally got away with his "coronavirus parties". The police handed him and the Finance Minister monetary fines, and the Parliament once again criticized and called him to resign. This is the end of this topic. But Johnson continues to conduct "anti-Russian rhetoric", absolutely rightly believing that it will increase his ratings and the ratings of his party after the not very successful first three years of government. Johnson understands that the majority of Europeans and Britons support Ukraine. Yesterday, it became known that German Chancellor Olaf Scholz personally blocked the supply of heavy armored vehicles and tanks to Ukraine after the Netherlands decided to take a similar step and called on the entire European Union to support Kyiv. Scholz has come under a barrage of criticism in Germany, his political ratings have plummeted, and opposition parties are going to give him a vote of no-confidence next week. In addition, the two parties are going to issue a resolution to send the necessary weapons to Ukraine, bypassing the Scholz ban.

Thus, Johnson understands which cards need to be played. He said yesterday that London will supply any weapons that Kyiv asks for. In particular, artillery weapons. In addition, the British Prime Minister warned the Kremlin that if it uses weapons of mass destruction, the UK reserves the right to strike back without consulting other NATO countries. The British pound is not happy with such rhetoric. It may lead to an increase in Boris Johnson's popularity and make him a strong leader, but the deterioration of economic relations with the Russian Federation leads to a new weakening of the pound.

The debate between Le Pen and Macron only strengthened the latter's position.

The elections in France play an important role in the issue of the unity of the entire European nation at a time when fighting is underway in Europe. If there is no consensus, this could lead to a split of the entire EU. Marine Le Pen, who actively supported "Frexit" several years ago, has repeatedly advocated for such a split. She reached the second round of elections, but her ratings are lower than Macron. Macron is not the most outstanding president in the history of France, but most of the French are ready to vote for him. However, as of yesterday, about 10% of the French have not yet decided who they will vote for this Sunday. Therefore, a three-hour TV debate was held between Le Pen and Macron. The current president of France drew the attention of viewers to the fact that Le Pen supports Russian President Vladimir Putin, and her party resorted to funding from Russian sources. In addition, Macron asked Le Pen on what basis she called Crimea "part of Russia" if France did not officially recognize Crimea as Russian? Le Pen, in turn, blamed Macron for the deterioration of the financial situation in the country, as well as the growth of the national debt to 600 billion euros. Le Pen said she wants to organize a "union of nations", but does not want France to leave the EU. By all accounts, Macron won the televised debate.

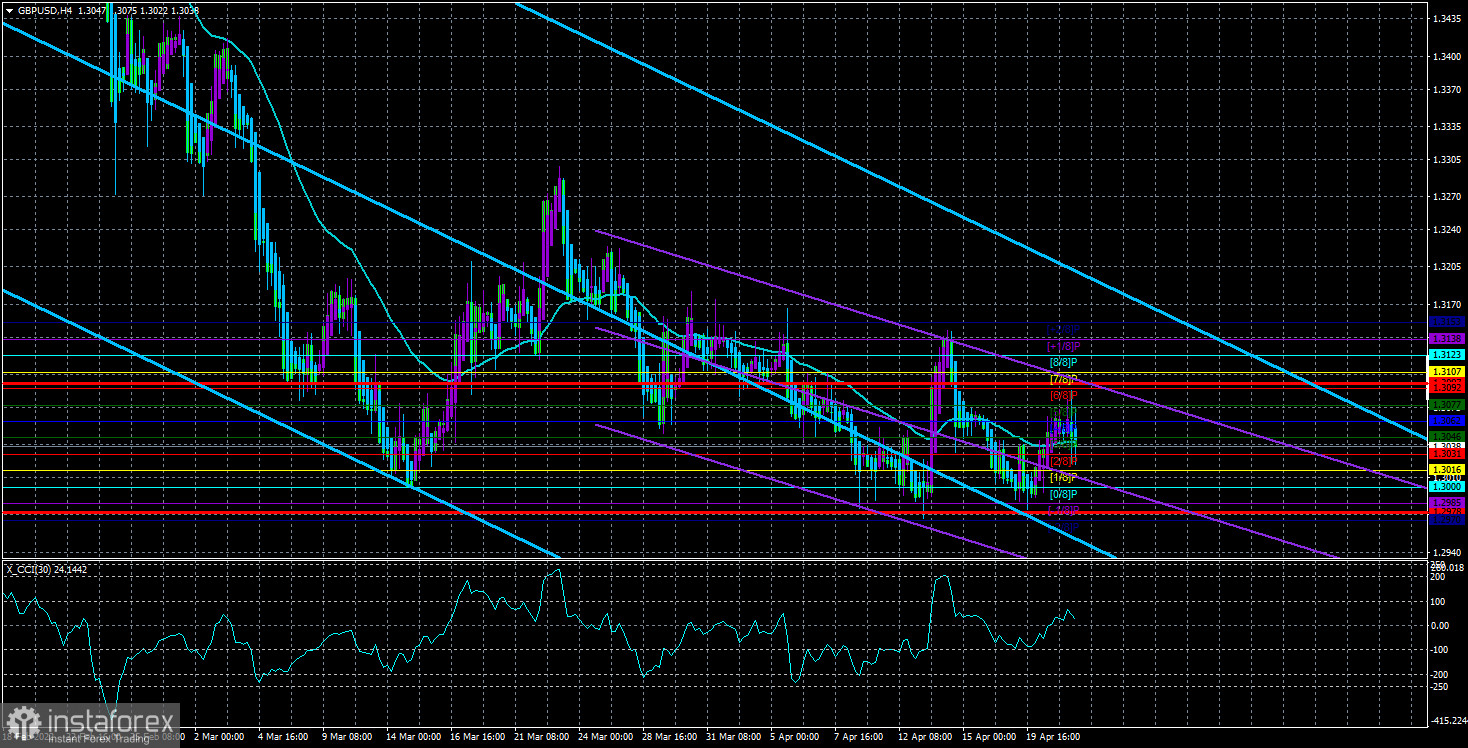

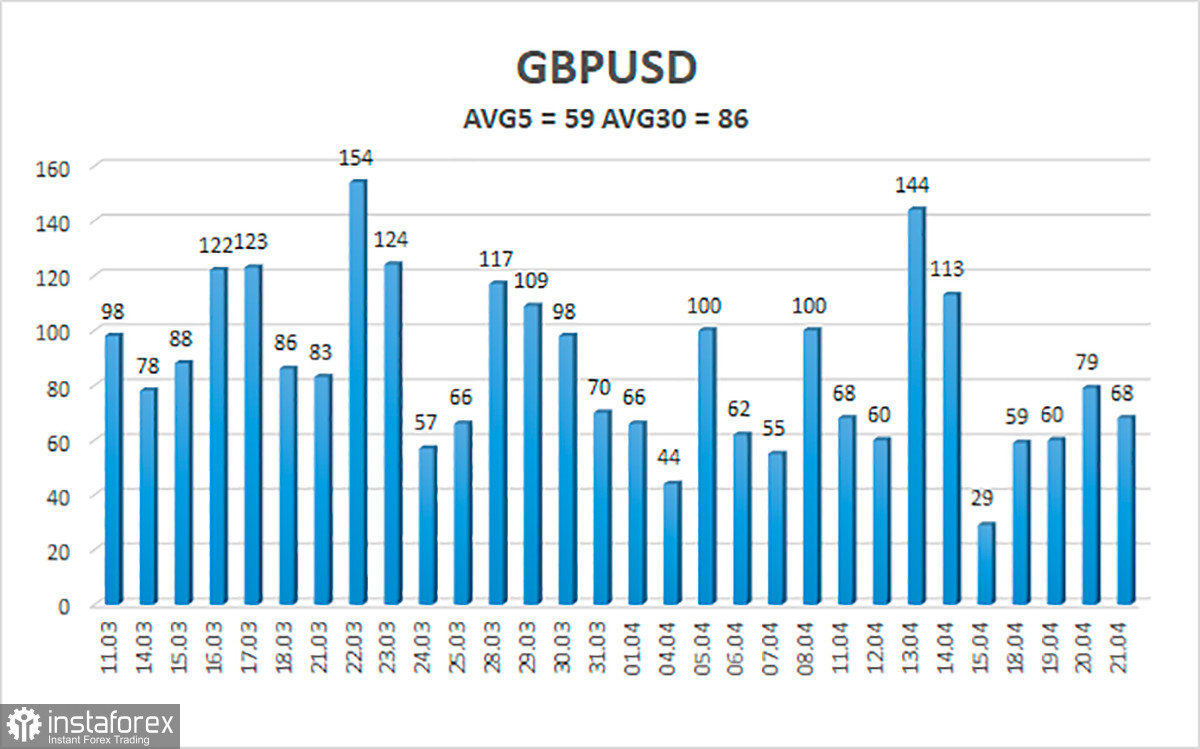

The average volatility of the GBP/USD pair over the last 5 trading days is 59 points. For the pound/dollar pair, this value is "average". On Friday, April 22, thus, we expect movement inside the channel, limited by the levels of 1.2978 and 1.3097. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.3031

S2 – 1.3000

S3 – 1.2970

Nearest resistance levels:

R1 – 1.3062

R2 – 1.3092

R3 – 1.3123

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe again unsuccessfully tested the Murray level of "2/8" - 1.3000. Thus, at this time, sell orders with targets of 1.3000 and 1.2970 should be considered in case of consolidation below the moving average. It will be possible to consider long positions in the event of a price rebound from the moving average line with targets of 1.3092 and 1.3123. It should be taken into account that the movement is now indistinct.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română